The information in this preliminary prospectus supplement, which relates to an effective registration statement under the Securities Act of 1933, as amended, is not complete and may be changed. This prospectus supplement and the accompanying prospectus do not constitute an offer to sell these securities or a solicitation of an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

Filed Pursuant to Rule 424(b)(4)

Registration No. 333-176944

Subject to Completion

Preliminary Prospectus Supplement dated December 10, 2012

PROSPECTUS SUPPLEMENT

(To prospectus dated June 7, 2012)

18,500,000 Shares

Common Stock

We are selling 18,500,000 shares of our common stock.

Our shares of common stock trade on the New York Stock Exchange (“NYSE”) under the symbol “CORR.” On December 7, 2012, the last sale price of our shares as reported on the NYSE was $8.25 per share. Prior to December 3, 2012, our name was Tortoise Capital Resources Corporation and our shares of common stock traded on the NYSE under the symbol “TTO.”

We intend to use the net proceeds from this offering to make a capital contribution to our newly formed acquisition subsidiary. That subsidiary will utilize our contributed proceeds, along with proceeds of a concurrent co-investment and debt financing, to acquire a liquids gathering system and certain associated real property rights located in the Pinedale Anticline in Wyoming from a subsidiary of Ultra Petroleum Corp. This acquisition will be our largest acquisition of REIT-qualifying assets to date.

Investing in our common stock involves risks that are described in the “Risk Factors” section beginning on page S-11 of this prospectus supplement and on page 11 of the accompanying prospectus.

| Per Share |

Total |

|||||||

| Public offering price |

$ | $ | ||||||

| Underwriting discount |

$ | $ | ||||||

| Proceeds, before expenses, to us |

$ | $ | ||||||

The underwriters may also exercise their option to purchase up to an additional 2,775,000 shares from us, at the public offering price, less the underwriting discount, for 30 days after the date of this prospectus supplement.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus supplement or the accompanying prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The shares will be ready for delivery on or about December , 2012.

| BofA Merrill Lynch |

KeyBanc Capital Markets |

| RBC Capital Markets |

Wells Fargo Securities | Stifel Nicolaus Weisel | ||||

The date of this prospectus supplement is December , 2012.

Prospectus Supplement

| Page | ||||

| S-i | ||||

| S-ii | ||||

| S-iii | ||||

| S-1 | ||||

| S-11 | ||||

| S-17 | ||||

| S-18 | ||||

| S-21 | ||||

| S-21 | ||||

| S-22 | ||||

| S-22 | ||||

| S-24 | ||||

| S-25 | ||||

| Management’s Discussion and Analysis of Pro Forma Financial Information |

S-31 | |||

| S-40 | ||||

| S-43 | ||||

| S-48 | ||||

| S-48 | ||||

| S-48 | ||||

| S-49 | ||||

| F-1 | ||||

| Prospectus |

||||

| Prospectus Summary |

1 | |||

| The Offering |

7 | |||

| Risk Factors |

11 | |||

| Use of Proceeds |

22 | |||

| Ratio of Earnings to Fixed Charges |

22 | |||

| Supplemental Pro Forma Selected Financial Data |

23 | |||

| The Company |

25 | |||

| Recent Developments |

33 | |||

| Manager |

35 | |||

| Dividend Reinvestment Plan |

39 | |||

| Valuation of Securities Portfolio |

41 | |||

| U.S. Federal Income Tax Considerations |

44 | |||

| Description of Securities |

63 | |||

| Certain Provisions of Our Charter and Bylaws and The Maryland General Corporation Law |

76 | |||

| Shares Eligible for Future Sale |

80 | |||

| Selling Security Holders |

80 | |||

| Plan of Distribution |

80 | |||

| Independent Registered Public Accounting Firm |

83 | |||

| Legal Matters |

83 | |||

| Available Information |

83 | |||

| Incorporation of Certain Documents By Reference |

83 | |||

ABOUT THIS PROSPECTUS SUPPLEMENT

We are providing information to you about this offering of our common stock in two parts. The first part is this prospectus supplement, which provides the specific details regarding this offering. The second part is the accompanying prospectus, which provides general information, including information about our common stock and information that may not apply to this offering.

This prospectus supplement may add, update or change information contained in or incorporated by reference in the accompanying prospectus. If the information in this prospectus supplement is inconsistent with any information contained in or incorporated by reference in the accompanying prospectus, the information in this prospectus supplement will apply and will supersede the inconsistent information contained in or incorporated by reference in the accompanying prospectus. See “Incorporation of Certain Information by Reference” on page S-49 of this prospectus supplement.

You should rely only on the information contained in or incorporated by reference in this prospectus supplement and the accompanying prospectus. We have not, and the underwriters have not, authorized any other person to provide you with any different or additional information. If anyone provides you with different or additional information, you should not rely on it. We are not, and the underwriters are not, making an offer to sell these securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein is accurate only as of the specified dates. Our business, financial condition, liquidity, results of operations and prospects may have changed since those dates. We will advise investors of any material changes to the extent required by applicable law.

S-i

This prospectus supplement, the accompanying prospectus and the documents incorporated by reference herein and therein include forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (“Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). Forward-looking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995, as amended. All statements other than statements of historical fact should be considered to be forward-looking statements.

Forward-looking statements can often be identified by the use of forward-looking terminology, such as “expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,” “estimates,” “may,” “will be” and variations of these words and similar expressions. Any forward-looking statement speaks only as of the date on which it is made and is qualified in its entirety by reference to the factors discussed throughout this prospectus supplement, the accompanying prospectus and the documents incorporated by reference in this prospectus supplement and the accompanying prospectus.

Although we believe that the expectations reflected in any forward-looking statements are based on reasonable assumptions, forward-looking statements are not guarantees of future performance or results and we can give no assurance that these expectations will be achieved. It is possible that the actual results may differ materially from those indicated by these forward-looking statements due to a variety of known and unknown risks and uncertainties. Some of the factors that could cause actual results to differ include, without limitation:

| • | general economic and business conditions and specifically conditions in the U.S. energy infrastructure sector; |

| • | interest rate fluctuations, costs and availability of capital and capital requirements; |

| • | costs and availability of real property assets; |

| • | inability to consummate acquisition opportunities, or if consummated, integrate them into our business; |

| • | competition from other companies; |

| • | changes in lease rates; |

| • | tenant bankruptcies; |

| • | changes in operating expenses; |

| • | changes in applicable laws, rules and regulations; and |

| • | the ability to obtain suitable equity and/or debt financing and the continued availability of financing in the amounts and on the terms necessary to support our future refinancing requirements and business. |

This list of risks and uncertainties, however, is only a summary and is not intended to be exhaustive. For a discussion of these and other factors that could cause actual results to differ from those contemplated in the forward-looking statements, please see the “Risk Factors” section of this prospectus supplement beginning on page S-11, the “Risk Factors” section of the accompanying prospectus beginning on page 11 thereof and the “Risk Factors” section of our Annual Report on Form 10-K for the year ended November 30, 2011. We do not undertake any responsibility to update any of these factors or to announce publicly any revisions to forward-looking statements, whether as a result of new information, future events or otherwise.

S-ii

Certain of the defined terms used in this prospectus supplement are set forth below.

Acquisition: the purchase by us of the LGS and certain associated real property rights from a subsidiary of Ultra Petroleum and subsequent lease of the LGS to a different Ultra Petroleum subsidiary

AFFO: Adjusted Funds from Operations

BLM: U.S. Bureau of Land Management

CAD: Cash Available for Distribution

CorEnergy: CorEnergy Infrastructure Trust, Inc.

