Exhibit 99.1

Investor Overview March 2021

Disclaimer Forward Looking StatementsThis presentation contains certain statements that may include

"forward-looking statements" within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. All statements, other than statements of historical fact, included herein are

"forward-looking statements." Although CorEnergy believes that the expectations reflected in these forward-looking statements are reasonable, they do involve assumptions, risks and uncertainties, and these expectations may prove to be

incorrect. Actual results could differ materially from those anticipated in these forward-looking statements as a result of a variety of factors, including, among others, failure to realize the anticipated benefits of the Transaction or

Internalization (as further described in this presentation); the risk that CPUC approval is not obtained, is delayed or is subject to unanticipated conditions that could adversely affect CorEnergy or the expected benefits of the Crimson

Transaction, risks related to the uncertainty of the projected financial information with respect to Crimson, the failure to receive the required approvals by existing CorEnergy stockholders; the risk that a condition to the closing of the

Internalization may not be satisfied, CorEnergy’s ability to consummate the Internalization, and those factors discussed in CorEnergy’s reports that are filed with the Securities and Exchange Commission. You should not place undue reliance on

these forward-looking statements, which speak only as of the date of this presentation. Other than as required by law, CorEnergy does not assume a duty to update any forward-looking statement. In particular, any distribution paid in the

future to our stockholders will depend on the actual performance of CorEnergy, its costs of leverage and other operating expenses and will be subject to the approval of CorEnergy’s Board of Directors and compliance with leverage

covenants.Non-GAAP Financial MeasuresThis document includes certain non-GAAP financial measures that are not prepared in accordance with accounting principles generally accepted in the United States (“GAAP”) and that may be different from

non-GAAP financial measures used by other companies. CorEnergy believes that the use of these non-GAAP financial measures provides an additional tool for investors to use in evaluating the Crimson Transaction. These non-GAAP measures should

not be considered in isolation from, or as an alternative to, financial measures determined in accordance with GAAP. Additionally, to the extent that forward-looking non-GAAP financial measures are provided, including EBITDA, they are

presented on a non-GAAP basis without reconciliations of such forward-looking non-GAAP measures due to the inherent difficulty in forecasting and quantifying certain amounts that are necessary for such reconciliation.

Disclaimer Additional Information and Where to Find ItThe issuance of CorEnergy common stock upon

conversion of CorEnergy preferred stock in connection with the Transaction as described in this presentation (the “Stock Issuance”) and the Internalization will be submitted to the stockholders of CorEnergy for their consideration. In

connection with the Stock Issuance and Internalization, CorEnergy intends to file a proxy statement and other documents with the SEC. INVESTORS AND CORENERGY STOCKHOLDERS ARE URGED TO READ THE PROXY STATEMENT (INCLUDING ALL AMENDMENTS AND

SUPPLEMENTS THERETO) REGARDING THE STOCK ISSUANCE AND INTERNALIZATION AND OTHER DOCUMENTS RELATING TO THE TRANSACTIONS THAT WILL BE FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN

IMPORTANT INFORMATION ABOUT THE STOCK ISSUANCE AND INTERNALIZATION. The proxy statement and other relevant documents (when they become available), and any other documents filed by CorEnergy with the SEC may be obtained free of charge at the

SEC’s website at www.sec.gov. In addition, stockholders may obtain free copies of the documents filed with the SEC by CorEnergy through its website at corenergy.reit. The information on CorEnergy’s website is not, and shall not be deemed to

be a part hereof or incorporated into this or any other filings with the SEC. You may also request them in writing, by telephone or via the Internet at: CorEnergy Infrastructure Trust, Inc., Investor Relations, 877-699-CORR (2677),

info@corenergy.reit. Participants in the SolicitationCorEnergy, the Manager and their respective directors and executive officers and other persons may be deemed to be participants in the solicitation of proxies from CorEnergy’s stockholders

in respect of the Stock Issuance and Internalization. Information about CorEnergy’s directors and executive officers is available in CorEnergy’s definitive proxy statement, prepared in connection with CorEnergy’s 2020 annual meeting of

stockholders and will be set forth in the proxy statement in respect of the Stock Issuance and Internalization when it is filed with the SEC. Other information regarding the persons who may, under the rules of the SEC, be deemed participants

in the solicitation of proxies from CorEnergy’s stockholders in connection with the Stock Issuance and Internalization, including a description of their direct or indirect interests, by security holdings or otherwise, in CorEnergy will be set

forth in the proxy statement in respect of the Stock Issuance and Internalization when it is filed with the SEC. You can obtain free copies of these documents, which are filed with the SEC, from CorEnergy using the contact information above.

