1 Investor Presentation June 2023

2 Disclaimer Forward Looking Statements With the exception of historical information, certain statements contained in this presentation may include "forward- looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934, such as those pertaining to our guidance, pursuit of growth opportunities, anticipated transportation volumes, expected rate increases, planned capital expenditures, planned dividend payment levels, planned cost reductions, potential asset sales and the use of proceeds therefrom, expected ESG program updates and developments, capital resources and liquidity, and our planned acts relating thereto, and results of operations and financial condition. You can identify forward-looking statements by use of words such as "will," "may," "should," "could," "believes," "expects," "anticipates," "estimates," "intends," "projects," "goals," "objectives," "targets," "predicts," "plans," "seeks," or similar expressions or other comparable terms or discussions of strategy, plans or intentions. Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including, among others, changes in economic and business conditions; a decline in oil production levels; competitive and regulatory pressures; failure to realize the anticipated benefits of requested tariff increases; failure to complete the sale of our MoGas and Omega natural gas pipeline systems; compliance with environmental, safety and other laws; our ability to access debt and equity markets and comply with existing debt covenants; risks associated with climate change; risks associated with changes in tax laws and our ability to continue to qualify as a REIT; and other factors discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on these forward-looking statements, which speak only as of the date of this presentation. Other than as required by law, CorEnergy does not assume a duty to update any forward-looking statement. In particular, any dividends paid in the future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage covenants and other applicable requirements. Non-GAAP Financial Measures This document includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from non-GAAP financial measures used by other companies. CorEnergy believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating the Company’s performance. These non-GAAP measures should not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, including EBITDA, they are presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation. Accordingly, CorEnergy is not providing such comparable GAAP measures or reconciliations in reliance on the "unreasonable efforts" exception for forward-looking non-GAAP measures set forth in SEC rules because certain financial information, the probable significance of which cannot be determined, is not available and cannot be reasonably estimated without unreasonable effort and expense.

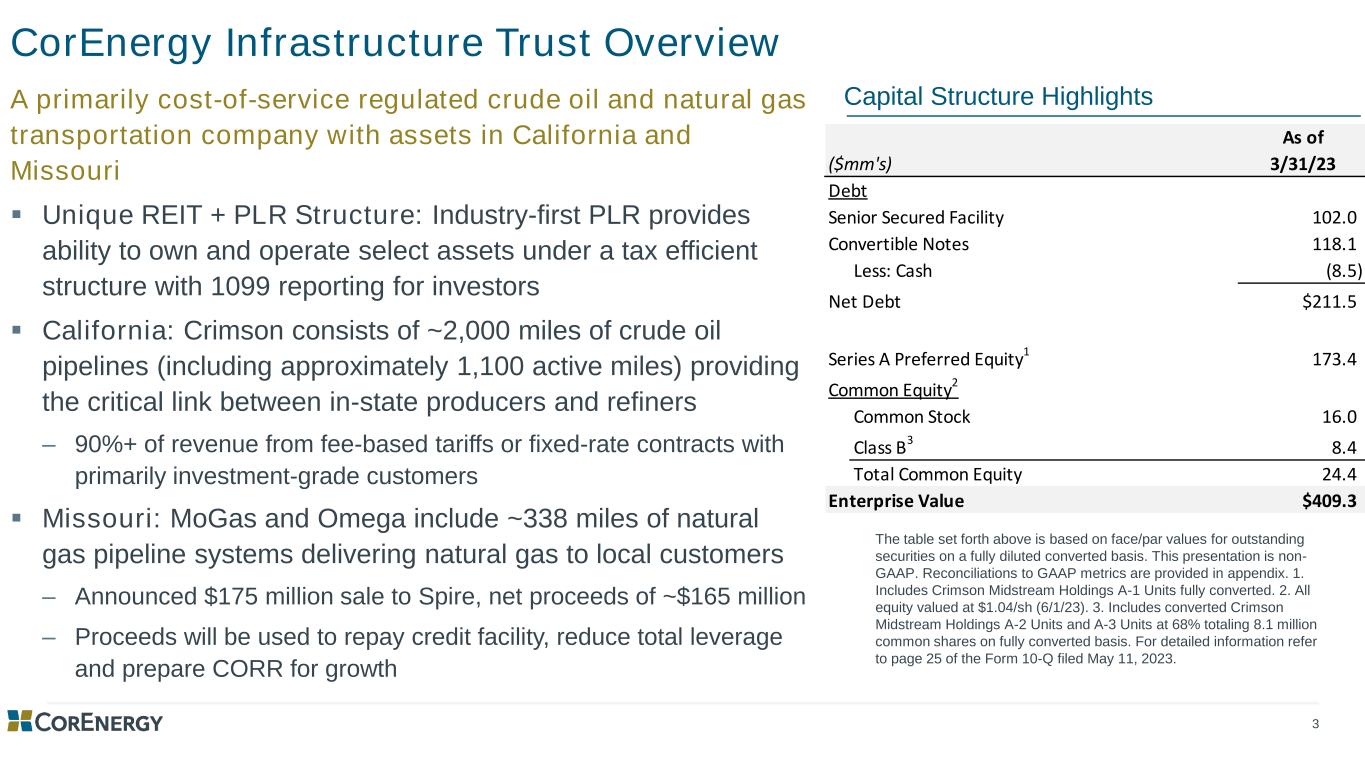

3 CorEnergy Infrastructure Trust Overview A primarily cost-of-service regulated crude oil and natural gas transportation company with assets in California and Missouri ▪ Unique REIT + PLR Structure: Industry-first PLR provides ability to own and operate select assets under a tax efficient structure with 1099 reporting for investors ▪ California: Crimson consists of ~2,000 miles of crude oil pipelines (including approximately 1,100 active miles) providing the critical link between in-state producers and refiners ‒ 90%+ of revenue from fee-based tariffs or fixed-rate contracts with primarily investment-grade customers ▪ Missouri: MoGas and Omega include ~338 miles of natural gas pipeline systems delivering natural gas to local customers ‒ Announced $175 million sale to Spire, net proceeds of ~$165 million ‒ Proceeds will be used to repay credit facility, reduce total leverage and prepare CORR for growth Capital Structure Highlights The table set forth above is based on face/par values for outstanding securities on a fully diluted converted basis. This presentation is non- GAAP. Reconciliations to GAAP metrics are provided in appendix. 1. Includes Crimson Midstream Holdings A-1 Units fully converted. 2. All equity valued at $1.04/sh (6/1/23). 3. Includes converted Crimson Midstream Holdings A-2 Units and A-3 Units at 68% totaling 8.1 million common shares on fully converted basis. For detailed information refer to page 25 of the Form 10-Q filed May 11, 2023. As of ($mm's) 3/31/23 Debt Senior Secured Facility 102.0 Convertible Notes 118.1 Less: Cash (8.5) Net Debt $211.5 Series A Preferred Equity 1 173.4 Common Equity2 Common Stock 16.0 Class B 3 8.4 Total Common Equity 24.4 Enterprise Value $409.3