Corridor: Corridor InfraTrust Management, LLC

DD&A: Depreciation, depletion and amortization:

EEI: Edison Electric Institute

EIA: Energy Information Administration

EIP: Eastern Interconnect Project

Exchange Act: Securities Exchange Act of 1934, as amended

FERC: Federal Energy Regulatory Commission

FFO: Funds from Operations

Guaranty: the guaranty by Ultra Petroleum and Ultra Resources of Ultra Newco’s obligations under the Lease Agreement

KeyBank: KeyBank National Association

INGAA: Interstate Natural Gas Association of America Foundation

Lease Agreement: the lease agreement with Ultra Newco relating to the lease of the LGS

Liquids Gathering System or LGS: a system of pipelines and central gathering facilities

Mcfe: 1,000 cubic feet equivalent

MLP: master limited partnership

NERC: North America Electric Reliability Corporation

NYSE: New York Stock Exchange

Pinedale LP: Pinedale Corridor, LP

Pinedale GP: the general partner of Pinedale LP

PNM: Public Service Company of New Mexico

Prudential: Prudential Financial, Inc.

QDI: Qualified Dividend Income

ROD: record of decision

REIT: real estate investment trust

Securities Act: Securities Act of 1933, as amended

TCA: Tortoise Capital Advisors, L.L.C.

Tcfe: Trillion cubic feet equivalent

Ultra Newco: Ultra Wyoming LGS, LLC, an indirect wholly-owned subsidiary of Ultra Petroleum

Ultra Petroleum: Ultra Petroleum Corp.

Ultra Resources: Ultra Resources, Inc., an indirect wholly-owned subsidiary of Ultra Petroleum

S-iii

This summary contains basic information about us and the offering but does not contain all of the information that is important to your investment decision. You should read this summary together with the more detailed information contained elsewhere in this prospectus supplement and the accompanying prospectus, and the documents incorporated herein and therein by reference, especially the information set forth in the “Risk Factors” section of this prospectus supplement beginning on page S-11 and the “Risk Factors” section of the accompanying prospectus beginning on page 11 thereof, as well as other information contained in our publicly available filings with the Securities and Exchange Commission (“SEC”). When used in this prospectus supplement, the terms “we,” “us,” “our” and “CorEnergy” refer to CorEnergy Infrastructure Trust, Inc. and its subsidiaries unless specified otherwise.

The Company

We seek to acquire midstream and downstream U.S. energy infrastructure assets and concurrently enter into long-term triple net leases with energy companies. Targeted assets may include pipelines, storage tanks, transmission lines and gathering systems, among others. These sale-leaseback transactions provide the lessee company with a source of capital that is an alternative to other capital sources such as corporate borrowing, mortgaging real property or equity offerings. We expect our leases to include provisions that enable us to participate in the revenue and/or value of the underlying infrastructure real property asset. We intend to acquire infrastructure assets that qualify as real property for REIT purposes. Our principal objective is to provide stockholders with an attractive risk-adjusted total return, with an emphasis on distributions and distribution growth.

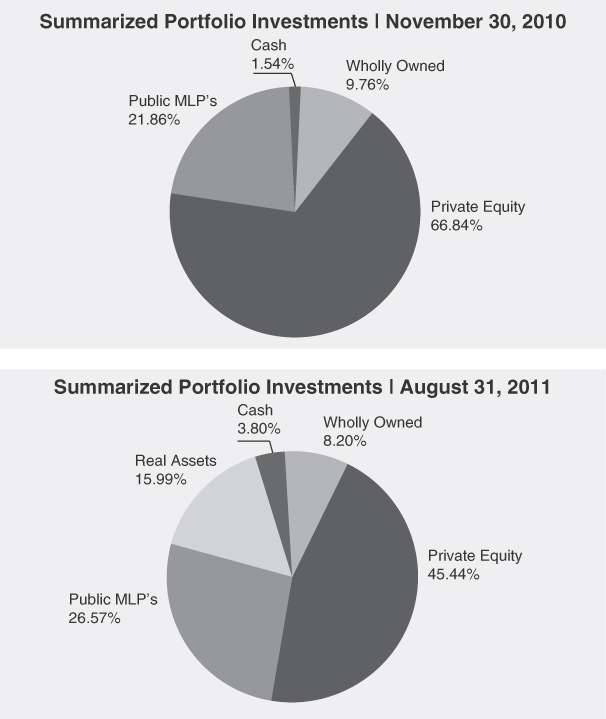

We are externally managed by Corridor InfraTrust Management, LLC (“Corridor”), an affiliate of Tortoise Capital Advisors, L.L.C. (“TCA”), a registered investment adviser with over $9.4 billion of assets under management in the U.S. energy infrastructure sector and 48 employees as of November 30, 2012. Corridor is a real property asset manager with a focus on U.S. energy infrastructure real assets and will have access to certain resources of TCA while acting as our manager. We historically operated as a business development company under the name Tortoise Capital Resources Corporation and invested primarily in securities of privately held and micro-cap public companies operating in the U.S. energy sector. In April 2011, in connection with our strategic decision to become a REIT and focus on the acquisition of real property assets in the energy infrastructure sector, our stockholders authorized withdrawal of our election to be treated as a business development company. We do not plan on making additional investments in securities (other than short-term, highly liquid investments to be held pending acquisition of real property assets) and intend to liquidate our existing securities portfolio in an orderly manner.

As of August 31, 2012 , the fair value of our securities portfolio (excluding short-term investments) totaled $76.9 million. The fair value of the securities remaining in our portfolio as of August 31, 2012 includes: (i) publicly-traded and liquid master limited partnership (“MLP”) equity securities of approximately $57.3 million and (ii) approximately $19.5 million of illiquid securities issued by two privately-held companies. The publicly traded securities can be liquidated more readily than the securities of the privately-held companies.

S-1

Acquisition of Liquids Gathering System from Ultra Petroleum

Background

On December 7, 2012, our newly-formed subsidiary, Pinedale Corridor, LP (“Pinedale LP”), entered into a Purchase and Sale Agreement with an indirect wholly-owned subsidiary of Ultra Petroleum Corp. (NYSE: UPL) (“Ultra Petroleum”). The Purchase and Sale Agreement provides for Pinedale LP’s acquisition of a system of pipelines and central gathering facilities (the “Liquids Gathering System” or “LGS”) and certain associated real property rights in the Pinedale Anticline in Wyoming (the “Acquisition”) for $225 million in cash.

Pinedale LP intends to enter into a customized long-term triple net Lease Agreement relating to the use of the LGS (the “Lease Agreement”) with Ultra Wyoming LGS, LLC, another indirect wholly-owned subsidiary of Ultra Petroleum (“Ultra Newco”). Ultra Newco will utilize the LGS as a method for separating water, condensate and associated flash gas from a unified stream which consists primarily of water and is a by-product of natural gas extraction. Ultra Newco’s obligations under the Lease Agreement will be guaranteed by Ultra Petroleum and Ultra Petroleum’s operating subsidiary, Ultra Resources, Inc. (“Ultra Resources”), pursuant to the terms of a Parent Guaranty (the “Guaranty”). Annual rent for the initial term under the Lease Agreement will be a minimum of $20 million (as adjusted annually for changes based on the consumer price index) and a maximum of $27.5 million, with the exact rental amount being determined depending on changes in the product volume handled by the LGS and subject to Pinedale LP not being in default under the Lease Agreement.

Upon completion of this offering, consummation of the Acquisition and effectiveness of the Lease Agreement, the LGS will account for approximately 65% of our total assets on a pro forma basis as of August 31, 2012 and the lease payments under the Lease Agreement will account for approximately 66% of our total revenue on a pro forma basis for the nine months ended August 31, 2012. The financial condition of Ultra Newco, Ultra Petroleum and Ultra Resources and the ability and willingness of each to satisfy its obligations under the Lease Agreement and Guaranty will have a major impact on our results of operation, ability to service our indebtedness and ability to make distributions. As such, we have included the most recent consolidated financial statements of Ultra Petroleum beginning on page F-1 of this prospectus supplement.

The Liquids Gathering System acquisition will be our largest acquisition of REIT-qualifying assets to date and will serve as a cornerstone asset for our energy infrastructure real asset strategy.