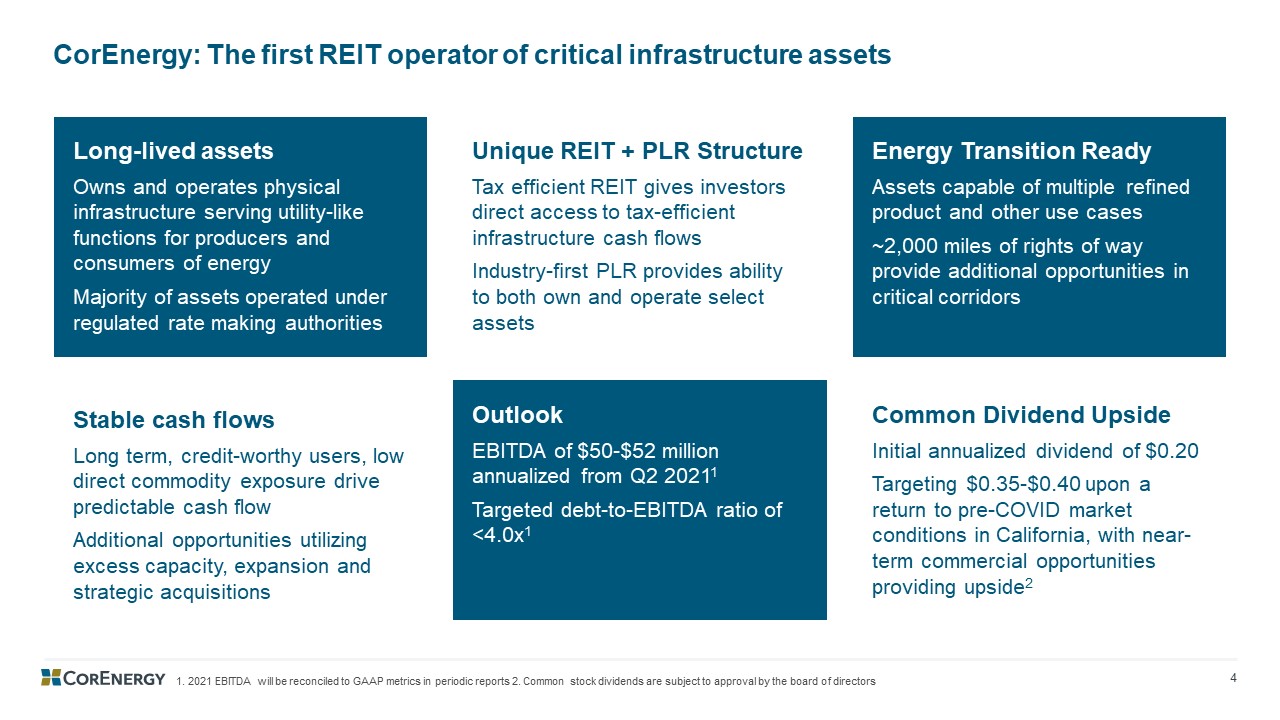

CorEnergy: The first REIT operator of critical infrastructure assets 1. 2021 EBITDA will be

reconciled to GAAP metrics in periodic reports 2. Common stock dividends are subject to approval by the board of directors Long-lived assets Owns and operates physical infrastructure serving utility-like functions for producers and

consumers of energyMajority of assets operated under regulated rate making authorities Stable cash flowsLong term, credit-worthy users, low direct commodity exposure drive predictable cash flowAdditional opportunities utilizing excess

capacity, expansion and strategic acquisitions Unique REIT + PLR StructureTax efficient REIT gives investors direct access to tax-efficient infrastructure cash flowsIndustry-first PLR provides ability to both own and operate select

assets Outlook EBITDA of $50-$52 million annualized from Q2 20211Targeted debt-to-EBITDA ratio of <4.0x1 Common Dividend UpsideInitial annualized dividend of $0.20 Targeting $0.35-$0.40 upon a return to pre-COVID market conditions in