4 CorEnergy’s 2023 Initiatives Increase Crimson pipeline system cash flow ▪ Initiated tariff increases on California pipelines based on the regulated cost-of-service tariff structure ‒ Currently, all regulated systems are materially underearning ▪ Continue to file 10% tariff increases on filing anniversaries until initial filings approved ‒ 10% tariff increase on all CA regulated pipelines represents ~$10mm/yr of incremental revenue1 ▪ Completed corporate restructuring to eliminate approximately $2.5 million in annualized corporate expenses Reduce leverage ▪ Proceeds from MoGas and Omega proposed sale used to reduce debt ▪ Priorities include full payoff of senior credit facility and likely retire a significant percentage of other outstanding debt ▪ Suspension of dividend payments on 7.375% Series A Cumulative Redeemable Preferred Stock and the Company’s Common Stock to preserve liquidity and reduce debt Participate in the energy transition through carbon capture and renewable energy sources ▪ Crimson owns 900 miles of idle pipeline which could potentially be reconstructed for carbon sequestration ▪ Many infrastructure assets needed for energy transition are REIT qualifying but can also participate in nonqualifying projects as well 1) Assumes constant volumes

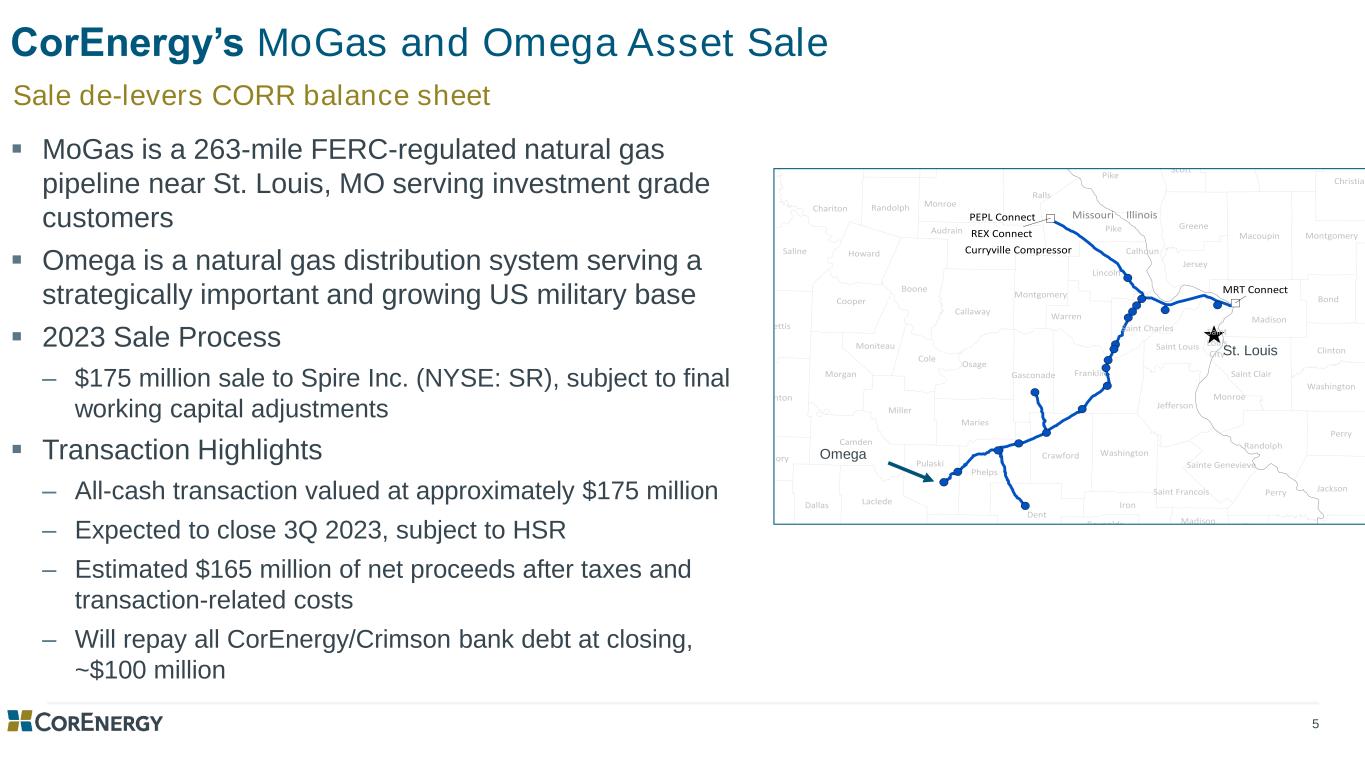

5 CorEnergy’s MoGas and Omega Asset Sale ▪ MoGas is a 263-mile FERC-regulated natural gas pipeline near St. Louis, MO serving investment grade customers ▪ Omega is a natural gas distribution system serving a strategically important and growing US military base ▪ 2023 Sale Process ‒ $175 million sale to Spire Inc. (NYSE: SR), subject to final working capital adjustments ▪ Transaction Highlights ‒ All-cash transaction valued at approximately $175 million ‒ Expected to close 3Q 2023, subject