Filed Pursuant to Rule 424(b)(2)

Registration No. 333-176944

PROSPECTUS SUPPLEMENT

(To prospectus dated June 7, 2012)

6,500,000 Shares

Common Stock

We are selling 6,500,000 shares of our common stock.

Our shares of common stock trade on the New York Stock Exchange (“NYSE”) under the symbol “CORR.” On January 14, 2014, the last sale price of our shares as reported on the NYSE was $6.93 per share. We intend to use the net proceeds from this offering to fund the acquisition of a petroleum products terminal located in Portland, Oregon, which will be triple-net leased to a subsidiary of Arc Logistics Partners LP.

To assist us with qualifying as a real estate investment trust for U.S. federal income tax purposes, our Amended and Restated Charter includes various restrictions on the ownership and transfer of our stock, including among others, a restriction that, subject to certain exceptions, prohibits any person from owning more than 9.8% (in value or in number, whichever is more restrictive) of our outstanding shares of common stock or 9.8% in value of our outstanding shares of capital stock.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page S-8 of this prospectus supplement and on page 11 of the accompanying prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | 6.50 | $ | 42,250,000 | ||||

| Underwriting discount |

$ | 0.39 | $2,535,000 | |||||

| Proceeds, before expenses, to us |

$ | 6.11 | $ | 39,715,000 | ||||

The underwriters may also exercise their option to purchase up to an additional 975,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange Commission (the “SEC”) nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about January 21, 2014.

Sole Book-Running Manager

BofA Merrill Lynch

Co-Managers

KeyBanc Capital Markets Stifel

The date of this prospectus supplement is January 15, 2014.

| Prospectus Supplement |

| |||

| Page | ||||

| S-i | ||||

| S-ii | ||||

| S-iv | ||||

| S-1 | ||||

| S-6 | ||||

| S-8 | ||||

| S-10 | ||||

| S-10 | ||||

| S-14 | ||||

| S-14 | ||||

| S-15 | ||||

| S-16 | ||||

| S-26 | ||||

| S-32 | ||||

| S-32 | ||||

| S-32 | ||||

| S-33 | ||||

| Prospectus |

||||

| 1 | ||||

| 7 | ||||

| 11 | ||||

| 22 | ||||

| 22 | ||||

| 23 | ||||

| 25 | ||||

| 33 | ||||

| 35 | ||||

| 39 | ||||

| 41 | ||||

| 44 | ||||

| 63 | ||||

| Certain Provisions of Our Charter and Bylaws and The Maryland General Corporation Law |

76 | |||

| 80 | ||||

| 80 | ||||

| 80 | ||||

| 83 | ||||

| 83 | ||||

| 83 | ||||

| 83 | ||||

ABOUT THIS PROSPECTUS SUPPLEMENT

We are providing information to you about this offering of our common stock in two parts. The first part is this prospectus supplement, which provides the specific details regarding this offering. The second part is the accompanying prospectus, which provides general information, including information about our common stock and information that may not apply to this offering.

This prospectus supplement may add, update or change information contained in or incorporated by reference in the accompanying prospectus. If the information in this prospectus supplement is inconsistent with any information contained in or incorporated by reference in the accompanying prospectus, the information in this prospectus supplement will apply and will supersede the inconsistent information contained in or incorporated by reference in the accompanying prospectus. See “Incorporation of Certain Information by Reference”.

Ultra Petroleum leases a substantial portion of our net leased property, which is a significant source of revenues and operating income, and under the requirements of Exchange Act, we include certain portions of Ultra Petroleum’s financial statements in our periodic reports and incorporate them by reference in this prospectus supplement. Ultra Petroleum is currently subject to the reporting requirements of the Exchange Act and is required to file with the SEC annual reports containing audited financial statements and quarterly reports containing unaudited financial statements. The audited financial statements and unaudited financial statements of Ultra Petroleum can be found on the SEC's website at www.sec.gov. We have not prepared the financial statements of Ultra Petroleum incorporated by reference in this prospectus supplement and, although we have no reason to believe they are not accurate in all material respects, we are not able to confirm the accuracy of the Ultra Petroleum financial statements. We cannot assure you that there has not been any material adverse changes since the date of the information incorporated by reference in this prospectus supplement.

We have not, and the underwriters have not, authorized any other person to provide you with information or to make any representation other than those contained or incorporated by reference in this prospectus supplement, the accompanying prospectus or in any free writing prospectus that we have prepared. We take no responsibility for, and can provide no assurance as to the reliability of, any other information that others may give you. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is accurate only as of the specified dates. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates. We will advise investors of any material changes to the extent required by applicable law.

S-i

Certain statements included in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein may be deemed “forward looking statements” within the meaning of the federal securities laws. In many cases, these forward looking statements may be identified by the use of words such as “will,” “may,” “should,” “could,” “believes,” “expects,” “anticipates,” “estimates,” “intends,” “projects,” “goals,” “objectives,” “targets,” “predicts,” “plans,” “seeks,” or similar expression. Any forward looking statement speaks only as of the date on which it is made and is qualified in its entirety by reference to the factors discussed throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein.

Although we believe the expectations reflected in any forward looking statements are based on reasonable assumptions, forward looking statements are not guarantees of future performance or results and we can give no assurance that these expectations will be attained. Our actual results may differ materially from those indicated by these forward looking statements due to a variety of known and unknown risks and uncertainties. In addition to the risk factors discussed in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein, such known risk and uncertainties include, without limitation:

| • | the ability of our tenants and borrowers to make payments owed to us, our reliance on certain major tenants and borrowers, and our ability to re-lease or sell properties that become vacant; |

| • | our ability to obtain suitable tenants for our properties; |

| • | changes in economic and business conditions, including the financial condition of our tenants and general economic conditions in the energy industry, and in the particular sectors of that industry served by each of our infrastructure assets; |

| • | the inherent risks associated with owning real estate, including prevailing real estate market conditions, governing laws and regulations, including potential liabilities relating to environmental matters, and the illiquidity of real estate investments; |

| • | our ability to sell properties at an attractive price; |

| • | our ability to repay debt financing obligations; |

| • | our ability to refinance amounts outstanding under our credit facility at maturity on terms favorable to us; |

| • | the loss of any member of our management team; |

| • | our ability to comply with certain debt covenants; |

| • | our ability to integrate acquired properties and operations into existing operations; |

| • | our continued ability to access the debt or equity markets; |

| • | the availability of other debt and equity financing alternatives; |

| • | market conditions affecting our debt and equity securities; |

| • | changes in interest rates under our current credit facility and under any additional variable rate debt arrangements that we may enter into in the future; |

| • | our ability to successfully implement our selective acquisition strategy; |

S-ii

| • | our ability to maintain internal controls and processes to ensure all transactions are accounted for properly, all relevant disclosures and filings are timely made in accordance with all rules and regulations, and any potential fraud or embezzlement is thwarted or detected; |

| • | changes in federal or state tax rules or regulations that could have adverse tax consequences; |

| • | declines in the market value of our investment securities; and |

| • | our ability to qualify as a real estate investment trust for federal income tax purposes. |

This list of risks and uncertainties is only a summary and is not intended to be exhaustive. For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward looking statements, please see the “Risk Factors” section of this prospectus supplement beginning on page S-8, the “Risk Factors” section of the accompanying prospectus beginning on page 10 thereof, and the “Risk Factors” section of our Annual Report on Form 10-K for the year ended November 30, 2012. We disclaim any obligation to update or revise any forward looking statements to reflect actual results or changes in the factors affecting the forward looking information.

S-iii

Certain of the defined terms used in this prospectus supplement are set forth below.

AFFO: Adjusted Funds from Operations

Ancillary Assets: certain non-real property rights associated with the Portland Terminal Facility

Arc Terminals: Arc Terminals Holdings LLC

Arc Logistics: Arc Logistics Partners LP, the parent of Arc Terminals

City Council: The City Council of the City of Portland, Oregon

CorEnergy: CorEnergy Infrastructure Trust, Inc.