California, with near-term commercial opportunities providing upside2 Energy Transition ReadyAssets capable of multiple refined product and other use cases ~2,000 miles of rights of way provide additional opportunities in critical corridors

Global COVID-19 PandemicUnprecedented simultaneous supply and demand shocks to the energy

industryExtraordinary reductions in energy demand and pricing pressured CORR tenantsExited Troubled Single-Tenant AssetsPinedale LGS – July 2020 – Tenant entered bankruptcy reorganization, significantly reduced reserves valuation. Sold to

bankruptcy estate and fully discharged associated subsidiary secured debtGrand Isle Gathering System – February 2021 – Tenant unable to pay rent due to shut-ins resulting from declines in Gulf oil pricing and record hurricane seasonSold as

part of Crimson transaction funding acquisition of 4 critical infrastructure pipelines suitable for multiple usesBalance Sheet Resiliency CORR’s judicious debt levels and high liquidity allowed it to navigate difficult marketsPositioned the

Company to acquire new, high-quality dividend producing assets Commenced significant business development engagement in June 2020, leading to successful transaction 2020 Challenges and Resiliency

Long-live assets critical to producer and refiner operations with limited direct commodity price

sensitivity.CPUC regulated owner/operator of ~2,000 miles of critical infrastructure pipeline systems across northern, central and southern CaliforniaConnecting desirable native California crude production to in-state refineries producing

state-mandated specialized fuel blendsLong-standing customer relationships with diversified, credit-worthy shippersREIT qualifying under CORR’s PLR Ability to participate in the energy transition via existing assets, acquisitions and rights

of wayExperienced management team with history of of operating assets safely in highly regulated environments 2021 Strategic Transactions with Crimson Midstream