to HSR ‒ Estimated $165 million of net proceeds after taxes and transaction-related costs ‒ Will repay all CorEnergy/Crimson bank debt at closing, ~$100 million Sale de-levers CORR balance sheet 600188_1.wor (NY00813G) Pike Calhoun Lincoln Audrain Monroe Laclede Pulaski Madison Saint Louis City Saint Charles Saint Louis Chariton Moniteau Warren Franklin Phelps BollingerCape Girardeau Madison Saint Francois Texas Reynolds Iron IllinoisMissouri Curryville Compressor REX Connect PEPL Connect MRT Connect Alexander Bond Christian Clinton Fayette Franklin Greene Jackson Jefferson Jersey Macon Macoupin Marion Monroe Montgomery Morgan Perry Pike Pulaski Randolph Saint Clair Sangamon Scott Shelby Union Washington Williamson Benton Boone Callaway Camden Carroll Cole Cooper Crawford Dallas Dent Gasconade Greene Hickory Howard Jefferson Linn Livingston Macon Maries Marion Miller Montgomery Morgan Osage Perry Pettis Polk Ralls Randolph Sainte Genevieve Saline Shannon Shelby Washington Wayne Webster Wright St. Louis Omega

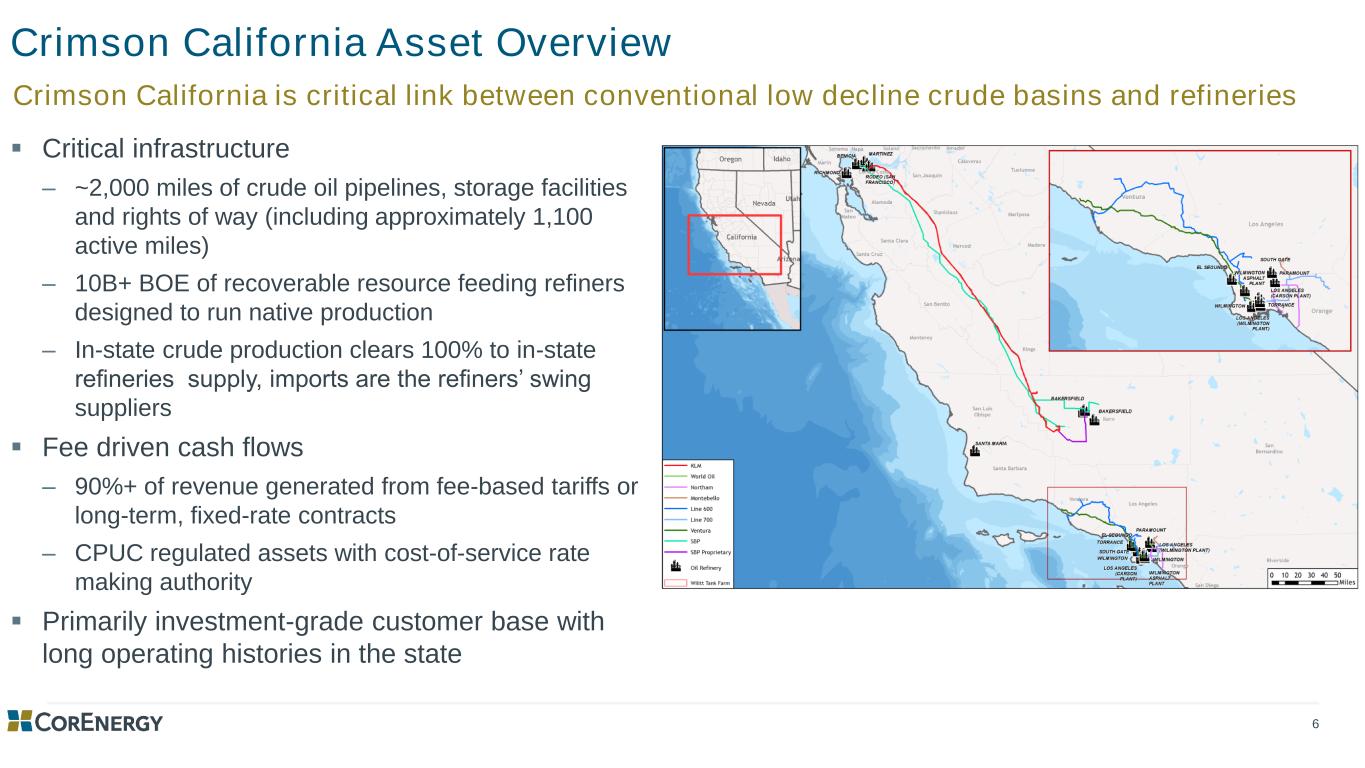

6 Crimson California Asset Overview ▪ Critical infrastructure ‒ ~2,000 miles of crude oil pipelines, storage facilities and rights of way (including approximately 1,100 active miles) ‒ 10B+ BOE of recoverable resource feeding refiners designed to run native production ‒ In-state crude production clears 100% to in-state refineries supply, imports are the refiners’ swing suppliers ▪ Fee driven cash flows ‒ 90%+ of revenue generated from fee-based tariffs or long-term, fixed-rate contracts ‒ CPUC regulated assets with cost-of-service rate making authority ▪ Primarily investment-grade customer base with long operating histories in the state Crimson California is critical link between conventional low decline crude basins and refineries