Corridor: Corridor InfraTrust Management, LLC

EIP: Eastern Interconnect Project

Exchange Act: Securities Exchange Act of 1934, as amended

Franchise Agreement: the agreement that provides authorization for the pipelines at the Portland Terminal Facility to traverse the rights-of-way associated with public roadways owned by the City of Portland, Oregon

FFO: Funds from Operations

Guaranty: the guaranty by Arc Logistics

IRS: Internal Revenue Service

KeyBank: KeyBank National Association

LCP Oregon: LCP Oregon Holdings, LLC

Lease Agreement: the primary lease agreement with Arc Terminals relating to the lease of the Portland Terminal Facility

Lightfoot: Lightfoot Capital Partners, LP

Liquids Gathering System or Pinedale LGS: a system of pipelines and central gathering facilities

Membership Interests Purchase Agreement: the agreement where CorEnergy purchases the membership interests of LCP Oregon from Lightfoot

Pinedale LP: Pinedale Corridor, LP

PNM: Public Service Company of New Mexico

Portland Terminal Facility: a petroleum products terminal located in Portland, Oregon

Portland Transaction: the transaction for (i) the acquisition of the Portland Terminal Facility and certain associated real property rights from an unrelated third party and (ii) the lease of the Portland Terminal Facility to Arc Terminals

S-iv

Prudential: Prudential Financial, Inc.

Purchase Agreement: the agreement setting forth the terms of the purchase of the Portland Terminal Facility by LCP Oregon

REIT: real estate investment trust

TCA: Tortoise Capital Advisors, L.L.C.

Ultra Petroleum: Ultra Petroleum Corp.

S-v

This summary contains basic information about us and the offering but does not contain all of the information that is important to your investment decision. You should read this summary together with the more detailed information contained elsewhere in this prospectus supplement and the accompanying prospectus, and the documents incorporated herein and therein by reference, especially the information set forth in the “Risk Factors” section of this prospectus supplement beginning on page S-8 and the “Risk Factors” section of the accompanying prospectus beginning on page 10 thereof, as well as other information contained in our publicly available filings with the Securities and Exchange Commission. When used in this prospectus supplement, the terms “we,” “us,” “our” and “CorEnergy” refer to CorEnergy Infrastructure Trust, Inc. and its subsidiaries unless specified otherwise.

The Company

We are primarily focused on acquiring and financing midstream and downstream real estate assets within the U.S. energy infrastructure sector and concurrently entering into long-term triple net participating leases with energy companies. We also may provide other types of capital, including loans secured by energy infrastructure assets. Targeted assets include pipelines, storage tanks, transmission lines and gathering systems, among others. These sale-leaseback or real property mortgage transactions provide the energy company with a source of capital that is an alternative to sources such as corporate borrowing, bond offerings, or equity offerings. We expect to receive participation features in the financial performance and/or value of the underlying infrastructure real property asset. The triple net lease structure requires that the tenant pay all operating expenses of the business conducted by the tenant, including real estate taxes, insurance, utilities, and expenses of maintaining the asset in good working order.

We intend to acquire assets that are accretive to our stockholders and support our growth as a diversified energy infrastructure real estate investment trust (“REIT”). Our principal objective is to provide stockholders with an attractive risk-adjusted total return, with an emphasis on distributions and long-term distribution growth.

While we have not yet formally elected REIT status for U.S. federal income tax purposes through the filing of Form 1120-REIT, we expect to do so in the first quarter of 2014, applicable for the calendar year commencing January 1, 2013. Our REIT election, assuming continuing compliance with the then applicable qualification tests, will continue in effect for subsequent taxable years.

We are externally managed by Corridor InfraTrust Management, LLC (“Corridor”), an affiliate of Tortoise Capital Advisors, L.L.C. (“TCA”), a registered investment adviser with over $14.2 billion of assets under management in the U.S. energy infrastructure sector and 52 employees as of December 31, 2013. Corridor is a real property asset manager with a focus on U.S. energy infrastructure real assets and will have access to certain resources of TCA while acting as our manager.

Current Asset Portfolio

Currently, our most significant asset is the Pinedale LGS, which represents $224 million of our $284 million in consolidated assets as of September 30, 2013.

Pinedale LGS

On December 20, 2012, our subsidiary, Pinedale Corridor, LP (“Pinedale LP”), acquired from an indirectly wholly-owned subsidiary of Ultra Petroleum Corp. (“Ultra Petroleum”) a system of gathering, storage, and pipeline facilities (the “Liquids Gathering System” or “Pinedale LGS”), with associated real property rights

S-1

in the Pinedale Anticline in Wyoming. The Pinedale LGS consists of more than 150 miles of pipelines with 107 receipt points and four above-ground central gathering facilities. We then entered into a triple-net lease agreement for these assets with another subsidiary of Ultra Petroleum. The system is used by Ultra Petroleum as a method of separating water, condensate and associated flash gas from a unified stream and subsequently selling or treating and disposing of the separated products. A subsidiary of Prudential Financial, Inc. owns an 18.95% economic interest in Pinedale LP.

In addition to the Pinedale LGS, we currently own four other principal assets, as described below.

Eastern Interconnect Project (EIP)

We own a 40 percent undivided interest in the EIP transmission assets, which move electricity across New Mexico between Albuquerque and Clovis. The physical assets include 216 miles of 345 kilovolts transmission lines, towers, easement rights, converters and other grid support components. These assets are leased on a triple net basis through April 1, 2015 to PNM, an independent electric utility company serving approximately 500 thousand customers in New Mexico. PNM is a subsidiary of PNM Resources Inc. (NYSE: PNM). On November 1, 2012, we entered into a purchase agreement with PNM to sell our interest in the EIP upon lease termination on April 1, 2015 for $7.7 million. PNM also accelerated its remaining lease payments to us. Both lease payments due in 2013 were paid upon execution of that purchase agreement on November 1, 2012. The three remaining lease payments due April 1, 2014, October 1, 2014 and April 1, 2015, were paid in full on January 2, 2014.

Mowood, LLC

Mowood, LLC (“Mowood”) is the holding company of Omega Pipeline, LLC (“Omega”). Omega is a natural gas local distribution company located on the Fort Leonard Wood military installation in south-central Missouri. Omega owns approximately 70 miles of pipeline, has a long term contract with the Department of Defense and serves the natural gas needs of Fort Leonard Wood in addition to marketing natural gas services to several customers in the surrounding area. We hold 100 percent of the equity interests in Mowood.

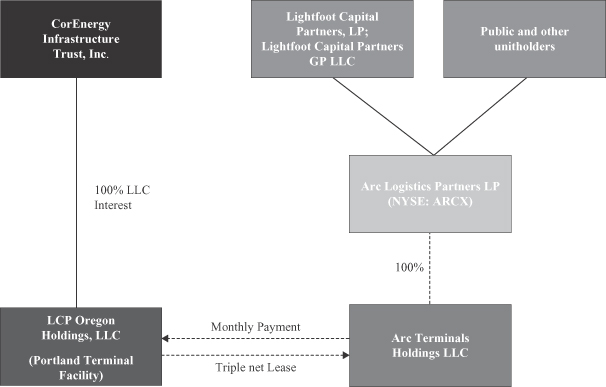

Lightfoot Capital Partners, LP; Lightfoot Capital Partners GP LLC; Arc Logistics Partners LP

We hold a direct investment in Lightfoot Capital Partners, LP (6.6 percent) and Lightfoot Capital Partners GP LLC (1.5 percent) (collectively “Lightfoot”). Lightfoot’s assets include common units and subordinated units representing an approximately 40 percent aggregate limited partner interest, and a non-economic general partner interest, in Arc Logistics Partners LP (NYSE: ARCX) (“Arc Logistics”), a fee-based, growth-oriented Delaware limited partnership formed by Lightfoot to own, operate, develop and acquire a diversified portfolio of complementary energy logistics assets that is principally engaged in the terminalling, storage, throughput and transloading of crude oil and petroleum products. In November 2013, Arc Logistics completed its initial public offering (“IPO”) of common units.