Acquisition Rationale

We believe that the key characteristics of the LGS align with our targeted strategy and investment criteria. Those investment criteria and corresponding LGS key characteristics include:

| • | Fixed Asset-Intensive Investments. We target investments in assets owned by companies with a significant base of fixed assets that characteristically display relatively inelastic demand resulting in low volatility and low cyclicality. The LGS is a stable, low volatility asset that is vital to Ultra Petroleum’s operations. |

| • | Long-life Assets with Stable Cash Flows and Limited Commodity Price Sensitivity. We seek real property assets having the potential to generate stable cash flows over long periods of time. The LGS is subject to a long-term lease with a strong counterparty and subject to large fixed payments with limited commodity risk. The Pinedale field where the LGS is located had an estimated reserve life of over 30 years as of December 31, 2011. |

| • | Growth Opportunities. We generally seek to enter into leases that provide base rent and participating rent over the term of the lease. The Pinedale field is a long-life field with significant |

S-2

| growth potential. Less than 25% of the Pinedale field had been developed as of December 31, 2011 and Ultra Petroleum is focused on continued production and expansion in the field. Lease escalators and the variable component of the Lease Agreement provide us participation in growth opportunities. |

| • | Experienced Management Team and High Quality Tenant. We target assets operated by management teams that have a track record of success and that often have substantial knowledge and focus in particular segments of the energy infrastructure sector or with certain types of assets. Ultra Petroleum is recognized as a top operator with strong operating and financial metrics and has a management team with an average of over 30 years of experience. |

| • | Limited Technological Risk. We generally do not target acquisition opportunities involving the application of new technologies or significant geological, drilling or development risk. The LGS has limited technological risk given the simple and efficient nature of the system. |

Impact of Acquisition on REIT Status

We anticipate that completion of the Acquisition, when combined with the expected contribution of certain of our assets to a taxable REIT subsidiary, the acquisition of other assets and the receipt of other income, will allow us to meet the income and assets tests necessary for us to qualify and elect to be taxed as a REIT for 2013. Because certain of our assets may not produce REIT-qualifying income or be treated as interests in real property, we intend to contribute those assets into taxable REIT subsidiaries prior to 2013 in order to limit the potential offset that such assets and income would have on our ability to qualify as a REIT for 2013.

Upon the completion of the Acquisition, the effectiveness of the Lease Agreement and consummation of the contribution transactions, and based on the value of our existing assets as of August 31, 2012, we expect that our pro forma income for the nine month period ended August 31, 2012 would satisfy the REIT income tests and approximately 65% of our pro forma assets as of August 31, 2012 will qualify under the REIT requirements. To the extent we are unable to consummate sufficient other acquisitions of REIT-qualifying assets by the end of the first calendar quarter of 2013, we intend to liquidate a portion of our securities portfolio to allow us to meet both the asset and income tests necessary to qualify for REIT status for 2013.

Co-Investment and Concurrent Debt Financing

The aggregate purchase price of the LGS is $225.0 million, payable in cash. We intend to use a portion of the net proceeds from this offering to make a capital contribution to Pinedale LP, which will utilize our contributed proceeds, along with proceeds of the concurrent co-investment and debt financing described below, to pay the aggregate purchase price of the LGS.

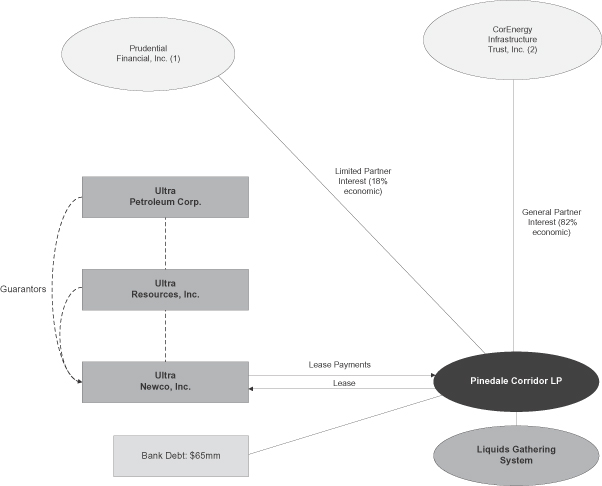

Co-Investment

On December 7, 2012, we entered into a Subscription Agreement with Ross Avenue Investments, LLC (“Ross”), a wholly-owned subsidiary of Prudential Financial, Inc. (collectively with Ross, “Prudential”), in which Prudential agreed to fund a portion of the Acquisition by investing $30 million in cash in Pinedale LP concurrent with, and conditioned on the consummation of, this offering, the debt financing, and the Acquisition. Prudential will then hold a limited partner interest in Pinedale LP, and we will hold a general partner interest. Prudential will hold approximately 18% of the economic interest in Pinedale LP and we, through Pinedale GP, Inc., the general partner of Pinedale LP and our wholly-owned subsidiary (“Pinedale GP”), will hold approximately 82% of the economic interest. Pinedale GP has been given broad discretion to manage and make decisions relating to Pinedale LP. Prudential has certain approval rights concerning the Lease Agreement and any financings undertaken by Pinedale LP.

S-3

Ross is managed by Prudential Capital Group (“PCG”), a private investment management business of Prudential Investment Management, an SEC registered Investment Adviser. PCG manages one of the world’s largest portfolios of traditional private placements with $64.8 billion in assets under management as of September 30, 2012. PCG’s Energy Finance Group, located in Dallas, Texas, provides capital to entities across the energy value chain, including oil and gas exploration and production companies, energy services companies, midstream energy infrastructure companies and utilities. Typical investment structures include investment grade and below investment grade debt, mezzanine debt and equity.

Debt Financing

On December 7, 2012, Pinedale LP entered into a $65 million secured term credit facility with KeyBank National Association (“KeyBank”) serving as a lender and the administrative agent on behalf of other lenders participating in the credit facility. Funding of the credit facility is conditioned on our contribution of the proceeds of this offering to Pinedale LP and the receipt by Pinedale LP of the co-investment funds from Prudential. Outstanding balances under the credit facility will generally accrue interest at a variable annual rate equal to LIBOR plus 3.25%. The credit facility will remain in effect through December 2015, with an option to extend through December 2016. The credit facility will be secured by the LGS. See “Credit Facility.”

S-4

Pro Forma Structure Post-Acquisition, Co-Investment and Debt Financing

A chart showing the proposed pro forma structure following the Acquisition, co-investment and debt financing is set forth below. For additional information on the Acquisition and the Lease Agreement see “The Acquisition” and “The Lease Agreement” beginning on pages S-18 and S-21 of this prospectus supplement, respectively.

| 1. | Prudential Financial, Inc. will be investing through an indirect wholly-owned subsidiary. |

| 2. | We will be investing through a wholly-owned subsidiary and will be providing guarantees to KeyBank on limited matters and to Ultra Newco as described below. |

S-5

Our Competitive Advantages

We believe that we are well-positioned to meet the capital needs of companies within the U.S. energy infrastructure sector for the following reasons:

| • | Attractive Partner for Energy Infrastructure Companies. We believe that we are a desirable partner for energy infrastructure companies because we have specialized knowledge of the economic, regulatory, and stakeholder considerations faced by them. We are an attractive capital provider because we do not intend to compete with the operations of our lessees and are willing to enter into long-term lease and capital arrangements that suit the requirements and achieve the goals of energy infrastructure companies. |

| • | Broad Energy Infrastructure Scope. The universe of assets that may be owned by a REIT has expanded significantly. The Internal Revenue Service has, through a series of private letter rulings, recently approved new types of assets in the energy sector as being eligible to be owned by a REIT, including electric transmission and distribution systems, pipeline systems, and storage and terminaling systems. While only the requesting party may rely on these rulings, they give insight into the potential for REIT qualifying assets. We also intend to acquire assets that do not generate qualifying income for MLPs, such as renewables and electric power transmission. |

| • | Efficient Capital Provider. If we are able to qualify as a REIT, our stockholders will generally not receive Unrelated Business Taxable Income or Effectively Connected Income. This offers us access to investors desiring the risk-adjusted return profile that we intend to provide but who are unable to invest directly in companies owning infrastructure assets, such as private equity funds or MLPs. As a REIT, we will seek to have a lower overall cost of capital compared to certain other energy infrastructure acquirors, which should enhance our future cash flows and provide for increased value-enhancing growth opportunities. |