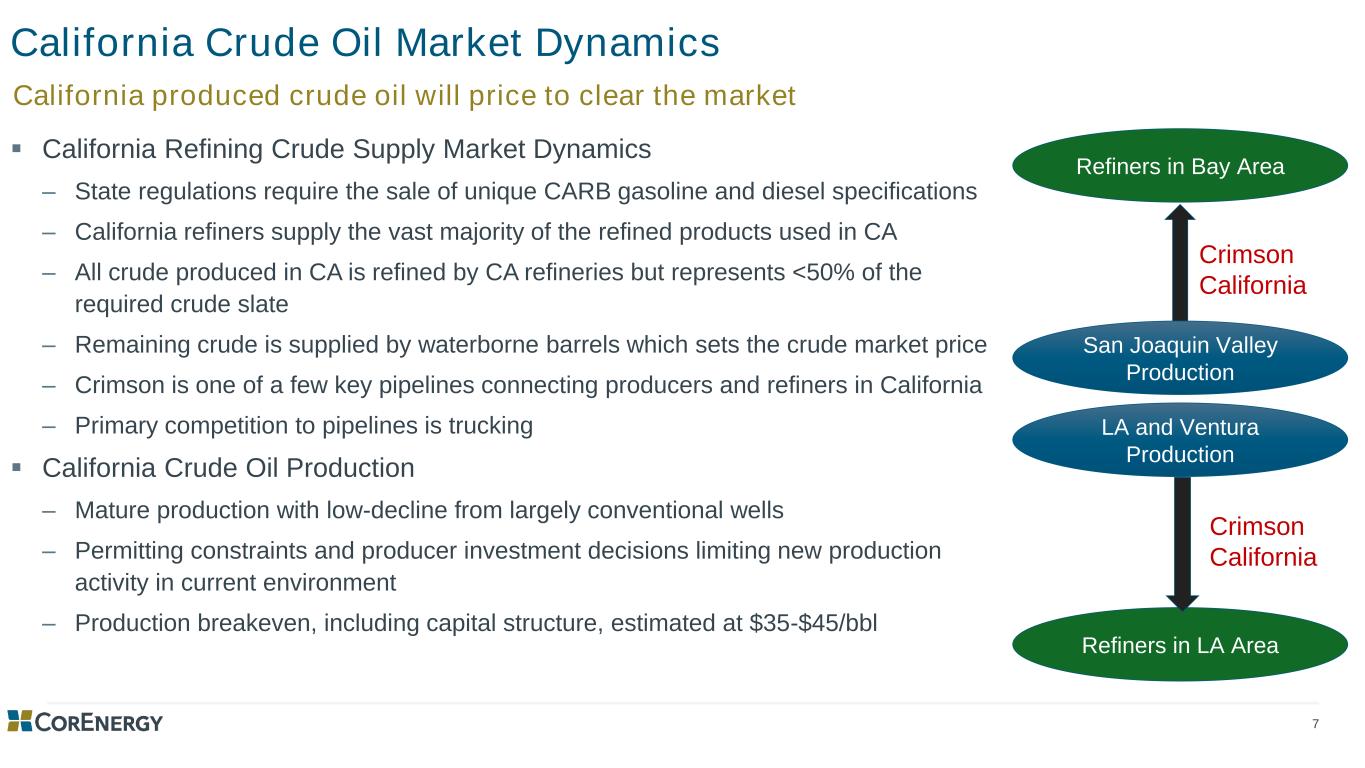

7 California Crude Oil Market Dynamics ▪ California Refining Crude Supply Market Dynamics ‒ State regulations require the sale of unique CARB gasoline and diesel specifications ‒ California refiners supply the vast majority of the refined products used in CA ‒ All crude produced in CA is refined by CA refineries but represents <50% of the required crude slate ‒ Remaining crude is supplied by waterborne barrels which sets the crude market price ‒ Crimson is one of a few key pipelines connecting producers and refiners in California ‒ Primary competition to pipelines is trucking ▪ California Crude Oil Production ‒ Mature production with low-decline from largely conventional wells ‒ Permitting constraints and producer investment decisions limiting new production activity in current environment ‒ Production breakeven, including capital structure, estimated at $35-$45/bbl California produced crude oil will price to clear the market San Joaquin Valley Production LA and Ventura Production Refiners in LA Area Refiners in Bay Area Crimson California Crimson California