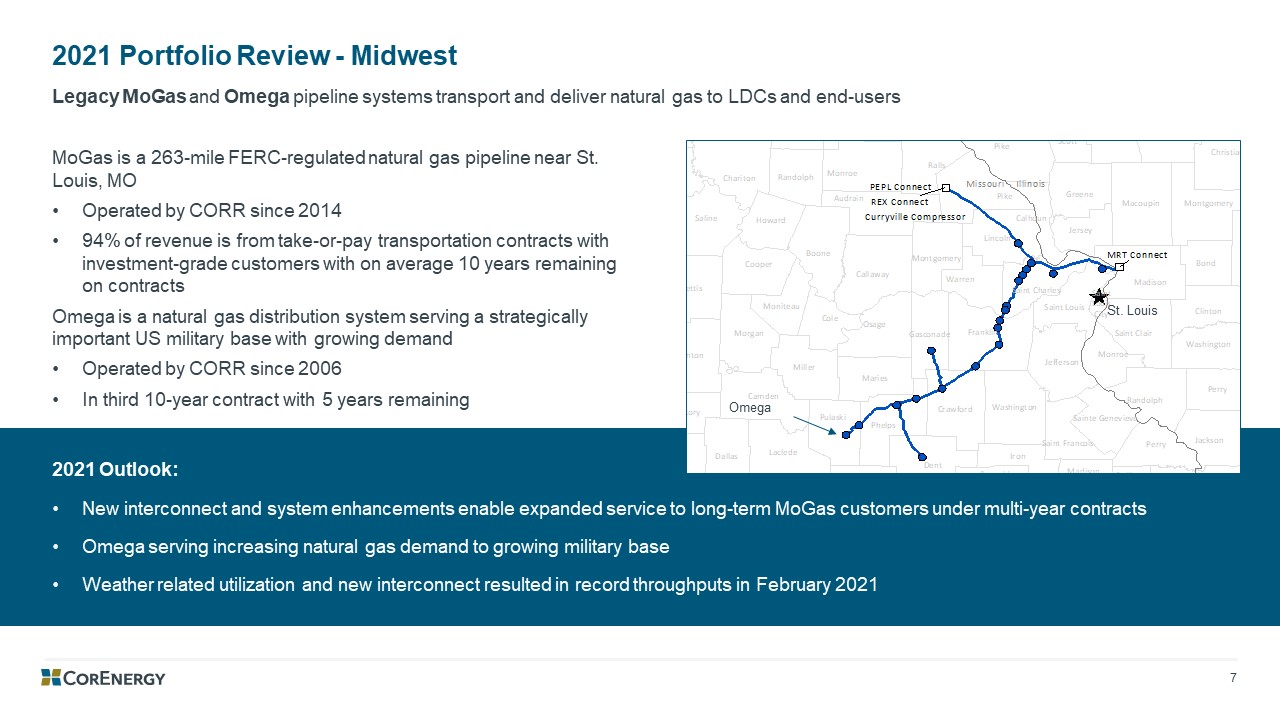

MoGas is a 263-mile FERC-regulated natural gas pipeline near St. Louis, MOOperated by CORR since

201494% of revenue is from take-or-pay transportation contracts with investment-grade customers with on average 10 years remaining on contractsOmega is a natural gas distribution system serving a strategically important US military base with

growing demandOperated by CORR since 2006In third 10-year contract with 5 years remaining Legacy MoGas and Omega pipeline systems transport and deliver natural gas to LDCs and end-users St. Louis Omega 2021 Portfolio Review -

Midwest 2021 Outlook: New interconnect and system enhancements enable expanded service to long-term MoGas customers under multi-year contractsOmega serving increasing natural gas demand to growing military baseWeather related utilization and

new interconnect resulted in record throughputs in February 2021

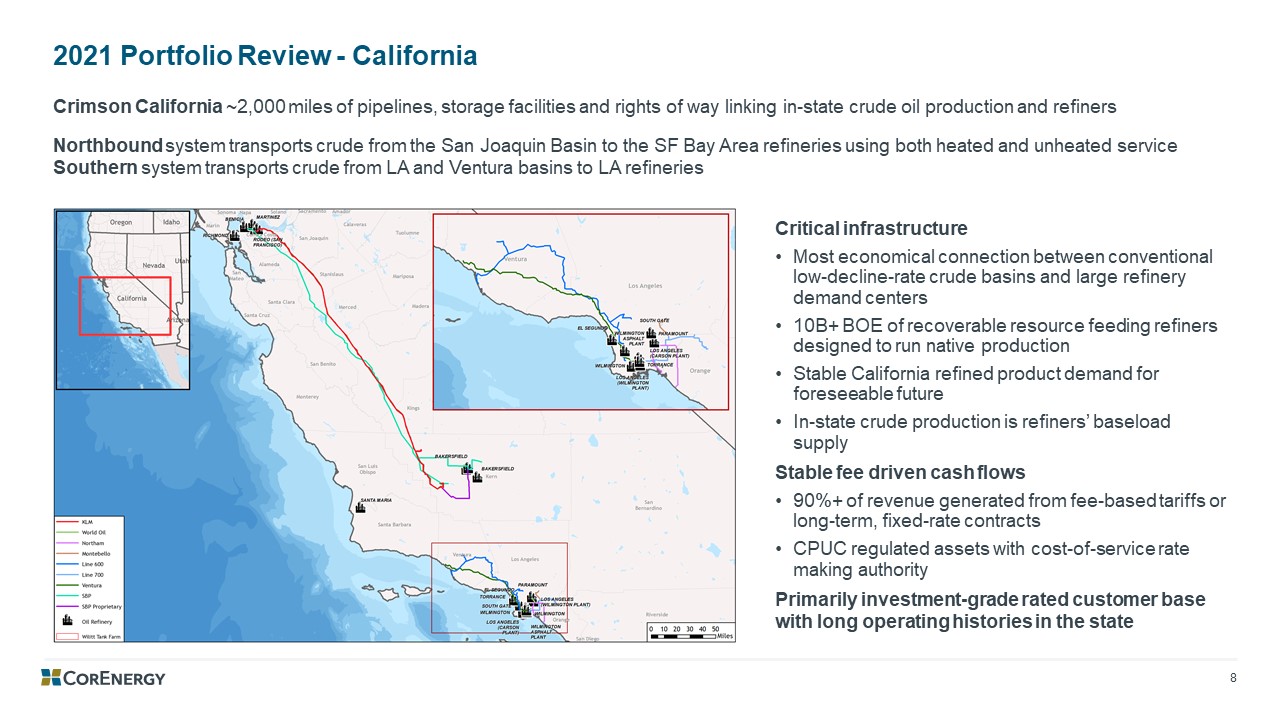

Crimson California ~2,000 miles of pipelines, storage facilities and rights of way linking in-state

crude oil production and refinersNorthbound system transports crude from the San Joaquin Basin to the SF Bay Area refineries using both heated and unheated serviceSouthern system transports crude from LA and Ventura basins to LA

refineries Critical infrastructureMost economical connection between conventional low-decline-rate crude basins and large refinery demand centers10B+ BOE of recoverable resource feeding refiners designed to run native productionStable