| • | Disciplined Investment Philosophy. Our investment approach emphasizes overall asset operational and financial performance with the potential for enhanced returns through incremental asset growth, capital appreciation, and minimization of downside risk. Our process for selecting investments involves an assessment of the overall attractiveness of the specific subsector of the energy infrastructure sector in which a prospective tenant company is involved; such company’s specific competitive position within that subsector; operational asset engineering due diligence; potential commodity price impact, supply and demand and regulatory concerns; the stability and potential growth of the prospective real property asset’s cash flows; the prospective operating company’s management track record; and our ability to structure an attractive investment. |

| • | Experienced Management Team. The principals of Corridor have an average of over 26 years of experience in energy operations of multi-national electric and gas utilities and other national energy marketing and trading businesses and in optimizing portfolios for real property energy asset investments. Based on their real property asset operational experience and strong industry relationships, we believe that the principals of Corridor provide the expertise and knowledge necessary to acquire real property assets with strong performance standards. |

| • | Extensive Relationships. The principals of Corridor maintain relationships with various owners and operators of real property assets in the energy infrastructure sector. They regularly communicate with these owners and operators to discuss their real property assets and the potential for structuring financing transactions that would be both beneficial to them and to us. |

| • | Manager’s Affiliation with Tortoise Capital Advisors, LLC. Our manager, Corridor, is an affiliate of TCA, a registered investment adviser with over $9.4 billion of assets under management in the U.S. energy infrastructure sector as of November 30, 2012. Corridor has access to certain resources of TCA while acting as our manager. |

S-6

Market Opportunity

We believe the environment for acquiring energy infrastructure real property assets is attractive for the following reasons:

| • | Energy infrastructure provides essential services, and the demand for energy resources is expected to grow in the future. We believe energy infrastructure is the backbone of the U.S. economy. The energy infrastructure sector includes the pipes, wires and storage facilities that connect and deliver some of our most critical resources: electricity, oil and natural gas. |

The demand for energy resources is correlated with population growth and has a low correlation to market cycles. U.S. energy consumption is forecasted to grow by 11% from 2010 to 2035 according to the U.S. Energy Information Administration’s (“EIA”) Annual Energy Outlook (April 2012). Demand for natural gas continues to increase as power generation companies switch to lower-cost, cleaner burning fuels such as natural gas. Natural gas is the cleanest fossil fuel, with fewer carbon dioxide emissions than coal and oil. Natural gas is viewed as a reliable back-up energy source to alternative energy (e.g., wind and solar) as it is not dependent on weather patterns.

The U.S. is the third largest producer of crude oil and the second largest producer of natural gas products in the world. The United States has an abundant supply of natural gas with enough natural gas to last for approximately 150 years, according to the Interstate Natural Gas Association of America Foundation (“INGAA”). Natural gas provides a means of energy independence; in recent years, 80 to 90 percent of the natural gas consumed in the United States was produced domestically.

| • | Investment is needed in U.S. energy infrastructure. Due to renewable energy requirements, rapid technological advances in the methods used to extract oil and natural gas and aging infrastructure, substantial amounts of capital are expected to be invested in energy infrastructure. For entities under the jurisdiction of the Federal Energy Regulatory Commission (“FERC”), investments in the power transmission sector in 2010 were quadruple the average investment level throughout the 1990s. According to Edison Electric Institute (“EEI”) data, planned transmission investment by shareholder-owned utilities from 2012 through 2015 will total $11.6 to $15.2 billion. A Brattle Group study, based on North America Electric Reliability Corporation (“NERC”) and EEI data, projects transmission additions of 3,000 to 6,000 miles per year from 2010 through 2015. A 2012 study by INGAA noted that in the U.S. lower 48 states alone $200 billion in midstream investments will be required to accommodate the development of natural gas, oil and natural gas liquid resources from 2012 through 2035. We believe that the U.S. energy infrastructure sector’s high level of projected capital expenditures and continued acquisition and divestiture activity provide numerous attractive acquisition opportunities. |

| • | There are a number of attractive operating companies with capital needs. We believe that the capital expansion plans of operating companies in the midstream and downstream segments of the U.S. energy infrastructure sector provide us attractive real property acquisition opportunities. The energy industry is characterized by assets with high barriers to entry, providing confidence that over an extended lease term an asset is unlikely to lose market share to a newly constructed asset. In addition, we can offer capital for assets that currently do not generate qualifying income for MLPs, such as renewables and electric power transmission. |

| • | There are a large number of assets in the energy infrastructure sector that are able to be held by a REIT. In 2007, 2009 and 2010, the Internal Revenue Service (“IRS”) issued three separate private letter rulings that defined certain energy infrastructure assets as real property assets for tax |

S-7

| purposes. The qualifying real property assets in the energy infrastructure sector are electric transmission and distribution systems, pipeline systems and storage and terminaling systems. The private letter rulings treat such assets as qualifying real property assets if the income from these assets is derived from rents on real property. While private letter rulings provide insight into the current thinking of the IRS on tax issues, such rulings may only be relied upon by the taxpayer to whom they were issued. We have not obtained any private letter rulings. |

Other Recent Developments

Name Change and New York Stock Exchange Symbol Change

On December 3, 2012, we changed our name from Tortoise Capital Resources Corporation to CorEnergy Infrastructure Trust, Inc. and changed our New York Stock Exchange symbol from “TTO” to “CORR.”

Address Change

Our address is 4200 W. 115th Street, Suite 210, Leawood, Kansas 66211, and our telephone number is 877-699-CORR (2677). Information about us is also on our website at www.corridortrust.com. Information on our website is not incorporated herein by reference.

S-8

| Shares of common stock offered by CorEnergy Infrastructure Trust, Inc. |

18,500,000 shares. |

| Shares of common stock outstanding after the offering |

27,684,463 shares. |

| Use of proceeds |

We estimate that our net proceeds from this offering, after deducting underwriting discounts and estimated offering expenses, will be approximately $ (or $ if the underwriters exercise their option to purchase 2,775,000 additional shares from us). We intend to use the net proceeds of this offering to make a capital contribution to Pinedale LP and for general business purposes. Pinedale LP will utilize our contributed proceeds, along with the proceeds of a concurrent co-investment and debt financing, to fund the Acquisition. See “Use of Proceeds” and “The Acquisition.” |

| Risk factors |

See the “Risk Factors” section of this prospectus supplement beginning on page S-11 and the “Risk Factors” section of the accompanying prospectus beginning on page 11 thereof for a discussion of factors you should carefully consider before deciding to invest in shares of our common stock. |

| New York Stock Exchange symbol |

“CORR” |

| REIT status and transfer restrictions |

We anticipate that completion of the Acquisition, when combined with the expected contribution of certain of our assets to a taxable REIT subsidiary, the acquisition of other assets and the receipt of other income, will allow us to meet the income and assets tests necessary for us to qualify for and elect to be taxed as a REIT for 2013. To the extent we are unable to consummate sufficient other acquisitions of REIT-qualifying assets by the end of the first calendar quarter of 2013, we intend to liquidate a portion of our securities portfolio necessary to allow us to meet both the asset and income tests necessary to qualify for REIT status for 2013. We anticipate that in connection with any election to be treated as a REIT, we will change our fiscal year to a calendar year ending December 31. |

| At our most recent annual meeting, our stockholders voted to authorize an amendment to our articles of incorporation, and our articles will be amended, to include various restrictions on the ownership and transfer of our common stock if we qualify for and decide to elect REIT status, including among others, a restriction that, subject to certain exceptions, prohibits any person from owning more than 9.8% of the aggregate value of our outstanding common stock or capital stock. |

| Distributions |

We intend to continue to make distributions on a quarterly basis to our stockholders out of assets legally available for distribution. Our Board of Directors will determine the amount of any distribution. A REIT is generally required to distribute during the taxable year an |