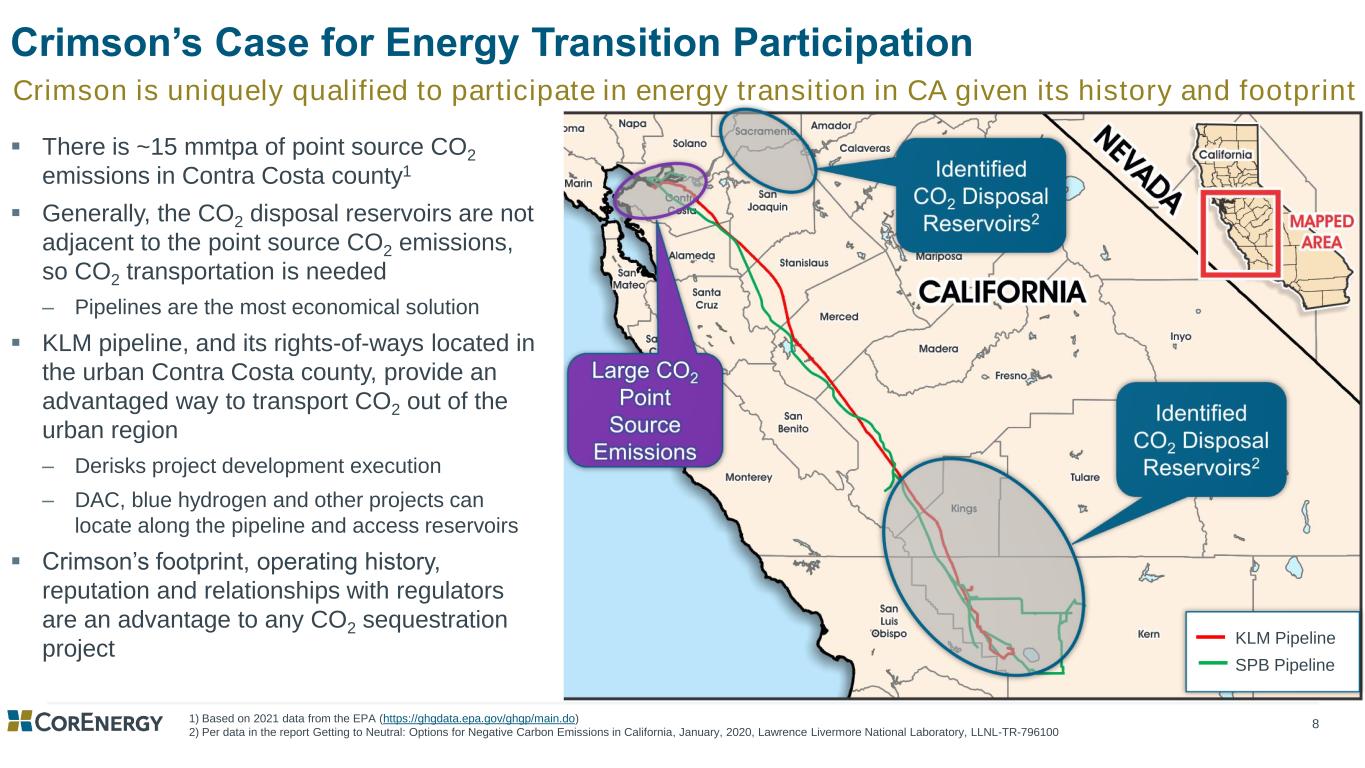

8 Crimson’s Case for Energy Transition Participation ▪ There is ~15 mmtpa of point source CO2 emissions in Contra Costa county1 ▪ Generally, the CO2 disposal reservoirs are not adjacent to the point source CO2 emissions, so CO2 transportation is needed ‒ Pipelines are the most economical solution ▪ KLM pipeline, and its rights-of-ways located in the urban Contra Costa county, provide an advantaged way to transport CO2 out of the urban region ‒ Derisks project development execution ‒ DAC, blue hydrogen and other projects can locate along the pipeline and access reservoirs ▪ Crimson’s footprint, operating history, reputation and relationships with regulators are an advantage to any CO2 sequestration project Crimson is uniquely qualified to participate in energy transition in CA given its history and footprint KLM Pipeline SPB Pipeline 1) Based on 2021 data from the EPA (https://ghgdata.epa.gov/ghgp/main.do) 2) Per data in the report Getting to Neutral: Options for Negative Carbon Emissions in California, January, 2020, Lawrence Livermore National Laboratory, LLNL-TR-796100

9 CorEnergy Outlook Financial Outlook for 2023 (Does not include impact of the MoGas & Omega sale) ▪ The Company plans to provide an updated 2023 outlook, including opportunities within its California energy transition and other business initiatives, after the close of the MoGas transaction ▪ Adjusted EBITDA1 of $33.0-$35.0 million ▪ Maintenance capital expenditures in the range of $10.0 to $11.0 million ‒ Incurred at periodic times throughout the year based on project timing ▪ An expectation that the Company’s Class B Common Stock will mandatorily convert to Common Stock at a ratio of 0.68:1, as opposed to 1:1, during Q1 2024 ‒ Also impacts the Crimson A-2 and A-3 securities owned by Grier Primary Assumptions in the 2023 Outlook ▪ Volumes originally shifted away from SPB pipeline in Q1 2022, which temporarily returned with the 3rd party pipeline shutdown in July 2022, shifted away from the SPB pipeline again in February 2023 ‒ Volumes originally were moved off the system at the start of the Ukraine war and the resulting crude oil supply disruptions ▪ 10% tariff increases on the SPB, SoCal and KLM pipelines effective March 1, August 1 and September 1, respectively ‒ Represents the anniversary effective date of the original tariff filing for a 36%, 35% and 127% increase, respectively ‒ 10% increases are anticipated on the anniversary date until the total increase is reached or the rate case is resolved 1) Adjusted EBITDA is reconciled to GAAP metrics on Slide 14 and in periodic reports.

10 CorEnergy ESG Initiatives ▪ CORR is committed to ESG stewardship through 3 guiding principles: ‒ Environmental Stewardship: Reducing the impact of our operations ‒ Social Responsibility: Engaging openly and transparently on issues ‒ Corporate Governance: Sustainable development through strong governance ▪ Crimson operates in one of the most efficient and environmentally responsible crude oil regions in the world ▪ MoGas and Omega provide critical distribution for public health and safety ▪ Published a comprehensive ESG report on March 29, 2023, highlights include: ‒ 56% reduction in Scope 1 and 2 emissions across all CorEnergy assets from its 2021 baseline. ‒ Commenced a new methane emission measurement and monitoring program at MoGas, targeting a minimum reduction of 65% by 2025. ‒ Adopted the Energy Infrastructure Counsel (EIC) ESG reporting framework and initiated Board-level oversight of its ESG and Cybersecurity programs ‒ In addition to improvement in existing operations, CORR is exploring alternative uses of its assets for programs such as carbon sequestration and transportation of biofuels or other renewable products Read our initial ESG report online at https://corenergy.reit/esg/