California refined product demand for foreseeable future In-state crude production is refiners’ baseload supplyStable fee driven cash flows90%+ of revenue generated from fee-based tariffs or long-term, fixed-rate contractsCPUC regulated

assets with cost-of-service rate making authorityPrimarily investment-grade rated customer base with long operating histories in the state 2021 Portfolio Review - California

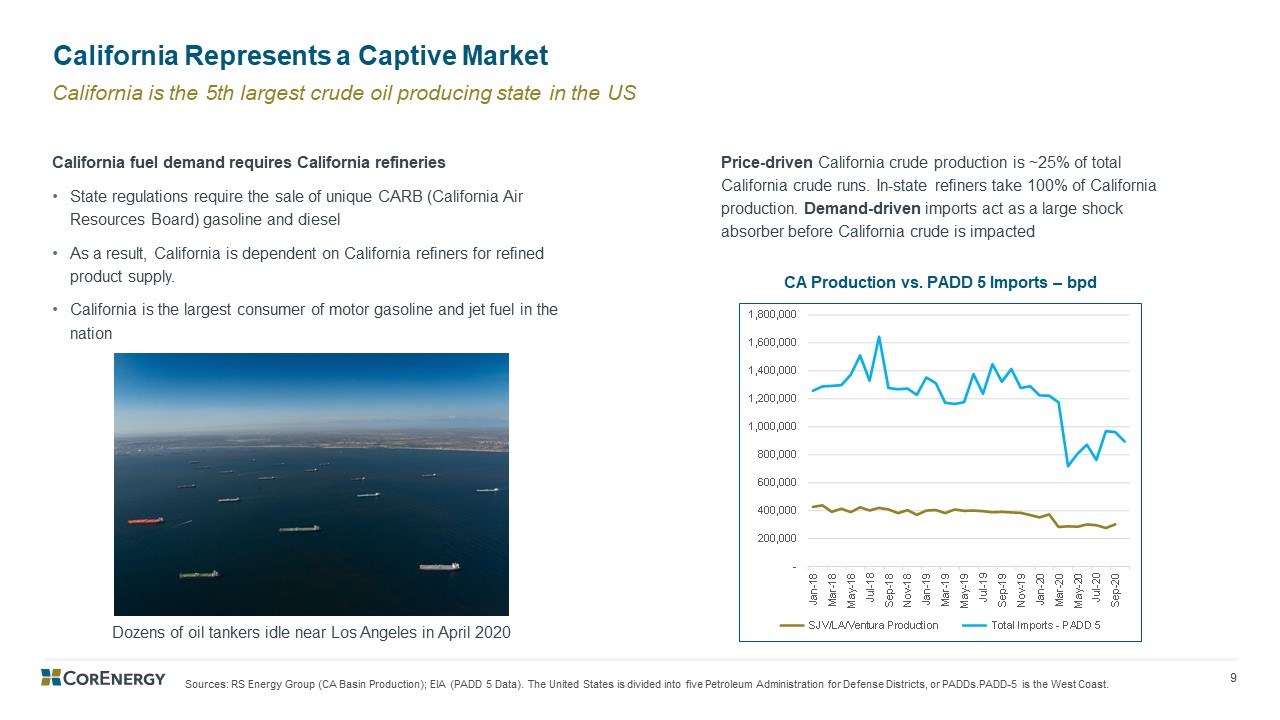

Price-driven California crude production is ~25% of total California crude runs. In-state refiners take

100% of California production. Demand-driven imports act as a large shock absorber before California crude is impacted California fuel demand requires California refineriesState regulations require the sale of unique CARB (California Air