S-9

| amount equal to at least 90% of the REIT taxable income (determined under Internal Revenue Code section 857(b)(2), without regard to the deduction for dividends paid). We intend to adhere to this requirement in order to qualify as a REIT. |

| We intend to make a one-time special distribution to distribute our accumulated C corporation earnings and profits, if any, prior to our election to be taxed as a REIT. See “Distribution Policy” beginning on page S-22 of this prospectus supplement. |

| Our Board of Directors has indicated that it intends to approve an increase in our quarterly distribution payable to stockholders from $0.11 per share to $0.125 per share for the first full quarter following completion of the Acquisition. There is no assurance that we will continue to make regular distributions at such increased level or at all. If we change our fiscal year to a calendar year as anticipated, our next distribution will be for the period beginning on December 1, 2012 and ending on March 31, 2013, with the anticipated $0.125 per share quarterly distribution amount applicable to the period beginning January 1, 2013. See “Risk Factors.” |

S-10

You should carefully consider the risks described below, in the “Risk Factors” section of the accompanying prospectus beginning on page 11 thereof and the “Risk Factors” section of our Annual Report on Form 10-K for the year ended November 30, 2011, together with all other information included or incorporated by reference in this prospectus supplement and the accompanying prospectus, before you decide to invest in shares of our common stock.

If we consummate the Acquisition and the Lease Agreement becomes effective, the majority of our infrastructure real property assets will be leased to a single tenant.

Assuming the Acquisition is completed and the Lease Agreement becomes effective, the LGS will represent approximately 65% of our total assets or a pro forma basis as of August 31, 2012 and the lease payments under the Lease Agreement with Ultra Newco will represent approximately 66% of our total revenue on a pro forma basis as of August 31, 2012. Ultra Newco or Ultra Petroleum, one of the guarantors of Ultra Newco’s obligations under the Lease Agreement and Ultra Newco’s ultimate parent company, may experience a downturn in its business, which may weaken its financial condition and result in Ultra Newco’s failure to make timely lease payments or give rise to another default under the Lease Agreement or Ultra Petroleum’s failure to meet its Guaranty obligations. In the event of a default by Ultra Newco or Ultra Petroleum, we may experience delays in enforcing our rights as landlord and may incur substantial costs in protecting our investment. In addition, if Ultra Newco fails to renew the Lease Agreement and we cannot find a new lessee at the same or better lease rates, the expiration of the Lease Agreement in fifteen years could have a material adverse impact on our business and financial condition.

The following is a brief summary of certain risk factors disclosed by Ultra Petroleum in its most recent Annual Report on Form 10-K, which should be carefully considered before you decide to invest in shares of our common stock. For a complete discussion of the risks that may be applicable to Ultra Petroleum, please review its complete Annual Report on Form 10-K for the fiscal year ended December 31, 2011.

| • | Ultra Petroleum’s reserve estimates may turn out to be incorrect if the assumptions upon which these estimates are based are inaccurate. Any material inaccuracies in these reserve estimates or underlying assumptions will materially affect the quantities and present value of Ultra Petroleum’s reserves. |

| • | Competitive industry conditions may negatively affect Ultra Petroleum’s ability to conduct operations. |

| • | Factors beyond Ultra Petroleum’s control may affect its ability to effectively market production and may ultimately affect its financial results. |

| • | A decrease in oil and natural gas prices may adversely affect Ultra Petroleum’s results of operations and financial condition. |

| • | A substantial portion of Ultra Petroleum’s reserves and production is natural gas. Prices for natural gas have been lower in recent years than at various times in the past and may remain lower in the future. Sustained low prices for natural gas may adversely affect Ultra Petroleum’s operational and financial condition. |

| • | Compliance with environmental and other governmental regulations could be costly and could negatively impact Ultra Petroleum’s production. |

| • | Climate change legislation or regulations restricting emissions of “greenhouse gases” could result in increased operating costs and reduced demand for the oil and natural gas that Ultra Petroleum produces. |

S-11

| • | Ultra Petroleum may not be able to replace its reserves or generate cash flows if it is unable to raise capital. Ultra Petroleum will be required to make substantial capital expenditures to develop existing reserves and to discover new oil and natural gas reserves. |

| • | Ultra Petroleum’s operations may be interrupted by severe weather or drilling restrictions. |

| • | Ultra Petroleum is exposed to operating hazards and uninsured risks that could adversely impact its results of operations and cash flows. |

| • | If oil and natural gas prices decrease, Ultra Petroleum may be required to write down the carrying value of its oil and natural gas properties. |

We will be subject to risks associated with ownership of the Liquids Gathering System.

Our ownership of the LGS will subject us to all of the inherent hazards and risks normally incidental to the storage and distribution of natural gas and natural gas liquids, such as well site blowouts, cratering and explosions, pipe and other equipment and system failures, uncontrolled flows of natural gas or well fluids, fires, formations with abnormal pressures, pollution and environmental risks and natural disasters. These risks could result in substantial losses due to personal injury and/or loss of life, significant damage to and destruction of property and equipment and pollution or other environmental damage. Moreover, if one or more of these hazards occur, there can be no assurance that a response will be adequate to limit or reduce damage. As a result of these risks, we may also sometimes be a defendant in legal proceedings and litigation arising in the ordinary course of business. There can be no assurance that the insurance policies that we maintain to limit our liability for such losses will be adequate to protect us from all material expenses related to potential future claims for personal injury and property damage or that such levels of insurance will be available in the future at economical prices or to cover all risks.

We will be subject to the risk of Ultra Newco transferring its obligations under the Lease Agreement.

The terms of the Lease Agreement provide that Ultra Newco may transfer its rights and obligations under the Lease Agreement at any time, subject to certain conditions. We thus bear the risk that Ultra Newco will transfer its rights and obligations under the Lease Agreement to a third party whose creditworthiness may not be on par with that of Ultra Newco, which could inhibit such transferee’s ability to make timely lease payments under the Lease Agreement or increase the likelihood that a downturn in the business of such transferee could give rise to a default under the Lease Agreement. The occurrence of either of these events could have a material adverse impact on our business and financial condition.

Our operations could be adversely affected if third-party pipelines or other facilities interconnected to our facilities become partially or fully unavailable.

The LGS connects to other pipelines or facilities owned by third parties. The continuing operation of such third-party pipelines or facilities is not within our control. These pipelines and other facilities may become unavailable, or available only at a reduced capacity. If any of these third-party pipelines or facilities becomes unable to transport the natural gas or natural gas liquids stored or distributed by the LGS, our business, results of operations, financial condition and ability to make cash distributions to our stockholders could be adversely affected.

Although we believe that the Liquids Gathering System will constitute a real estate asset for tax purposes, that belief is not binding on the Internal Revenue Service or any court and does not guarantee our qualification as a REIT.

In 2007, 2009 and 2010, the IRS issued three separate private letter rulings that defined certain energy infrastructure assets as real estate assets for tax purposes. The potential qualifying real estate assets in the energy

S-12

infrastructure sector are electric transmission and distribution systems, pipeline systems, and storage and terminaling systems. We believe that the Liquids Gathering System constitutes a real estate asset for tax purposes consistent with these private letter rulings. Although private letter rulings provide insight into the current thinking of the IRS on tax issues, such rulings may only be relied upon by the taxpayer to whom they were issued and are not binding on the IRS with respect to us or the Liquids Gathering System. We have not obtained any private letter rulings with respect to the Liquids Gathering System. If the Liquids Gathering System does not constitute a real estate asset for tax purposes, we would likely fail to qualify as a REIT, would not achieve our objectives and the value of our stock could decline.

The Acquisition must be approved by the U.S. Bureau of Land Management. If such approval is not granted, the Acquisition may be unwound and you will not receive any return of your investment.