VantaCore Partners LP

We hold an 11 percent direct investment as of September 30, 2013 in VantaCore Partners LP (“VantaCore”), a private company. VantaCore’s operations consist of an integrated limestone quarry (with permitted surface reserves of about 72 million tons), a dock facility, two asphalt plants and a commercial asphalt lay down business located in Clarksville, Tennessee, a limestone quarry located in Todd County, Kentucky, a sand and gravel business (with approximately 40 million tons of gravel reserves) located near Baton Rouge, Louisiana serving the south central Louisiana market and a surface and underground limestone quarry (with in excess of 200 million tons of reserves) located in Pennsylvania serving energy and construction businesses in Pennsylvania, West Virginia and Ohio. We hold observation rights on VantaCore’s Board of Directors.

S-2

Acquisition of Portland Terminal Facility and Arc Terminals Lease Agreement

(the “Portland Transaction”)

Transaction Terms

The Purchase Agreement and Acquisition of LCP Oregon

On October 17, 2013, LCP Oregon Holdings, LLC (“LCP Oregon”), which is currently a direct wholly-owned subsidiary of Lightfoot, entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with the current owner of the Portland Terminal Facility. The Purchase Agreement provides for LCP Oregon to acquire the Portland Terminal Facility in Portland, Oregon and certain associated non-real property rights (the “Ancillary Assets”) for a purchase price of $40 million. We have entered into an agreement with Lightfoot to acquire LCP Oregon, making it a direct wholly-owned subsidiary of the Company (the “Membership Interests Purchase Agreement”). We will acquire LCP Oregon, as a part of the closing of the Portland Transaction, for nominal consideration and reimbursement of approximately $1 million of amounts paid and expenses incurred by Lightfoot in connection with due diligence for the acquisition of the Portland Terminal Facility. We will use proceeds from this offering to acquire the Portland Terminal Facility.

The Lease Agreement

LCP Oregon intends to enter into a fifteen-year triple net operating lease agreement relating to the use of the Portland Terminal Facility (the “Lease Agreement”) with Arc Terminals Holdings LLC (“Arc Terminals”), an indirect wholly-owned operating subsidiary of Arc Logistics, upon the closing of the acquisition of the Portland Terminal Facility. Arc Logistics will guaranty the obligations of Arc Terminals under the Lease Agreement. The Lease Agreement grants Arc Terminals substantially all authority to operate, and imposes on them the responsibility for the operation of, the Portland Terminal Facility. During the initial term, Arc Terminals will make base monthly rental payments (to be increased on the fifth anniversary by the change in the consumer price index for the prior five years, and every year thereafter by the greater of 2 percent or the change in the consumer price index) and variable rent payments based on the volume of liquid hydrocarbons that flowed through the Portland Terminal Facility in a prior month. The base rent in the initial year of the Lease Agreement increases to approximately $417,522 per month starting with August 2014 and each month thereafter. The base rent is also expected to increase during the initial year of the Lease Agreement based on a percentage of specified construction costs at the Portland Terminal Facility incurred by LCP Oregon, estimated at $10 million. Variable rent is capped at 30% of total rent, which would be the equivalent of the Portland Terminal Facility’s expected throughput capacity.

Arc Logistics is a fee-based, growth-oriented Delaware limited partnership formed by Lightfoot to own, operate, develop and acquire a diversified portfolio of complementary energy logistics assets. Arc Logistics’ public disclosures filed with the SEC indicate that Arc Logistics is principally engaged in the terminalling, storage, throughput and transloading of crude oil and petroleum products and is focused on growing its business through the optimization, organic development and acquisition of terminalling, storage, rail, pipeline and other energy logistics assets that generate stable cash flows.

Terminal Improvement Projects

After the closing of the Portland Transaction, we anticipate funding an additional $10 million of terminal related improvement projects in support of Arc Terminals’ commercial strategy to optimize the Portland Terminal Facility and generate stable cash flows, including: i) clean, inspect and upgrade a portion of the existing storage assets; ii) enhance existing terminal infrastructure; and iii) develop, design, engineer and construct throughput expansion opportunities.

S-3

Portland Transaction Rationale

We believe that the key characteristics of the Portland Transaction align with our targeted strategy and investment criteria.

| • | Fixed Asset-Intensive Investments. We target investments in fixed assets that characteristically display relatively inelastic demand, resulting in low volatility and low cyclicality. |

| • | Long-life Assets with Stable Cash Flows and Limited Commodity Price Sensitivity. We seek real property assets having the potential to generate stable cash flows over long periods of time. |

| • | Growth Opportunities. We generally seek to enter into transactions that provide base cash flow and variable cash flow over the term of the loan. |

| • | Experienced Management Team. We target assets operated by management teams that have a track record of success and that often have substantial knowledge and focus in particular segments of the energy infrastructure sector or with certain types of assets. |

| • | Limited Technological Risk. We generally target opportunities involving the application of proven technologies and limited geological, drilling and development risk. |

There is no guarantee that the Portland Transaction will actually be consummated, or consummated on the terms or in the manner described in this prospectus supplement. The offering of our shares described in this prospectus supplement is not conditioned on the closing of the Portland Transaction.

S-4

Structure of the Portland Transaction

A chart showing the proposed pro forma structure following the Portland Transaction is set forth below. For additional information on the Portland Transaction, see “The Portland Transaction”.

S-5

| Shares of common stock offered by CorEnergy Infrastructure Trust, Inc. |

6,500,000 shares. |

| Shares of common stock outstanding after the offering |

30,656,163 shares. |

| Use of proceeds |

We estimate that our net proceeds from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $38.3 million (or $44.3 million if the underwriters exercise their option to purchase 975,000 additional shares from us). We intend to use the net proceeds from this offering to fund the acquisition and certain associated expenses of the Portland Terminal Facility, which will be triple-net leased to a subsidiary of Arc Logistics. See “Use of Proceeds” and “The Portland Transaction.” This offering of shares is not conditioned on the consummation of the Portland Transaction. |

| Risk factors |

See the “Risk Factors” section of this prospectus supplement beginning on page S-8, the “Risk Factors” section of the accompanying prospectus beginning on page 10 thereof, and the risk factors described in “Item 1A. Risk Factors” in our most recent Annual Report on Form 10-K filed with the SEC, which is incorporated by reference herein, for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| New York Stock Exchange symbol |

“CORR” |

| REIT status and transfer restrictions |

While we have not yet formally elected REIT status for U.S. federal income tax purposes through the filing of Form 1120-REIT, we expect to do so in the first quarter of 2014, applicable for the calendar year commencing January 1, 2013. Our REIT election, assuming continuing compliance with the then applicable qualification tests, will continue in effect for subsequent taxable years. |

| To assist us with qualifying as a REIT, among other purposes, our Amended and Restated Charter includes various restrictions on the ownership and transfer of our stock, including among others, a restriction that, subject to certain exceptions, prohibits any person from owning more than 9.8% (in value or in number, whichever is more restrictive) of our outstanding shares of common stock or 9.8% in value of our outstanding shares of capital stock. |

| Distributions |

Our Board of Directors has indicated that it intends to approve an increase in our quarterly distribution payable to stockholders from $.125 to $.13 per share. The $.13 per share distribution is expected to apply from the date after closing of the Portland Transaction. While we intend to continue to make distributions on a quarterly basis to our stockholders out of assets legally available for distribution, there is no assurance that we will continue to make regular distributions. See “Risk Factors.” |

S-6

| Our Board of Directors will determine the amount of any distribution. A REIT is generally required to distribute during the taxable year an amount equal to at least 90% of the REIT taxable income (determined under Internal Revenue Code section 857(b)(2), without regard to the deduction for dividends paid). We intend to adhere to this requirement in order to qualify as a REIT. |

| See “Dividend Policy” for additional information. |

S-7

You should carefully consider the risks described below, in the “Risk Factors” section of the accompanying prospectus beginning on page 10 thereof and in the “Risk Factors” section of our Annual Report on Form 10-K for the year ended November 30, 2012, together with all other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before you decide to invest in shares of our common stock.

We will be subject to risks associated with ownership of the Portland Terminal Facility.