11 Appendix

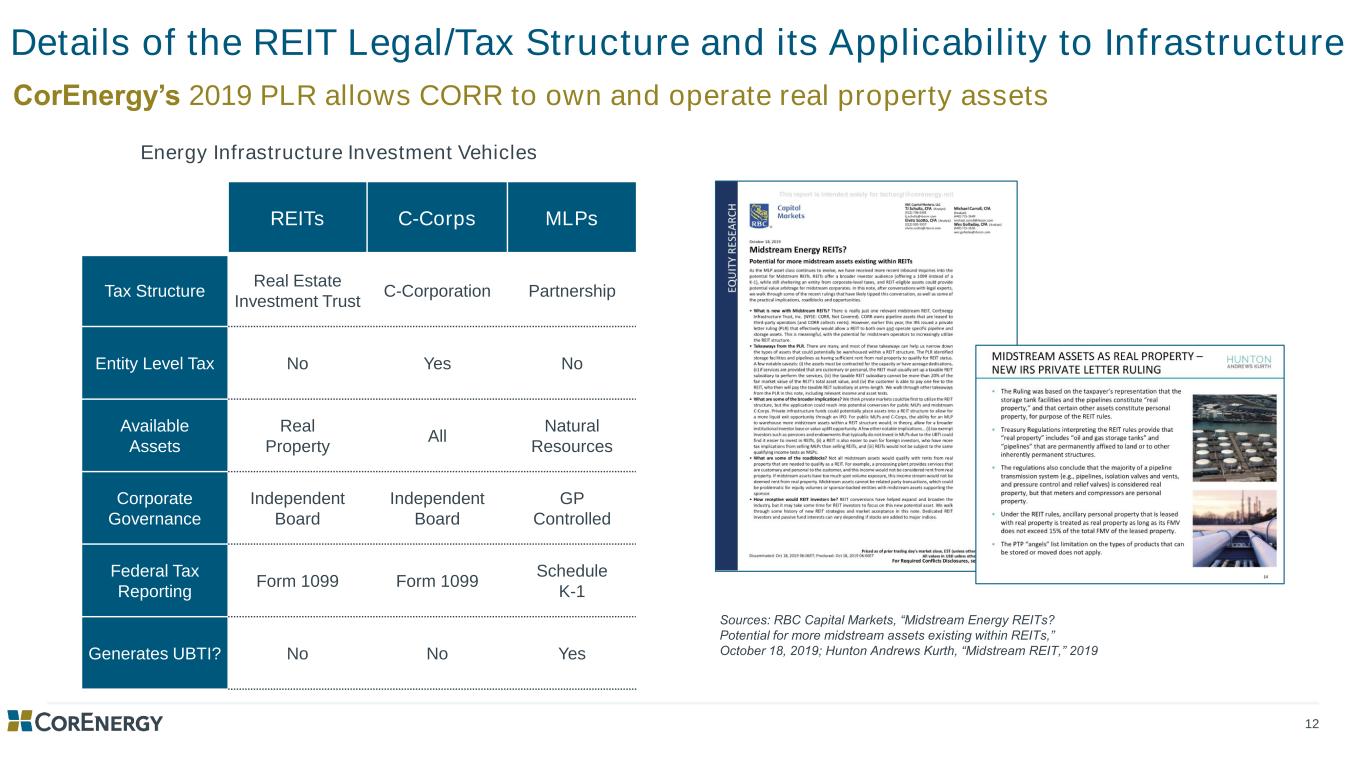

12 Details of the REIT Legal/Tax Structure and its Applicability to Infrastructure CorEnergy’s 2019 PLR allows CORR to own and operate real property assets Sources: RBC Capital Markets, “Midstream Energy REITs? Potential for more midstream assets existing within REITs,” October 18, 2019; Hunton Andrews Kurth, “Midstream REIT,” 2019 REITs C-Corps MLPs Tax Structure Real Estate Investment Trust C-Corporation Partnership Entity Level Tax No Yes No Available Assets Real Property All Natural Resources Corporate Governance Independent Board Independent Board GP Controlled Federal Tax Reporting Form 1099 Form 1099 Schedule K-1 Generates UBTI? No No Yes Energy Infrastructure Investment Vehicles

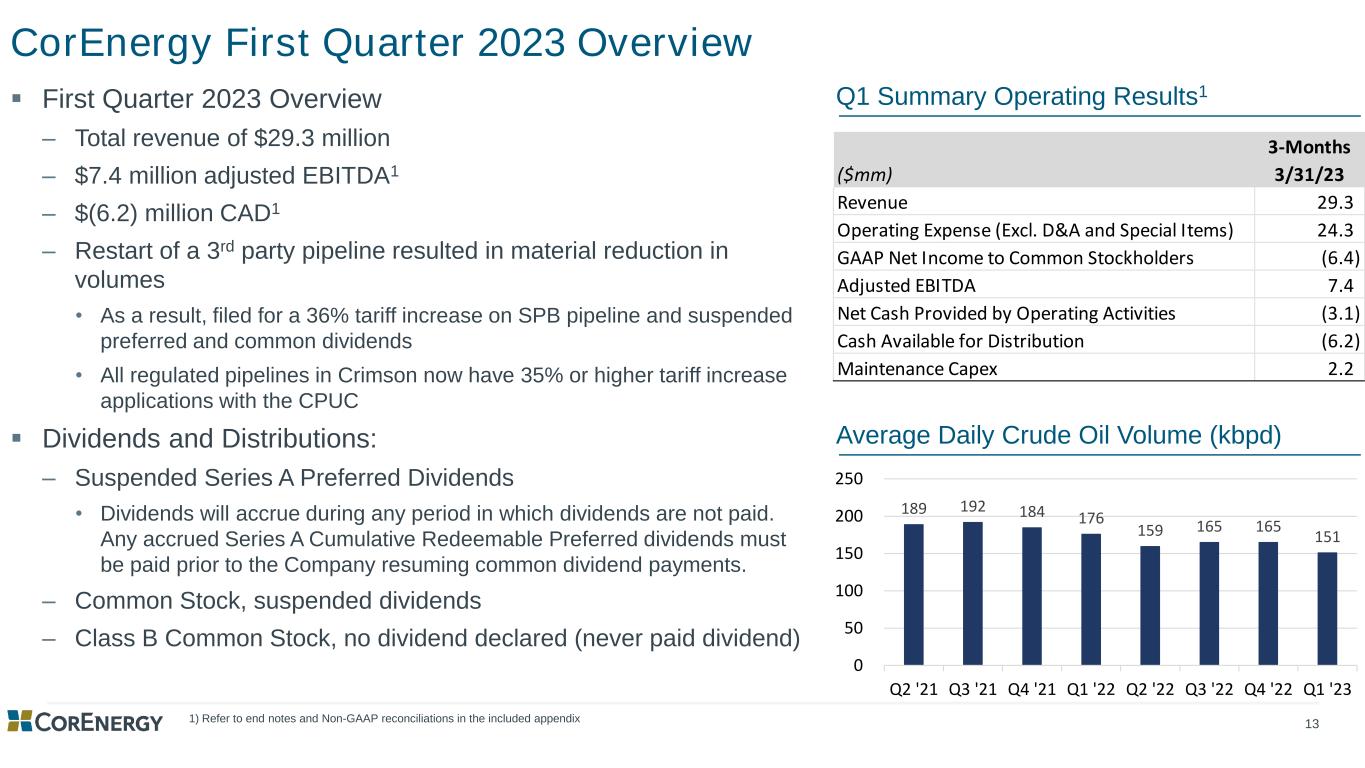

13 CorEnergy First Quarter 2023 Overview ▪ First Quarter 2023 Overview ‒ Total revenue of $29.3 million ‒ $7.4 million adjusted EBITDA1 ‒ $(6.2) million CAD1 ‒ Restart of a 3rd party pipeline resulted in material reduction in volumes • As a result, filed for a 36% tariff increase on SPB pipeline and suspended preferred and common dividends • All regulated pipelines in Crimson now have 35% or higher tariff increase applications with the CPUC ▪ Dividends and Distributions: ‒ Suspended Series A Preferred Dividends • Dividends will accrue during any period in which dividends are not paid. Any accrued Series A Cumulative Redeemable Preferred dividends must be paid prior to the Company resuming common dividend payments. ‒ Common Stock, suspended dividends ‒ Class B Common Stock, no dividend declared (never paid dividend) Q1 Summary Operating Results1 Average Daily Crude Oil Volume (kbpd) 1) Refer to end notes and Non-GAAP reconciliations in the included appendix 189 192 184 176 159 165 165 151 0 50 100 150 200 250 Q2 '21 Q3 '21 Q4 '21 Q1 '22 Q2 '22 Q3 '22 Q4 '22 Q1 '23 3-Months ($mm) 3/31/23 Revenue 29.3 Operating Expense (Excl. D&A and Special Items) 24.3 GAAP Net Income to Common Stockholders (6.4) Adjusted EBITDA 7.4 Net Cash Provided by Operating Activities (3.1) Cash Available for Distribution (6.2) Maintenance Capex 2.2