We must submit the Acquisition to the U.S. Bureau of Land Management (the “BLM”) for approval and may only do so following the closing of the Acquisition. There is a risk that the BLM will not approve the Acquisition. As a result, we would not be viewed by the BLM as the holder of rights in the BLM easements, which could adversely affect our ability to pledge the LGS as collateral for any future debt or sell our interest in the LGS. In such an event, you will not receive any return of your investment, and we would use the proceeds of this offering on one or more alternative acquisitions. We have not identified any alternative acquisitions at this time, and our decision with respect to any such alternative acquisition would generally not be subject to stockholder approval. In addition, alternative acquisitions may not be readily available to us or may yield lower returns than those expected to be received from the Acquisition. Pending the identification of alternative acquisitions, we may invest the proceeds of this offering in short-term investments that would likely generate lower returns than those expected to be received from the Acquisition, which in turn would cause our financial performance to suffer.

If we consummate the Acquisition, our indebtedness will be substantial and could have important consequences, including impairing our ability to obtain additional financing or pay future distributions.

On a pro forma basis as of August 31, 2012, assuming the completion of this offering, the consummation of the Acquisition, our borrowing of $65 million under our credit facility to fund a portion of the purchase price of the Acquisition and the co-investment by Prudential to fund a portion of the purchase price of the Acquisition, we will have outstanding consolidated indebtedness of approximately $66 million. Our substantial leverage could have important consequences. For example, it could:

| • | result in the acceleration of a significant amount of debt for non-compliance with the terms of such debt or, if such debt contains cross-default or cross-acceleration provisions, other debt; |

| • | result in the loss of assets due to foreclosure or sale on unfavorable terms, which could create taxable income without accompanying cash proceeds; |

| • | materially impair our ability to borrow undrawn amounts under existing financing arrangements or to obtain additional financing or refinancing on favorable terms or at all; |

| • | require us to dedicate a substantial portion of our cash flow to paying principal and interest on our indebtedness, thereby reducing the cash flow available to fund our business, to pay distributions, including those necessary to maintain REIT qualification, or to use for other purposes; |

| • | increase our vulnerability to economic downturns; |

| • | limit our ability to withstand competitive pressures; or |

| • | reduce our flexibility to respond to changing business and economic conditions. |

S-13

The terms of the co-investment in Pinedale LP may limit our ability to take certain actions in the future.

Pinedale GP, our wholly-owned subsidiary, is the general partner of Pinedale LP. Under the Pinedale LP partnership agreement, Pinedale GP is given broad authority to manage the affairs of Pinedale LP and to ensure that Pinedale LP complies with the terms of various agreements to which it is a party, including the Lease Agreement and the credit agreement with KeyBank. The Pinedale LP partnership agreement, however, requires the approval of the holder of a majority of a class of limited partner interests (all of which will be held initially by Prudential) before certain actions can be taken by Pinedale LP, including granting any consent under the Lease Agreement to: extend the term of the Lease Agreement; change the methodology of determining the rent; improve the leased property; reduce the present value of rental payments; merge with, or acquire unrelated assets from, a third party; incur debt, or amend the terms of any existing Pinedale LP debt, that would increase that debt above a specified amount; or issue partnership interests with rights superior to those held initially by Prudential. The need for approval of one or more of the foregoing matters may not be obtained at a time when we believe that an action requiring approval should be taken.

We may not be able to refinance the indebtedness that we incur to fund the Acquisition.

If we consummate the Acquisition and Pinedale LP borrows $65 million under its credit facility, such indebtedness will mature in 2015, or 2016 if the option to extend the date of maturity is exercised. Pinedale LP may not be able to refinance that indebtedness on its existing terms or at all. If funding is not available when needed, or is available only on unfavorable terms, we may not be able to meet our obligations as they come due. Moreover, without adequate funding, we may be unable to execute our growth strategies, complete future acquisitions, take advantage of other business opportunities or respond to competitive pressures, any of which could have a material adverse effect on our revenues and results of operations.

There are uncertainties relating to the estimate of our anticipated special distribution.

To qualify for taxation as a REIT, we will be required to distribute to our stockholders all of our pre-REIT accumulated earnings and profits, if any, as measured for federal income tax purposes, prior to the end of our first taxable year as a REIT. Failure to make the special distribution could result in our disqualification for taxation as a REIT. The determination of the timing and amount to be distributed in the special distribution is a complex factual and legal determination. We may have less than complete information at the time we undertake our analysis or may interpret the applicable law differently than the IRS. We currently believe and intend that our special distribution will satisfy the requirements relating to the distribution of our pre-REIT accumulated earnings and profits. There are, however, substantial uncertainties relating to the computation of our special distribution, including the possibility that the IRS could, in auditing tax years prior to our REIT election, successfully assert that our taxable income should be increased, which could increase our pre-REIT accumulated earnings and profits. Thus, we may fail to satisfy the requirement that we distribute all of our pre-REIT accumulated earnings and profits by the close of our first taxable year as a REIT. Moreover, although there are procedures available to cure a failure to distribute all of our pre-REIT accumulated earnings and profits, we cannot now determine whether we will be able to take advantage of them or the economic impact to us of doing so.

Failure to qualify as a REIT would have significant adverse consequences to us and the value of our common stock.

Although we anticipate that completion of the acquisition of the Liquids Gathering System, when combined with the expected contribution of certain of our assets to a taxable REIT subsidiary, the acquisition of other assets and the receipt of other income, will allow us to meet the income and asset tests necessary for us to qualify for and elect to be taxed as a REIT for fiscal 2013, we can not assure you that we will qualify to elect to be taxed as a REIT. Furthermore, qualification as a REIT involves the application of highly technical and complex provisions of the Internal Revenue Code as to which there may only be limited judicial and

S-14

administrative interpretations and involves the determination of facts and circumstances not entirely within our control. Future legislation, new regulations, administrative interpretations or court decisions may significantly change the tax laws or the application of the tax laws with respect to qualification as a REIT for federal income tax purposes or the federal income tax consequences of such qualification. Accordingly, we cannot assure you that we will be organized or will operate to qualify as a REIT for fiscal 2013 or thereafter. In addition, we have not obtained an opinion of counsel that we have been organized in conformity with the requirements for qualification as a REIT or that our proposed method of operation for fiscal 2013 and thereafter will enable us to satisfy the requirements for such qualification. If, with respect to any taxable year, we fail to qualify as a REIT, we would not be allowed to deduct distributions to stockholders in computing our taxable income. After an initial election and qualification as a REIT, if we later failed to so qualify and we were not entitled to relief under the relevant statutory provisions, we would also be disqualified from treatment as a REIT for four subsequent taxable years. If we fail to qualify as a REIT, corporate-level income tax, including any applicable alternative minimum tax, would apply to our taxable income at regular corporate rates. As a result, the amount available for distribution to holders of equity securities would be reduced for the year or years involved, and we would no longer be required to make distributions. In addition, our failure to qualify as a REIT could impair our ability to expand our business and raise capital, and it may adversely affect the value of our common stock.

The ability of stockholders to control our policies and effect a change of control of our company will be limited by certain provisions of our articles of incorporation and by Maryland law.

Our articles of incorporation authorize our board of directors to amend our charter to increase or decrease the aggregate number of authorized shares of stock, to authorize us to issue additional shares of our common stock or preferred stock and to classify or reclassify unissued shares of our common stock or preferred stock and thereafter to authorize us to issue such classified or reclassified shares of stock. We believe that these articles of incorporation provisions will provide us with increased flexibility in structuring possible future financings and acquisitions and in meeting other needs that might arise. The additional classes or series, as well as the additional authorized shares of common stock, will be available for issuance without further action by our stockholders, unless such action is required by applicable law or the rules of any stock exchange or automated quotation system on which our securities may be listed or traded. Although our board of directors does not currently intend to do so, it could authorize us to issue a class or series of stock that could, depending upon the terms of the particular class or series, delay, defer or prevent a transaction or a change of control of our company that might involve a premium price for holders of our common stock or that our common stockholders otherwise believe to be in their best interests.