Our ownership of the Portland Terminal Facility will subject us to all of the inherent hazards and risks normally incidental to the storage and distribution of crude oil and petroleum products, such as fires, explosions, leaks or hazardous materials releases, disruptions in supply infrastructure or logistics and other equipment failures, pollution and environmental risks and natural disasters. These risks could result in substantial losses due to personal injury and/or loss of life, significant damage to and destruction of property and equipment and pollution or other environmental damage. Moreover, if one or more of these hazards occur, there can be no assurance that a response will be adequate to limit or reduce damage. As a result of these risks, we may also sometimes be a defendant in legal proceedings and litigation arising in the ordinary course of business. While the terms of the Lease Agreement require the tenant to bear the cost of all insurance coverage (which is currently not material), there can be no assurance that the insurance policies that we maintain to limit our liability for such losses will be adequate to protect us from all material expenses related to potential future claims for personal injury and property damage or that such levels of insurance will be available in the future at economical prices or to cover all risks. The Terrorism Risk Insurance Act of 2002 is designed for a sharing of terrorism losses between insurance companies and the federal government, and has been renewed until December 31, 2014. We cannot be certain how this act will impact us or what additional cost to us or to the tenant, if any, could result.

As owners of the Portland Terminal Facility, we may incur significant costs and liabilities in complying with environmental, health and safety laws and regulations, which are complex and frequently changing.

The operations at the Portland Terminal Facility involve the storage and throughput of crude oil, petroleum products and chemicals and are subject to federal, state, and local laws and regulations governing, among other things, the gathering, storage, handling, and transportation of petroleum and hazardous substances, the emission and discharge of materials into the environment, the generation, management and disposal of wastes, and other matters otherwise relating to the protection of the environment. The operations at the Portland Terminal Facility are also subject to various laws and regulations relating to occupational health and safety. Moreover, the operations at the Portland Terminal Facility are inherently subject to accidental spills, discharges or other releases of petroleum or hazardous substances into the environment and neighboring areas, for which we may incur substantial liabilities, including those to investigate and remediate. Failure to comply with applicable environmental, health, and safety laws and regulations may result in the assessment of sanctions, including administrative, civil or criminal penalties, permit revocations, and injunctions limiting or prohibiting some or all of the operations at the Portland Terminal Facility.

The approval of the transfer of the Franchise Agreement to us by the City Council of the City of Portland is subject to the potential submission of petitions through close of business January 17, 2014 that could trigger a public referendum process. If a referendum is initiated prior to such date and is successful in overturning such approval, the Portland Transaction could be unwound or delayed without you receiving any return of your investment.

LCP Oregon has received approval from the City Council of the City of Portland, Oregon (the “City Council”) for the transfer of the franchise agreement (the “Franchise Agreement”) to LCP Oregon from the current owner of the Portland Terminal Facility. Such approval could potentially be made subject to a referendum through the close of business on January 17, 2014. As of the date hereof, the City Council has not

S-8

received from any person the petition that would be a prerequisite to obtaining such signatures. If, however, such a petition is submitted prior to the close of business on January 17, 2014 our participation in the Portland Transaction could be withdrawn or delayed. In such an event, you will not receive any return of your investment, and we would use the proceeds of this offering on one or more alternative acquisitions. We have not identified any alternative acquisitions at this time, and our decision with respect to any such alternative acquisition generally would not be subject to stockholder approval. In addition, alternative acquisitions may not be readily available to us or may yield lower returns than those expected to be received from the Portland Transaction. Pending the identification of alternative acquisitions, we may invest the proceeds of this offering in short-term investments that would likely generate lower returns than those expected to be received from the Portland Transaction, which in turn would cause our financial performance to suffer. As of the date hereof, we do not have reason to believe such referendum has been initiated.

If we consummate the Portland Transaction and the Lease Agreement becomes effective, the financial condition of Arc Terminals and Arc Logistics and the ability and willingness of each to satisfy its obligations under the Lease Agreement and Guaranty will have a material impact on our results of operation, ability to service our indebtedness and ability to make distributions.

Arc Terminals, or Arc Logistics, the guarantor of Arc Terminals’ obligations under the Lease Agreement, may experience a downturn in its business. If Arc Logistics identifies appropriate acquisition candidates, it may be unable to negotiate successfully the terms of the acquisitions, finance them, or integrate the acquired business into its then existing business. Completing an acquisition and integrating an acquired business may require a significant diversion of Arc Terminals’ management time and resources and involve significant costs. If Arc Terminals makes one or more significant acquisitions in which the consideration includes cash, Arc Terminals could be required to use a substantial portion of its available cash, or obtain financing, in order consummate such acquisitions. Any of the above may weaken Arc Terminals’ or Arc Logistics’ financial condition and result in Arc Terminals’ failure to make timely lease payments or give rise to another default under the Lease Agreement or Arc Logistics’ failure to meet its Guaranty obligations. Further, Arc Terminals or Arc Logistics could be subject to a bankruptcy proceeding pursuant to Title 11 of the bankruptcy laws of the United States.

In the event of any of the above by Arc Terminals or Arc Logistics, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment. The financial condition of Arc Terminals and Arc Logistics and the ability and willingness of each to satisfy its obligations under the Lease Agreement and Guaranty will have a material impact on our results of operation, ability to service our indebtedness and ability to make distributions. In addition, if Arc Terminals fails to renew the Lease Agreement and we cannot find a new lessee at the same or better lease rates, the expiration of the Lease Agreement in fifteen years could have a material adverse impact on our business and financial condition.

Although we believe that the Portland Terminal Facility will constitute a real estate asset for tax purposes, that belief is not binding on the IRS or any court and does not guarantee our qualification as a REIT.

In 2007, 2009 and 2010, the IRS issued three separate private letter rulings that defined certain energy infrastructure assets as real estate assets for tax purposes. The potential qualifying real estate assets in the energy infrastructure sector are electric transmission and distribution systems, pipeline systems, and storage and terminalling systems. Interests in mortgages on real estate assets generally also qualify as real estate assets. We believe that the Portland Terminal Facility constitutes a real estate asset for tax purposes consistent with these private letter rulings. Although private letter rulings provide insight into the current thinking of the IRS on tax issues, such rulings may only be relied upon by the taxpayer to whom they were issued and are not binding on the IRS with respect to us or the Portland Terminal Facility. We have not obtained any private letter rulings with respect to the Portland Terminal Facility.

S-9

We estimate that we will receive net proceeds from this offering of approximately $38.3 million after deducting the underwriting discount and our estimated offering expenses, or $44.3 million if the underwriters exercise their option to purchase 975,000 additional shares from us. We intend to use the net proceeds of this offering to fund the acquisition of the Portland Terminal Facility and certain associated expenses.

The Purchase Agreement and Acquisition of LCP Oregon

On October 17, 2013, LCP Oregon Holdings, LLC (“LCP Oregon”), which at the time was a direct wholly-owned subsidiary of Lightfoot, entered into a Purchase and Sale Agreement (the “Purchase Agreement”) with the current owner of the Portland Terminal Facility. The Purchase Agreement provides for LCP Oregon to acquire the Portland Terminal Facility and certain associated non-real property rights (“Ancillary Assets”) for a purchase price of $40 million. The Purchase Agreement, as amended, is described in more detail below.

Subsequent to the execution of the Purchase Agreement and in contemplation of the Portland Transaction as described herein, we have entered into an agreement with Lightfoot to acquire 100% of the ownership interests in LCP Oregon (the “Membership Interests Purchase Agreement”) for nominal consideration and reimbursement of approximately $1 million of amounts paid and expenses incurred by Lightfoot in connection with due diligence for the acquisition of the Portland Terminal Facility. Following closing of this offering, we will close on the acquisition of LCP Oregon from Lightfoot, making it a direct wholly-owned subsidiary of the Company. Subsequently, we will use the proceeds of this offering to complete the acquisition under the Purchase Agreement. The Membership Interests Purchase Agreement is included as an exhibit to our Form 8-K filed with the SEC on January 14, 2014. Prospective investors in this offering are encouraged to read the Membership Interests Purchase Agreement in its entirety, as the foregoing is merely a summary of certain of its provisions.