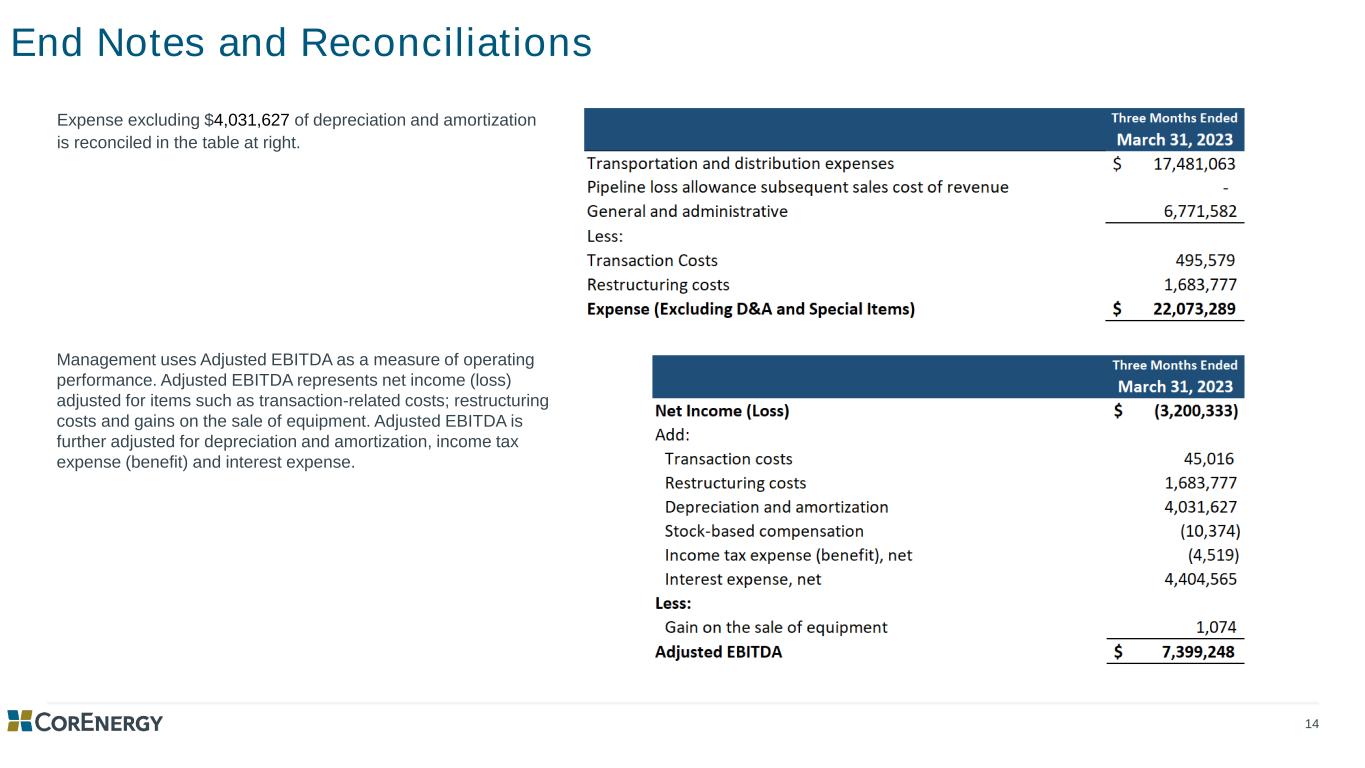

14 End Notes and Reconciliations Expense excluding $4,031,627 of depreciation and amortization is reconciled in the table at right. Management uses Adjusted EBITDA as a measure of operating performance. Adjusted EBITDA represents net income (loss) adjusted for items such as transaction-related costs; restructuring costs and gains on the sale of equipment. Adjusted EBITDA is further adjusted for depreciation and amortization, income tax expense (benefit) and interest expense.