To maintain our qualification as a REIT for U.S. federal income tax purposes, if we elect to be taxed as a REIT for fiscal 2013, starting in 2014 not more than 50% in value of our outstanding stock may be owned, directly or indirectly, by or for five or fewer individuals (as defined in the Internal Revenue Code to include certain entities such as private foundations) at any time during the last half of any taxable year. To maintain this qualification, and/or to address other concerns about concentrations of ownership of our stock, if we qualify for and decide to elect to be taxed as a REIT, our stockholders have already approved an amendment to our articles of incorporation, and our articles will be amended, to generally prohibit any individual (as defined under the Internal Revenue Code to include certain entities) from actually owning or being deemed to own by virtue of the applicable constructive ownership provisions of the Internal Revenue Code, (i) more than 9.8% (in value or in number of shares, whichever is more restrictive) of the issued and outstanding shares of our common stock or (ii) more than 9.8% in value of the aggregate of the outstanding shares of all classes and series of our stock, in each case, excluding any shares of our stock not treated as outstanding for federal income tax purposes. Subject to the exceptions described below, our articles of incorporation will further prohibit any person or entity from actually or constructively owning shares in excess of these limits. We refer to these restrictions as the “ownership limitation provisions.” These ownership limitation provisions may prevent or delay a change in control and, as a result, could adversely affect our stockholders’ ability to realize a premium for their shares of common stock. However, upon request, our board of directors will waive the ownership limitation provisions with respect to a particular stockholder and establish different ownership limitation provisions for such stockholder. In granting

S-15

such waiver, our board of directors may also require the stockholder receiving such waiver to make certain representations, warranties and covenants related to our ability to qualify as a REIT.

Complying with the REIT requirements may cause us to forgo otherwise attractive opportunities or liquidate certain of our investments.

To qualify as a REIT for U.S. federal income tax purposes, we must continually satisfy tests concerning, among other things, the sources of our income, the nature and diversification of our assets, the amounts we distribute to our stockholders and the ownership of our stock. We may be required to make distributions to our stockholders at disadvantageous times or when we do not have funds readily available for distribution. Thus, compliance with the REIT requirements may hinder our ability to make certain otherwise attractive investments or undertake other activities that might otherwise be beneficial to our company and our stockholders, or may require us to borrow or liquidate investments in unfavorable market conditions. In addition, Corridor may be unable to find investments that comply with REIT requirements, thereby limiting our ability to grow or even maintain our asset base.

In connection with such requirements if we elect to be taxed as a REIT, we must ensure that, at the end of each calendar quarter, at least 75% of the value of our assets consists of cash, cash items, government securities and qualified real property assets. The remainder of our investments in securities (other than cash, cash items, government securities, securities issued by a REIT taxable subsidiary or certain other qualified assets) generally cannot include more than 10% of the outstanding voting securities of any one issuer or more than 10% of the total value of the outstanding securities of any one issuer. In addition, in general, no more than 5% of the value of our total assets (other than cash, cash items, government securities, certain other securities and qualified real property assets) can consist of the securities of any one issuer, and no more than 25% of the value of our total securities can be represented by securities of one or more of a certain class of issuers. After meeting these requirements at the close of a calendar quarter, if we fail to comply with these requirements at the end of any subsequent calendar quarter, we must correct the failure within 30 days after the end of the calendar quarter or qualify for certain statutory relief provisions to avoid losing our REIT qualification. As a result, we may be required to liquidate from our portfolio otherwise attractive investments. These actions could have the effect of reducing our income and amounts available for distribution to our stockholders.

The ability of our board of directors to revoke our REIT qualification without stockholder approval may cause adverse consequences to our stockholders.

If we elect to be taxed as a REIT, our articles of incorporation will provide that our board of directors may revoke or otherwise terminate our REIT election, without the approval of our stockholders, if it determines that it is no longer in our best interest to continue to qualify as a REIT. If we cease to be a REIT, we will not be allowed a deduction for dividends paid to stockholders in computing our taxable income and will be subject to U.S. federal income tax at regular corporate rates and state and local taxes, which may have adverse consequences on our total return to our stockholders.

S-16

We estimate that we will receive net proceeds from this offering of approximately $ after deducting the underwriting discount and our estimated offering expenses, or $ if the underwriters exercise their option to purchase 2,775,000 additional shares from us. We intend to use the net proceeds of this offering to make a capital contribution to Pinedale LP in exchange for an approximately 82% general partner interest in Pinedale LP and for general business purposes. Pinedale LP will utilize our contributed proceeds, along with the proceeds of a concurrent co-investment by Prudential and a debt financing, to fund the net purchase price of the Acquisition.

S-17

Pinedale LP has entered into a Purchase and Sale Agreement with a wholly-owned subsidiary of Ultra Petroleum dated December 7, 2012, relating to the acquisition for $225 million of the LGS. That agreement is described in more detail later in this section.

Ultra Petroleum was incorporated in 1979 and is an independent oil and gas company engaged in the development, production, operation, exploration and acquisition of oil and natural gas properties. Ultra Petroleum leases approximately 93,000 gross (53,000 net) acres in and around the Pinedale and Jonah natural gas fields of the Greater Green River Basin in southwest Wyoming. The most recently available EIA data, dated 2009, indicated that the Pinedale field was among the top five U.S. natural gas plays based on proved reserves. As of December 31, 2011, Ultra Petroleum held an approximately 50% working interest in approximately 1,700 producing wells in these fields. The Pinedale and Jonah fields have estimated natural gas reserves of over 48 Tcfe as of December 31, 2011.

As of December 31, 2011, Ultra Petroleum had an estimated 4.3 Tcfe of proved reserves and 10.2 Tcfe of proved, probable and possible (3P) reserves in the Pinedale and Jonah fields. Ultra Petroleums’s third-party reservoir engineering firm, Netherland, Sewell & Associates, Inc., has identified an inventory of over 5,000 economic, future drilling locations.

Most of Ultra Petroleum’s exploration and development in the Pinedale field takes place on land under the jurisdiction of the BLM. The BLM has the authority to approve or deny oil and gas leases or to impose environmental restrictions on leases where appropriate. The BLM issued the Pinedale Record of Decision (“ROD”) in September 2008. Under the ROD, Ultra Petroleum gained year-round access to the Pinedale field for drilling and completion activities in development areas, provided Ultra Petroleum conducts an environmental mitigation effort, which includes the use of a liquids gathering system. This additional access resulted in increased drilling efficiencies and allowed for accelerated development of the field.

The LGS was completed in 2010 and consists of more than 150 miles of underground gathering pipelines with 107 receipt points and four above-ground central gathering facilities that are utilized by Ultra Petroleum as a method of separating water, condensate and associated flash gas from a unified stream and subsequently selling or treating and disposing of the separated products. Prior to entering the LGS, the unified stream goes through an initial separation process to separate the wellhead gas from the liquids stream. The wellhead gas is then transported off the leased lands to market by a third-party midstream service provider. The remaining liquids, primarily water, are transported by the LGS to one of its four central gathering facilities where they pass through a three-phase separator, which separates condensate, water and associated natural gas. Condensate is a valuable commodity that is sold by Ultra Petroleum; water is transported to disposal wells or a treatment facility for re-use; and natural gas is compressed, dehydrated and sold by Ultra Petroleum or otherwise used by Ultra Petroleum for fueling on-site operational equipment. Ultra Petroleum’s non-operating working interest partners in the Pinedale field where Ultra Petroleum’s LGS is located pay Ultra Petroleum a fee for the use of Ultra Petroleum’s LGS. As of June 30, 2012, Ultra Petroleum held an approximately 70% average working interest among the land it operates in the Pinedale field. To date, no major operational issues have been reported with respect to the LGS.

The Liquids Gathering System has a current capacity of approximately 45,000 barrels per day and average throughput during the four quarters ended September 30, 2012 of approximately 36,000 barrels per day. The underground pipelines constituting the majority of the LGS and certain other components, such as the separators, have useful lives that extend beyond the initial term of the Lease Agreement. We believe that the LGS is capable of being expanded at a relatively low incremental cost by, for example, adding additional separating equipment.