The Purchase Agreement defines the varying assets that are included within the Portland Terminal Facility and contains certain representations and warranties from the seller related to the proposed acquisition. Successful completion of this offering will provide the funds sufficient to pay the purchase price. LCP Oregon also has the option to terminate the Purchase Agreement at any time, subject only to forfeiture of an applicable termination fee. Currently, we do not expect LCP Oregon to exercise its right to terminate the Purchase Agreement.

Upon and subject to the closing of the acquisition of the Portland Terminal Facility, the Lease Agreement (as further described below) will be signed. Further, at such time, LCP Oregon will also close on an Asset Purchase Agreement with Arc Terminals to sell certain of the Ancillary Assets to Arc Terminals for a purchase price of $116,000.

Following the consummation of the Portland Transaction, the Portland Terminal Facility will account for approximately 12.7% of our total assets on a pro forma basis as of September 30, 2013, and the lease payments will account for approximately 14.6% of our total revenue on a pro forma basis for the nine months ended September 30, 2013, and approximately 14.8% of our total revenue on a pro forma basis for our most recent fiscal year ended November 30, 2012.

The Lease Agreement

Terms of the Lease Agreement

The Lease Agreement will be executed upon the closing of the acquisition of the Portland Terminal Facility and its initial term will begin contemporaneously with the closing of the acquisition of the Portland

S-10

Terminal Facility. Arc Terminals’ obligations under the Lease Agreement will be guaranteed by Arc Logistics pursuant to the terms of the Guaranty. The Lease Agreement has a fifteen year initial term and may be extended for additional five year terms at the sole discretion of Arc Terminals. The rent will be renegotiated for any extended term but in the event that the parties are unable to negotiate rent, the rent will increase each year according to a formula described below. During the initial term, Arc Terminals will make base monthly rental payments (to be increased on the fifth anniversary by the change in the consumer price index for the prior five years, and every year thereafter by the greater of 2 percent or the change in the consumer price index) and variable rent payments based on the volume of liquid hydrocarbons that flowed through the Portland Terminal Facility in a prior month. The base rent in the initial year of the Lease Agreement will be a minimum of approximately $230,000 per month through July 2014 (prorated for the partial month of January 2014) and approximately $417,522 for the month of August 2014 and each month thereafter. The base rent is also expected to increase each month starting with the month of August at a rate of one-twelfth of 11.5% of the costs incurred by LCP Oregon at the Portland Terminal Facility for specified construction costs, estimated at $10 million. Assuming such improvements are completed, the base rent will increase by approximately $96,000 per month. Variable rent will result from the flow of hydrocarbons through the Portland Terminal Facility in excess of a designated threshold of 12,500 barrels per day of oil equivalent. The base rent is not influenced by the flow of hydrocarbons. Variable rent is capped at 30% of total rent, which is the equivalent of the Portland Terminal Facility’s expected throughput capacity.

The Lease Agreement provides that Arc Terminals will be responsible for, among other matters, maintaining the Portland Terminal Facility in good operating condition, paying all utilities for the Portland Terminal Facility, insuring the Portland Terminal Facility and repairing the Portland Terminal Facility in the event of any casualty loss, paying property and similar taxes resulting from ownership of the Portland Terminal Facility, and causing the Portland Terminal Facility to comply with all environmental and other regulatory laws, rules and regulations. The obligations of Arc Terminals under the Lease Agreement will be guaranteed by Arc Logistics. The Lease Agreement grants Arc Terminals substantially all authority to operate, and imposes on them the responsibility for the operation of, the Portland Terminal Facility. The Lease Agreement provides LCP Oregon no control over the operation, maintenance, management, or regulatory compliance of the Portland Terminal Facility.

The Lease Agreement imposes numerous obligations on LCP Oregon, including keeping confidential certain information provided to it by Arc Terminals and keeping the Portland Terminal Facility free of certain liens. The Lease Agreement also provides that LCP Oregon will not be indemnified against or reimbursed for the first $210,000 of any environmental liability it may incur related to the Portland Terminal Facility, to the extent such liability is not covered by an agreement with a prior owner or by insurance. Thereafter, Arc Terminal is responsible for any and all such liability.

So long as Arc Terminals is not in default under the Lease Agreement, it shall have the right to purchase the Portland Terminal Facility at the end of the third year of the Lease Agreement and at the end of any month thereafter by delivery of 90 days’ notice. The purchase price shall be nine times the greater of (i) the total of base rent and variable rent for the 12 months immediately preceding the notice, or (ii) $7,300,000. If the purchase right is not exercised, the Lease Agreement shall remain in place and Arc Terminals shall continue to pay rent as provided above. Arc Terminals also has the option to terminate the Lease Agreement on the fifth and tenth anniversaries by providing written notice 12 months in advance for a termination fee of $4 million and $6 million, respectively.

In addition, a portion of the pipelines that connect to a neighboring facility will be the subject of a separate lease agreement between the parties, which will be co-terminus with the Lease Agreement. A portion of the total rent under the Lease Agreement will be allocated to this separate pipeline lease agreement.

The form of Lease Agreement is an exhibit to the Membership Interests Purchase Agreement included as an exhibit to our Form 8-K filed with the SEC on January 14, 2014, and prospective investors in this offering are encouraged to read the Lease Agreement in its entirety, as the foregoing is merely a summary of certain of its provisions.

S-11

Arc Terminals Holdings LLC and Arc Logistics Partners LP

Arc Logistics is a fee-based, growth-oriented Delaware limited partnership formed by Lightfoot to own, operate, develop and acquire a diversified portfolio of complementary energy logistics assets. In November 2013, Arc Logistics completed its IPO. Arc Logistics’ public disclosures filed with the SEC indicate that Arc Logistics is principally engaged in the terminalling, storage, throughput and transloading of crude oil and petroleum products with energy logistics assets strategically located in the East Coast, Gulf Coast and Midwest regions of the U.S. It is focused on growing its business through the optimization, organic development and acquisition of terminalling, storage, rail, pipeline and other energy logistics assets that generate stable cash flows and offers customers multiple supply and delivery modes via pipelines, rail, marine and truck. Arc Logistics indicated in its IPO that it had approximately 5.0 million barrels of crude oil and petroleum product storage capacity, and it has an equity market capitalization of approximately $258 million as of January 10, 2014, based on the number of common and subordinated units outstanding as of Arc Logistics’ quarterly report on Form 10-Q filed with the SEC on December 18, 2013. Arc Terminals is a wholly-owned subsidiary of Arc Logistics.

As described above, Arc Terminals’ obligations under the Lease Agreement will be guaranteed by Arc Logistics.

The Portland Terminal Facility

The Portland Terminal Facility is a rail/marine facility property adjacent to the Willamette River in Portland, Oregon. The 39-acre site has 84 tanks with a total storage capacity of 1,466,000 barrels. The Portland Terminal Facility is capable of receiving, storing and delivering heavy and refined petroleum products. Products are received and/or delivered via railroad, marine (up to Panamax size vessels) or truck loading rack. The marine facilities are accessed through a neighboring terminal facility via an owned pipeline. The Portland Terminal Facility offers heating systems, emulsions and an on-site product testing laboratory as ancillary services.

Terminal Improvement Projects

After the closing of the Portland Transaction, we anticipate funding an additional $10 million of terminal related improvement projects in support of Arc Terminals’ commercial strategy to optimize the Portland Terminal Facility and generate stable cash flows, including: i) clean, inspect and upgrade a portion of the existing storage assets; ii) enhance existing terminal infrastructure; and iii) develop, design, engineer and construct throughput expansion opportunities.