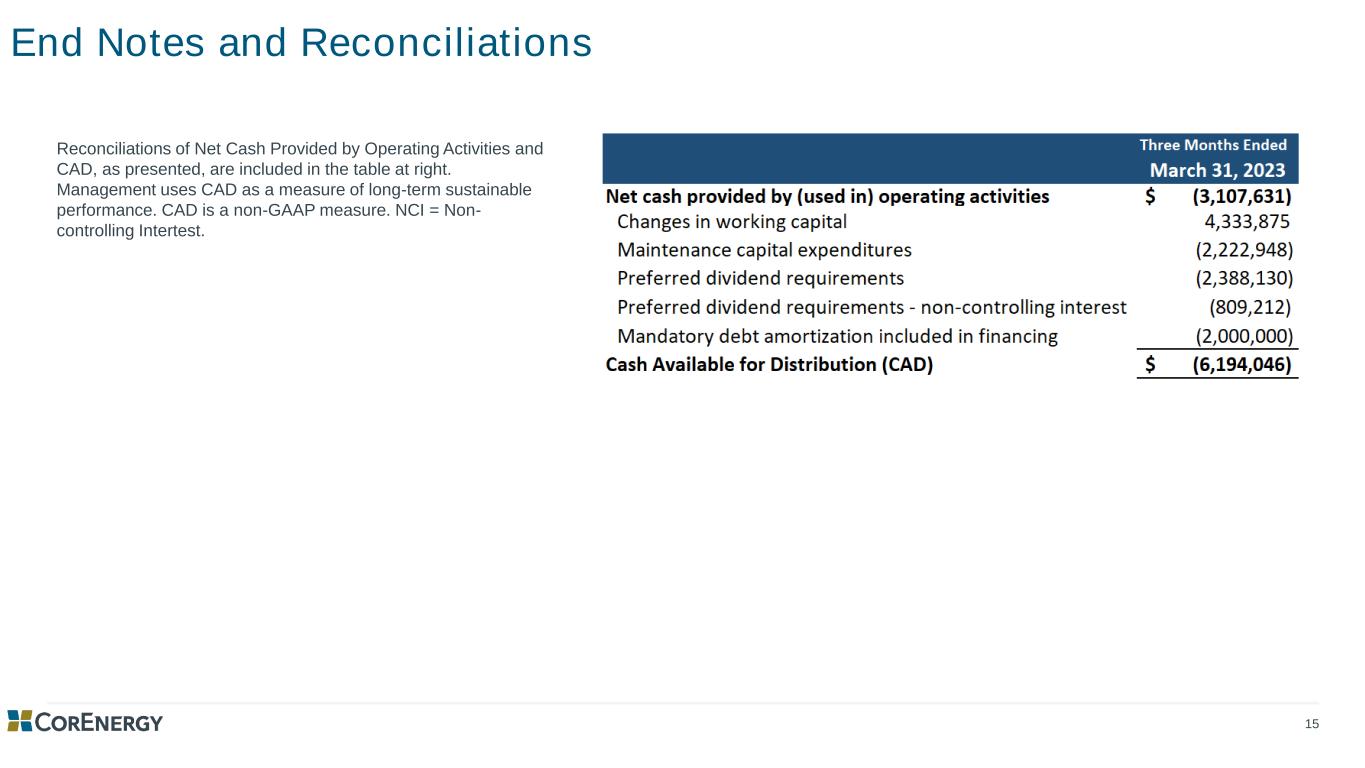

15 End Notes and Reconciliations Reconciliations of Net Cash Provided by Operating Activities and CAD, as presented, are included in the table at right. Management uses CAD as a measure of long-term sustainable performance. CAD is a non-GAAP measure. NCI = Non- controlling Intertest.

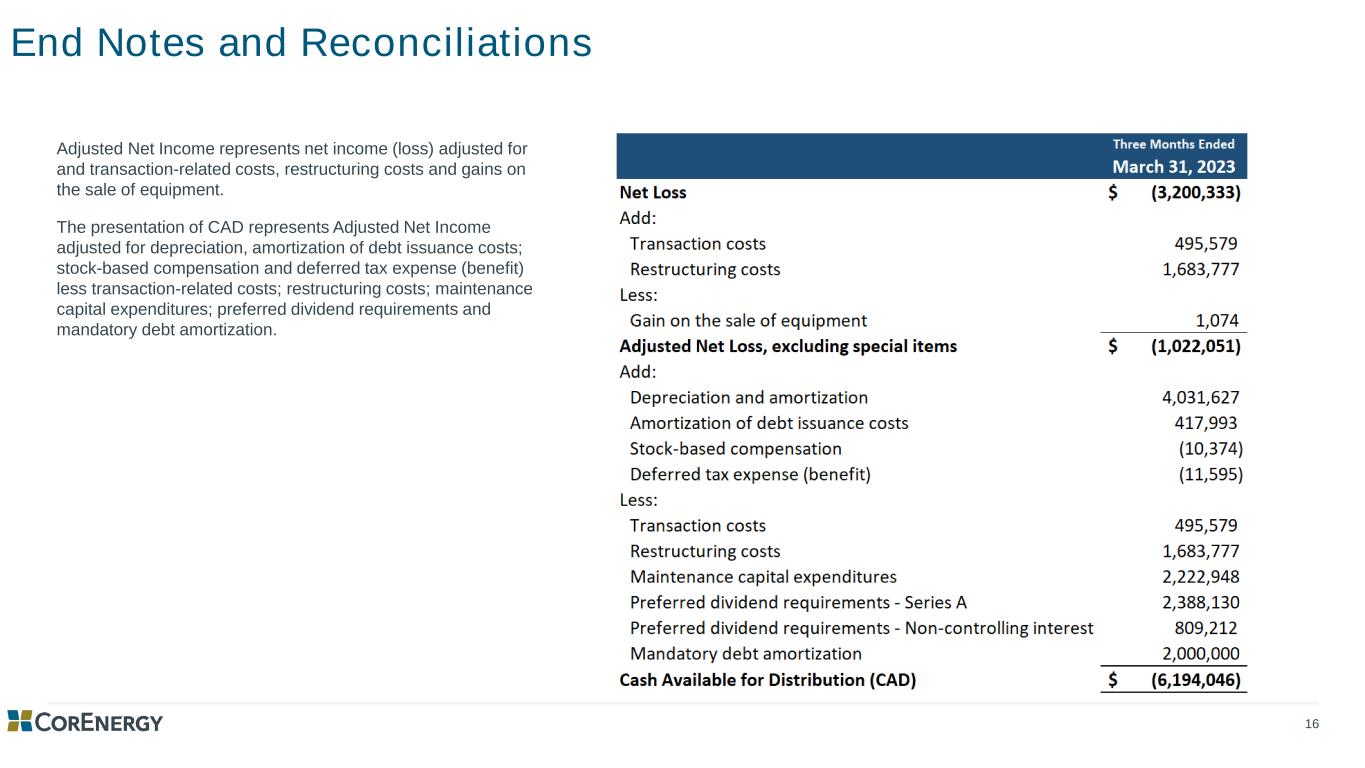

16 End Notes and Reconciliations Adjusted Net Income represents net income (loss) adjusted for and transaction-related costs, restructuring costs and gains on the sale of equipment. The presentation of CAD represents Adjusted Net Income adjusted for depreciation, amortization of debt issuance costs; stock-based compensation and deferred tax expense (benefit) less transaction-related costs; restructuring costs; maintenance capital expenditures; preferred dividend requirements and mandatory debt amortization.

17 For additional information: CorEnergy Infrastructure Trust, Inc. Investor Relations Jeff Teeven or Matt Kreps 877-699-CORR (2677) info@corenergy.reit