S-18

The key characteristics of the LGS acquisition align with our targeted strategy and investment criteria. We believe that those key characteristics are:

| • | a stable, low volatility asset with relatively inelastic demand; |

| • | the existence of a long-term lease with a strong counterparty with low commodity risk; |

| • | growth opportunity through the variable lease structure; |

| • | an experienced management team with a strong track record; and |

| • | a simple and efficient system that is well understood and mandated by regulators with limited risk. |

The Purchase and Sale Agreement defines the varying assets that are included within the LGS acquired, and contains representations and warranties from both the seller and Pinedale LP related to the proposed acquisition. The obligation of each party to close the proposed acquisition is subject to a number of conditions, including the receipt by Pinedale LP of funds sufficient to enable it to pay the purchase price. Successful completion of this offering, completion of the co-investment by Prudential, and completion of the KeyBank debt financing will provide the funds sufficient to pay the $225 million purchase price. In the event of a casualty loss of greater than $10 million at the LGS prior to closing and a determination by the seller that the LGS cannot be repaired, restored or replaced prior to December 21, 2012, Pinedale LP has the option to terminate the Purchase and Sale Agreement. In the event of a less significant casualty loss, the closing will occur and the seller will undertake the necessary repairs or replacements after the closing without any abatement in the resulting rent under the Lease Agreement. The Purchase and Sale Agreement has been included as an exhibit to our Form 8-K filed with the SEC on December 10, 2012, and prospective investors in this offering are encouraged to read it in its entirety, as the foregoing is merely a summary of certain of its provisions.

Pinedale LP intends to enter into a Lease Agreement with Ultra Newco relating to the lease of the LGS to Ultra Newco under a customized long-term triple net lease. Ultra Newco’s obligations under the Lease Agreement will be guaranteed by Ultra Petroleum and Ultra Resources pursuant to the terms of a Parent Guaranty. The Lease Agreement provides for an initial term of at least 15 years and potential successive renewal terms of 5 years or 75% of the then remaining useful life of the Liquids Gathering System. Annual rent for the initial term under the Lease Agreement will be a minimum of $20 million (as adjusted annually for changes based on the consumer price index) and a maximum of $27.5 million, with the exact rental amount being determined depending on changes in the product volume handled by the Liquids Gathering System and subject to Pinedale LP not being in default under the Lease Agreement. A form of the Lease Agreement is attached as an exhibit to the Purchase and Sale Agreement filed with the SEC, and prospective investors in this offering are encouraged to read it in its entirety, as the foregoing is merely a summary of certain of its provisions.

According to Ultra Petroleum’s public filings, its current operations in southwest Wyoming are focused on developing Ultra Petroleum’s long-life natural gas reserves in a tight gas sand trend located in the Greater Green River Basin with targets in the sands of the upper Cretaceous Lance Pool in the Pinedale and Jonah fields. Ultra Petroleum derives its revenues principally from the sale of its natural gas and associated condensate produced from wells operated by Ultra Petroleum and others in the Greater Green River Basin. In addition, Ultra Petroleum plans to continue its assessment of increased density drilling to more efficiently recover the oil and natural gas resources present in the area.

For its natural gas production in Wyoming, Ultra Petroleum has entered into various gathering and processing agreements with several midstream service providers that gather, compress and process natural gas owned or controlled by Ultra Petroleum from its producing wells in the Pinedale and Jonah fields. Under these agreements, the midstream service providers have routinely expanded their facilities’ capacities in southwest Wyoming to accommodate growing volumes from wells in which Ultra Petroleum owns an interest. Such

S-19

expansions are continuing, and Ultra Petroleum believes that the capacity of the midstream infrastructure related to its production will continue to be adequate to allow it to sell essentially all of its available natural gas production from Wyoming.

Ultra Petroleum is recognized as a low-cost operator in the industry in terms of both adding and producing oil and natural gas reserves. Ultra Petroleum’s all-in cash costs, defined as all-in costs excluding DD&A expenses, have consistently been lower than natural gas prices and for the twelve month period ended September 30, 2012 were $1.43 per Mcfe.

Following the consummation of the Acquisition, effectiveness of the Lease Agreement and the contribution and financing transactions described below, the LGS will account for approximately 65% of our total assets on a pro forma basis as of August 31, 2012 and the lease payments under the Lease Agreement will account for approximately 66% of our total revenue on a pro forma basis for the nine months ended August 31, 2012. The financial condition of Ultra Newco, Ultra Petroleum and Ultra Resources and the ability and willingness of each to satisfy its obligations under the Lease Agreement and Guaranty will have a major impact on our results of operation, ability to service our indebtedness and ability to make distributions. As such, we have included the most recent consolidated financial statements of Ultra Petroleum beginning on page F-1 of this prospectus supplement.

We intend to form multiple subsidiaries that we anticipate electing to treat as taxable REIT subsidiaries. We anticipate contributing certain assets to the taxable REIT subsidiaries, which we anticipate will neither be treated as real estate assets for purposes of the REIT asset test nor will they be treated as realizing income that is eligible income for purposes of the REIT income tests. The assets that we anticipate contributing to the taxable REIT subsidiaries include units in publicly trades MLPs, our wholly-owned subsidiary Mowood and other non-qualifying assets.

S-20

The Lease Agreement will be signed at the closing of the Acquisition of the LGS. The Lease Agreement has a fifteen year initial term and may be extended for additional five year terms at the sole discretion of Ultra Newco. During the initial fifteen year term, Pinedale LP will receive fixed monthly rental payments of $1,666,667 (as adjusted annually for changes based on the consumer price index) and variable rent based on the volume of liquid hydrocarbons and water that flowed through the LGS in a prior month. The minimum and maximum annual rental payments under the Lease Agreement during the initial fifteen year term are $20 million (as adjusted annually for changes based on the consumer price index) and $27.5 million, respectively, subject to Pinedale LP not being in default under the Lease Agreement. The rent will be renegotiated for any extended term. The Lease Agreement provides that Ultra Newco will be responsible for, among other matters, maintaining the LGS in good operating condition, repairing the LGS in the event of any casualty loss (except upon the occurrence of an event damaging more than 50% of the LGS, in which case Ultra Newco may propose to repurchase the LGS at a mutually agreeable price rather than repair the LGS), paying property and similar taxes resulting from Pinedale LP’s ownership of the LGS, and causing the LGS to comply with all environmental and other regulatory laws, rules and regulations. The Lease Agreement grants Ultra Newco substantially all authority to operate, and imposes on them the responsibility for the operation of, the LGS. The Lease Agreement provides Pinedale LP no control over the operation, maintenance, management or legal compliance of the LGS.

The Lease Agreement imposes numerous obligations on Pinedale LP, including maintaining its status as a special purpose entity that only engages in the business of owning, financing and leasing the LGS, keeping confidential certain information provided to it by Ultra Newco, keeping the LGS free of certain liens, observing certain limitations on the transfer and ownership of beneficial interests in, and control of, Pinedale LP and maintaining the relationship between Pinedale LP and its lender.

The Lease Agreement also describes the following situations in which Pinedale LP must consider a proposal by Ultra Newco to repurchase the LGS: if the LGS experiences a major casualty loss; if all or a significant portion of the LGS is condemned by a government authority; or if Ultra Newco concludes that its continued lease of the LGS is burdensome to it. In each of these events, Ultra Newco has the right to propose a purchase price to Pinedale LP, and Pinedale LP may accept or reject the proposal. If the parties do not reach agreement, the Lease Agreement continues in effect and Pinedale LP continues to own the LGS. In addition, Ultra Newco has, under certain circumstances, a right of first refusal during the initial term of the Lease Agreement and for two years thereafter to match any proposed transfer by Pinedale LP of its interest as lessor under the Lease Agreement or interest in the LGS. The obligations of Pinedale LP under the Lease Agreement are guaranteed by CorEnergy.

The form of Lease Agreement is an exhibit to the Purchase and Sale Agreement included as an exhibit to our Form 8-K filed with the SEC on December 10, 2012, and prospective investors in this offering are encouraged to read the Lease Agreement in its entirety, as the foregoing is merely a summary of certain of its provisions.