Environmental Considerations

The Portland Terminal Facility (the “Facility”) historically has operated as a petroleum products storage terminal since 1947. The current owner acquired the Facility in 2005. A 12,000 barrel per day (bbl/d) refining operation that previously was used in the asphalt manufacturing and finishing process ceased operations in November 2006 and was officially closed in December 2008. Over the last decade, the Facility has been used principally for the storage of crude oil, asphalt, VGO, jet-fuel and other refined petroleum products. As the site has been in operation since 1947, numerous releases have occurred, resulting in localized impacts to soil and groundwater at the site by petroleum hydrocarbons, volatile organic compounds (VOCs), polycyclic aromatic hydrocarbons (PAHs), and metals. Most of the known releases occurred prior to the current owner’s purchase of the Facility in 2005. The prior owners of the Facility have investigated the environmental conditions in consultation with the Oregon Department of Environmental Quality (“ODEQ”). In addition, the prior owners have been remediating the Facility to address the recommendations of the ODEQ. While these actions have improved the environmental conditions at the Facility, due to changing environmental regulations, additional costs could be incurred related to future remediation efforts.

S-12

Additionally, while it does not occupy river frontage, the Facility is located approximately 1,000 feet south of the Willamette River. The section of the Willamette River near the facility is a portion of the Portland Harbor, which was designated as a Superfund site by the Environmental Protection Agency (the “EPA”) in 2000. Portland Harbor is contaminated with PAH’s, heavy metals, PCBs and other contaminants as the result of more than a century of industrial use along the Willamette River. The Superfund site is currently in the Remedial Investigation/Feasibility Study phase of the Superfund process, and its final boundaries have not yet been determined. The Remedial Investigation/Feasibility Study is being performed by a group of 14 potentially responsible parties (“PRPs”) identified by the EPA (the “Lower Willamette Group” or “LWG”). The current owner of the Facility is not a member of the LWG. Under the terms of the Purchase Agreement, any potential future liabilities related to the Portland Harbor Superfund site and assessed against the current owner of the Portland Terminal Facility would become the responsibility of LCP Oregon. After LCP Oregon acquires the Portland Terminal Facility and if that facility is subsequently made part of the Portland Harbor Superfund site, LCP Oregon could become a responsible party under the terms of the Purchase Agreement.

While the risks of being asked to pay for a portion of the Superfund Site cleanup appear low, after LCP Oregon acquires the Facility and the Facility is subsequently made part of the Superfund Site, LCP Oregon could become a liable party as a current “owner or operator” of a Superfund facility, in addition to being responsible for any liabilities assumed from the current owner as either a former “owner or operator” or a person who “arranged for” disposal into the River. Although we could incur significant litigation costs in defending against any such action, management has concluded, based in part on our review of the independent environmental consultant’s report, that the current owner or its successors would be able to assert strong defenses in the event that the EPA or members of the LWG should ultimately seek contribution to the costs of cleaning up the Superfund Site from the current owner or its successors (such as LCP Oregon), and that the estimated overall allocation of liability to the Facility should not be material, and should be adequately covered by existing contractual arrangements or insurance proceeds.

The Lease Agreement includes provisions whereby LCP Oregon has agreed to indemnify Arc Terminals up to $210,000 of future remediation for the environmental conditions outlined above not covered by agreements with prior owners or insurance, after which Arc Terminals would be responsible for any additional remediation related costs. This figure was developed in consultation with Arc Terminals, legal counsel and third-party advisors.

The Franchise Agreement

LCP Oregon has received approval from the City Council of the City of Portland, Oregon (the “City Council”) for the transfer of the franchise agreement (the “Franchise Agreement”) to LCP Oregon from the current owner of the Portland Terminal Facility. Such approval could potentially be made subject to a public referendum through the close of business on January 17, 2014. As of the date hereof, we have no reason to believe such referendum has been initiated.

S-13

As of January 10, 2014, we had approximately 24,156,163 shares of our common stock outstanding held by 26 record holders. Our common stock trades on the NYSE under the symbol “CORR”. On January 14, 2014, the closing price of our common stock on the NYSE was $6.93 per share. The following table sets forth the high and low sales price per common share during each of the first three fiscal quarters of 2012, the one month transition period ended December 31, 2012, and our prior two fiscal years. Prior to December 3, 2012, our common stock traded on the NYSE under the symbol “TTO”.

| Price Ranges |

||||||||

| Period Ended: |

Low |

High |

||||||

| Fiscal 2013 |

||||||||

| September 30, 2013 |

$ | 6.83 | $ | 7.85 | ||||

| June 30, 2013 |

6.82 | 7.90 | ||||||

| March 30, 2013 |

6.03 | 7.06 | ||||||

| Transition Period: |

||||||||

| December 31, 2012 |

$ | 5.85 | $ | 8.78 | ||||

| Fiscal 2012 |

||||||||

| November 30, 2012 |

$ | 8.14 | $ | 9.24 | ||||

| August 31, 2012 |

8.50 | 9.39 | ||||||

| May 31, 2012 |

8.00 | 9.31 | ||||||

| February 29, 2012 |

7.29 | 9.15 | ||||||

| Fiscal 2011 |

||||||||

| November 30, 2011 |

$ | 6.94 | $ | 8.27 | ||||

| August 31, 2011 |

7.51 | 9.00 | ||||||

| May 31, 2011 |

8.18 | 9.24 | ||||||

| February 28, 2011 |

6.87 | 8.50 | ||||||

Our portfolio of real property assets, promissory notes, and investment securities generate cash flow to us from which we pay distributions to stockholders. For the historical period ended September 30, 2013, the sources of our stockholder distributions were lease income from our real property assets and distributions from our investment securities. The amount of any distribution is recorded by the Company on the ex-dividend date.

The characterization of any distribution for federal income tax purposes will not be determined until after the end of the taxable year. Our Board of Directors has indicated that it intends to approve an increase in our quarterly distribution payable to stockholders from $.125 to $.13 per share. The $.13 per share distribution is expected to apply from the date after closing of the Portland Transaction. There is no assurance that we will continue to make regular distributions.

During 2014, we intend to make publicly available standard performance measures utilized by REITs, including Funds from Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”). A REIT is generally required to distribute during the taxable year an amount equal to at least 90 percent of the REIT taxable income (determined under Internal Revenue Code section 857(b)(2), without regard to the deduction for dividends paid). We intend to adhere to this requirement in order to qualify as a REIT. The Board of Directors will continue to determine the amount of any distribution that we expect to pay our stockholders.

S-14

The following table sets forth our capitalization as of September 30, 2013:

| • | on an actual basis; |

| • | on an as adjusted basis to give effect to the issuance of the 6,500,000 shares of common stock offered hereby, after deducting $2.5 million for the underwriting discounts and commissions payable by us and estimated offering expenses of approximately $1.4 million; and |

| • | on a pro forma as adjusted basis, assuming the Portland Transaction had occurred on September 30, 2013. |

You should read this table in conjunction with “Use of Proceeds,” “Pro Forma Financial Information,” our financial statements and notes thereto incorporated by reference in this prospectus supplement.

| At September 30, 2013 |

||||||||||||

| Actual |

As Adjusted |

Pro Forma As |

||||||||||

| Cash and cash equivalents |

$ | 18,918,718 | 58,633,718 | 17,337,496 | ||||||||

|

|

|

|

|

|

|

|||||||

| Debt: |

||||||||||||

| Long-term debt |

70,000,000 | 70,000,000 | 70,000,000 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total debt |

70,000,000 | 70,000,000 | 70,000,000 | |||||||||

| Stockholders’ equity |

||||||||||||

| Warrants, no par value; 945,594 issued and outstanding |

1,370,700 | 1,370,700 | 1,370,700 | |||||||||

| Capital stock, non-convertible, $0.001 par value; 24,151,870 and 30,651,870 shares issued and outstanding, actual and pro forma as adjusted |

24,152 | 30,652 | 30,652 | |||||||||

| Additional paid-in capital |

173,411,657 | 213,120,157 | 213,120,157 | |||||||||

| Accumulated retained earnings |

658,470 | 658,470 | 658,470 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total stockholders’ equity |

175,464,979 | 215,179,979 | 215,179,979 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total capitalization |

$ | 245,464,979 | 285,179,979 | 285,179,979 | ||||||||

|

|

|

|

|

|

|

|||||||

Although we are not obtaining debt financing in connection with the acquisition of the Portland Terminal Facility, we have received a consent from our senior lender, KeyBank, under our Revolving Credit Agreement dated May 8, 2013, to allow us to guaranty future debt of LCP Oregon in an amount up to $20 million plus interest and to secure that guaranty with the equity of LCP Oregon should we seek to do so with another lender after the closing of this offering.

S-15

PRO FORMA FINANCIAL INFORMATION

The following unaudited pro forma condensed consolidated financial information gives effect to the Portland Transaction, the issuance by us of common stock and the use of net proceeds from this offering as described in “Use of Proceeds” and the December 20, 2012 acquisition of the Pinedale LGS from Ultra Petroleum (the “UPL Acquisition”). The preliminary allocation of the asset acquisition costs related to the Portland Transaction used in the unaudited pro forma condensed consolidated financial information is based on management’s preliminary valuation. The estimates and assumptions are subject to change upon the finalization of valuations, which are contingent upon final appraisals of plant and equipment, identifiable intangible assets and adjustments to other accounts. Revisions to the preliminary purchase price allocation could result in significant deviations from the accompanying pro forma financial information.

The pro forma condensed consolidated statements of income reflect adjustments as if the related transactions had occurred on December 1, 2011. The historical results of operations included in the unaudited pro forma condensed consolidated statements of income for the fiscal year ended November 30, 2012 were derived from the audited financial statements of CorEnergy incorporated by reference in this prospectus supplement. The historical results of operations included in the unaudited pro forma condensed consolidated statements of income for the nine months ended September 30, 2013 were derived from the unaudited financial statements of CorEnergy incorporated by reference in this prospectus supplement.

The pro forma consolidated balance sheet reflects adjustments as if the related transactions had occurred on September 30, 2013. The historical balance sheet of CorEnergy included in the unaudited pro forma condensed consolidated balance sheet was derived from the unaudited financial statements of CorEnergy incorporated by reference into this prospectus supplement.

This unaudited pro forma condensed consolidated financial information has been prepared by management for illustrative purposes only. The unaudited pro forma condensed consolidated financial information is not intended to represent or be indicative of the financial position or results of operations in future periods or the results that actually would have been realized had CorEnergy made the Portland Transaction and other transactions which are provided for in the pro forma financial information during the specified periods. The unaudited pro forma condensed consolidated financial information, including the notes thereto, is qualified in its entirety by reference to, and should be read in conjunction with, the historical financial statements and notes thereto incorporated by reference in this prospectus supplement.

S-16

CorEnergy Infrastructure Trust, Inc.

Unaudited Pro Forma Consolidated Balance Sheets

| At September 30, 2013 |

||||||||||||

| Historical |

Pro Forma Adjustments |

Pro Forma Combined |

||||||||||

| Assets |

||||||||||||

| Leased property, net of accumulated depreciation |

$ | 234,763,415 | $ | 41,296,222 | (1) | $ | 276,059,637 | |||||

| Other equity securities, at fair value |

22,168,268 | — | 22,168,268 | |||||||||

| Cash and cash equivalents |

18,918,718 | 39,715,000 | (2) | 17,337,496 | ||||||||

| (1,412,222 | ) (1) | |||||||||||

| (40,000,000 | ) (1) | |||||||||||

| 116,000 | (1) | |||||||||||

| Property and equipment, net of accumulated depreciation |

3,389,401 | — | 3,389,401 | |||||||||

| Accounts receivable |

1,142,898 | — | 1,142,898 | |||||||||

| Intangible lease asset, net of accumulated amortization |

437,908 | — | 437,908 | |||||||||

| Deferred debt issuance costs, net of accumulated amortization |

1,146,411 | 1,146,411 | ||||||||||

| Deferred lease costs, net of accumulated amortization |

872,533 | — | 872,533 | |||||||||

| Hedged derivative asset |

516,305 | 516,305 | ||||||||||

| Current tax asset |

770,763 | 770,763 | ||||||||||

| Prepaid expenses and other assets |

268,040 | — | 268,040 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Assets |

$ | 284,394,660 | $ | 39,715,000 | $ | 324,109,660 | ||||||

|

|

|

|

|

|

|

|||||||

| Liabilities and Stockholders’ Equity |

||||||||||||

| Liabilities |

||||||||||||

| Long-term debt |

$ | 70,000,000 | $ | — | $ | 70,000,000 | ||||||

| Accounts payable and other accrued liabilities |

2,574,541 | — | 2,574,541 | |||||||||

| Dividends payable to stockholders |

3,018,990 | 3,018,990 | ||||||||||

| Deferred tax liability |

4,576,499 | — | 4,576,499 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities |

$ | 80,170,030 | $ | — | $ | 80,170,030 | ||||||

|

|

|

|

|

|

|

|||||||

| Equity |

||||||||||||

| Warrants, no par value: 945,594 issued and outstanding at September 30, 2013 (5,000,000 authorized) |

$ | 1,370,700 | $ | — | $ | 1,370,700 | ||||||

| Capital stock, non-convertible, $0.001 par value; 24,151,870 shares issued and outstanding at September 30, 2013 (100,000,000 shares authorized) |

24,152 | 6,500 | (2) | 30,652 | ||||||||

| Additional paid-in capital |

173,411,657 | 39,708,500 | (2) | 213,120,157 | ||||||||

| Accumulated retained earnings |

658,470 | — | 658,470 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total CorEnergy Equity |

175,464,979 | 39,715,000 | 215,179,979 | |||||||||

| Non-controlling Interest |

28,759,651 | — | 28,759,651 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Equity |

204,224,630 | 39,715,000 | 243,939,630 | |||||||||

|

|

|

|

|

|

|

|||||||

| Total Liabilities and Stockholders’ Equity |

$ | 284,394,660 | $ | 39,715,000 | $ | 324,109,660 | ||||||

|

|

|

|

|

|

|

|||||||

See accompanying notes to pro forma financial statements

S-17

CorEnergy Infrastructure Trust, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Income

| For the Year Ended November 30, 2012 |

||||||||||||||||||||

| Historical |

Historical Adjustments |

Historical |

Pro Forma Adjustments |

Pro Forma |

||||||||||||||||

| Revenue |

||||||||||||||||||||

| Lease Revenue |

$ | 2,552,975 | $ | 20,000,000 | (6) | $ | 22,552,975 | $ | 5,319,021 | (3) | $ | 27,871,996 | ||||||||

| Sales Revenue |

8,021,022 | — | 8,021,022 | — | 8,021,022 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenue |

10,573,997 | 20,000,000 | 30,573,997 | 5,319,021 | 35,893,018 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses |

||||||||||||||||||||

| Cost of Sales (excluding depreciation expense) |

6,078,102 | — | 6,078,102 | — | 6,078,102 | |||||||||||||||

| Management fees, net of expense reimbursements |

1,046,796 | 1,526,252 | (7) | 2,573,048 | 412,962 | (4) | 2,986,010 | |||||||||||||

| Asset acquisition expense |

377,834 | — | 377,834 | — | 377,834 | |||||||||||||||

| Professional fees |

1,141,045 | 20,000 | (8) | 1,161,045 | — | 1,161,045 | ||||||||||||||

| Depreciation expense |

1,118,269 | 8,869,389 | (9) | 9,987,658 | 1,376,541 | (1) | 11,364,199 | |||||||||||||

| Amortization expense |

— | 61,364 | (10) | 61,364 | — | 61,364 | ||||||||||||||

| Operating expense |

739,519 | — | 739,519 | — | 739,519 | |||||||||||||||

| Directors’ fees |

85,050 | — | 85,050 | — | 85,050 | |||||||||||||||

| Other expenses |

231,086 | 72,128 | (11) | 303,214 | — | 303,214 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Expenses |

10,817,701 | 10,549,133 | 21,366,834 | 1,789,503 | 23,156,337 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating Income (Loss) |

$ | (243,704 | ) | 9,450,867 | 9,207,163 | 3,529,518 | 12,736,681 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Income (Expenses) |

||||||||||||||||||||

| Net distributions and dividend income |

(279,395 | ) | (30,416 | ) (12) | (309,811 | ) | — | (309,811 | ) | |||||||||||

| Net realized and unrealized gain (loss) on trading securities |

4,009,933 | (3,735,861 | ) (12) | 274,072 | — | 274,072 | ||||||||||||||

| Net realized and unrealized gain on other equity securities |

16,171,944 | (11,869,895 | ) (12) | 4,302,049 | — | 4,302,049 | ||||||||||||||

| Interest expense |

(81,123 | ) | (3,056,129 | ) (13) | (3,137,252 | ) | — | (3,137,252 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Other Income (Expenses) |

19,821,359 | (18,692,301 | ) | 1,129,058 | — | 1,129,058 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (Loss) before income taxes |

19,577,655 | (9,241,434 | ) | 10,336,221 | 3,529,518 | 13,865,739 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Taxes |

||||||||||||||||||||

| Income tax expense (benefit), net |

7,228,934 | (2,740,647 | ) (14) | 4,488,287 | 1,376,512 | (5) | 5,864,799 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

12,348,721 | (6,500,787 | ) | 5,847,934 | 2,153,006 | 8,000,940 | ||||||||||||||

| Less: Net Income (Loss) attributable to non-controlling interest |

— | 1,539,608 | (15) | 1,539,608 | — | 1,539,608 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) attributable to CORR Stockholders |

$ | 12,348,721 | $ | (8,040,395 | ) | $ | 4,308,326 | $ | 2,153,006 | $ | 6,461,332 | |||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (Loss) Per Common Share: |

||||||||||||||||||||

| Basic and Diluted |

$ | 1.34 | $ | 0.18 | $ | 0.21 | ||||||||||||||

| Weighted Average Shares of Common Stock Outstanding: |

||||||||||||||||||||

| Basic and Diluted |

9,182,425 | 14,950,000 | (16) | 24,132,425 | 6,500,000 | (2) | 30,632,425 | |||||||||||||

| Dividends declared per share |

$ | 0.440 | ||||||||||||||||||

See accompanying notes to pro forma financial statements

S-18

CorEnergy Infrastructure Trust, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Income

| For the One-Month Period Ended December 31, 2012 |

||||||||||||||||||||

| Historical |

Historical Adjustments |

Historical |

Pro Forma Adjustments |

Pro Forma |

||||||||||||||||

| Revenue |

||||||||||||||||||||

| Lease Revenue |

$ | 857,909 | $ | 1,021,505 | (6) | $ | 1,879,414 | $ | 443,252 | (3) | $ | 2,322,666 | ||||||||

| Sales Revenue |

868,992 | — | 868,992 | — | 868,992 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenue |

1,726,901 | 1,021,505 | 2,748,406 | 443,252 | 3,191,658 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses |

||||||||||||||||||||

| Cost of Sales (excluding depreciation expense) |

686,976 | — | 686,976 | — | 686,976 | |||||||||||||||

| Management fees, net of expense reimbursements |

155,242 | 77,954 | (7) | 233,196 | 34,414 | (4) | 267,610 | |||||||||||||

| Asset acquisition expense |

64,733 | — | 64,733 | — | 64,733 | |||||||||||||||

| Professional fees |

333,686 | 1,667 | (8) | 335,353 | — | 335,353 | ||||||||||||||

| Depreciation expense |

499,357 | 453,006 | (9) | 952,363 | 114,712 | (1) | 1,067,075 | |||||||||||||

| Amortization expense |

1,967 | 3,134 | (10) | 5,101 | — | 5,101 | ||||||||||||||

| Operating expense |

48,461 | — | 48,461 | — | 48,461 | |||||||||||||||

| Directors’ fees |

8,500 | — | 8,500 | — | 8,500 | |||||||||||||||

| Other expenses |

27,500 | 3,684 | (11) | 31,184 | — | 31,184 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Expenses |

1,826,422 | 539,445 | 2,365,867 | 149,126 | 2,514,993 | |||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Operating Income (Loss) |

(99,521 | ) | 482,060 | 382,539 | 294,126 | 676,665 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Other Income (Expenses) |

||||||||||||||||||||

| Net distributions and dividend income |

2,325 | — | 2,325 | — | 2,325 | |||||||||||||||

| Net realized and unrealized gain (loss) on trading securities |

(1,769,058 | ) | 1,930,164 | (12) | 161,106 | — | 161,106 | |||||||||||||

| Net realized and unrealized gain on other equity securities |

(159,495 | ) | — | (159,495 | ) | — | (159,495 | ) | ||||||||||||

| Interest expense |

(416,137 | ) | (156,092 | ) (13) | (572,229 | ) | — | (572,229 | ) | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Other Income (Expenses) |

(2,342,365 | ) | 1,774,072 | (568,293 | ) | — | (568,293 | ) | ||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Income (Loss) before income taxes |

(2,441,886 | ) | 2,256,132 | (185,754 | ) | 294,126 | 108,372 | |||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Taxes |

||||||||||||||||||||

| Income tax expense (benefit), net |

(920,143 | ) | 876,515 | (14) | (43,628 | ) | 114,709 | (5) | 71,081 | |||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) |

(1,521,743 | ) | 1,379,617 | (142,126 | ) | 179,417 | 37,291 | |||||||||||||

| Less: Net Income (Loss) attributable to non-controlling interest |

(18,347 | ) | 78,636 | (15) | 60,289 | 60,289 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Net Income (Loss) attributable to CORR Stockholders |

$ | (1,503,396 | ) | $ | 1,300,981 | $ | (202,415 | ) | $ | 179,417 | $ | (22,998 | ) | |||||||

|

|

|

|

|

|

|

|

|

|

|

|||||||||||

| Earnings (Loss) Per Common Share: |

||||||||||||||||||||

| Basic and Diluted |

$ | (0.10 | ) | $ | (0.01 | ) | $ | 0.00 | ||||||||||||

| Weighted Average Shares of Common Stock Outstanding: |

||||||||||||||||||||

| Basic and Diluted |

15,564,861 | 8,575,806 | (16) | 24,140,667 | 6,500,000 | (2) | 30,640,667 | |||||||||||||

| Dividends declared per share |

$ | — | ||||||||||||||||||

See accompanying notes to pro forma financial statements

S-19

CorEnergy Infrastructure Trust, Inc.

Unaudited Pro Forma Condensed Consolidated Statement of Income

| For the Nine-Month Periods Ended September 30, 2013 |

||||||||||||||||||

| Historical |

Historical Adjustments |

Historical |

Pro Forma Adjustments |

Pro Forma |

||||||||||||||

| Revenue |

||||||||||||||||||

| Lease Revenue |

$ | 16,914,732 | $ | 16,914,732 | $ | 3,989,266 | (3) | $ | 20,903,998 | |||||||||

| Sales Revenue |

6,381,213 | 6,381,213 | — | 6,381,213 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Revenue |

23,295,945 | 23,295,945 | 3,989,266 | 27,285,211 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Expenses |

||||||||||||||||||

| Cost of Sales (excluding depreciation expense) |

4,891,305 | 4,891,305 | — | 4,891,305 | ||||||||||||||

| Management fees, net of expense reimbursements |

1,937,588 | 1,937,588 | 309,722 | (4) | 2,247,310 | |||||||||||||

| Asset acquisition expense |

725,513 | 725,513 | — | 725,513 | ||||||||||||||

| Professional fees |

1,191,017 | 1,191,017 | — | 1,191,017 | ||||||||||||||

| Depreciation expense |

8,571,860 | 8,571,860 | 1,032,406 | (1) | 9,604,266 | |||||||||||||

| Amortization expense |

45,963 | 45,963 | — | 45,963 | ||||||||||||||

| Operating expense |

714,830 | 714,830 | — | 714,830 | ||||||||||||||

| Directors' fees |

124,994 | 124,994 | — | 124,994 | ||||||||||||||

| Other expenses |

403,766 | 403,766 | — | 403,766 | ||||||||||||||

|

|

|

|

|

|

|

|

|

|||||||||||

| Total Expenses |

18,606,836 | 18,606,836 | 1,342,128 | 19,948,964 | ||||||||||||||

|

|

|

|

|

|