Resources Board) gasoline and dieselAs a result, California is dependent on California refiners for refined product supply. California is the largest consumer of motor gasoline and jet fuel in the nation CA Production vs. PADD 5 Imports –

bpd California is the 5th largest crude oil producing state in the US California Represents a Captive Market Sources: RS Energy Group (CA Basin Production); EIA (PADD 5 Data). The United States is divided into five Petroleum Administration

for Defense Districts, or PADDs.PADD-5 is the West Coast. Dozens of oil tankers idle near Los Angeles in April 2020

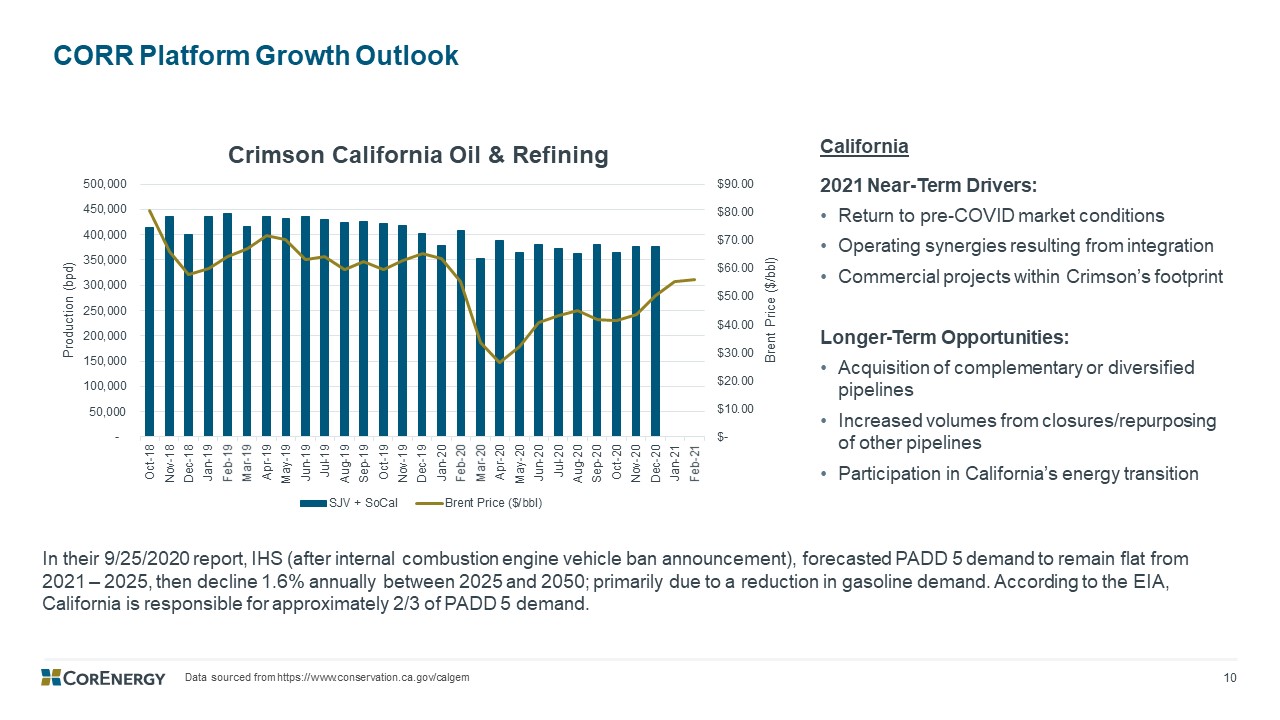

CORR Platform Growth Outlook California2021 Near-Term Drivers: Return to pre-COVID market conditions

Operating synergies resulting from integrationCommercial projects within Crimson’s footprintLonger-Term Opportunities: Acquisition of complementary or diversified pipelines Increased volumes from closures/repurposing of other

pipelinesParticipation in California’s energy transition In their 9/25/2020 report, IHS (after internal combustion engine vehicle ban announcement), forecasted PADD 5 demand to remain flat from 2021 – 2025, then decline 1.6% annually

between 2025 and 2050; primarily due to a reduction in gasoline demand. According to the EIA, California is responsible for approximately 2/3 of PADD 5 demand. Data sourced from https://www.conservation.ca.gov/calgem

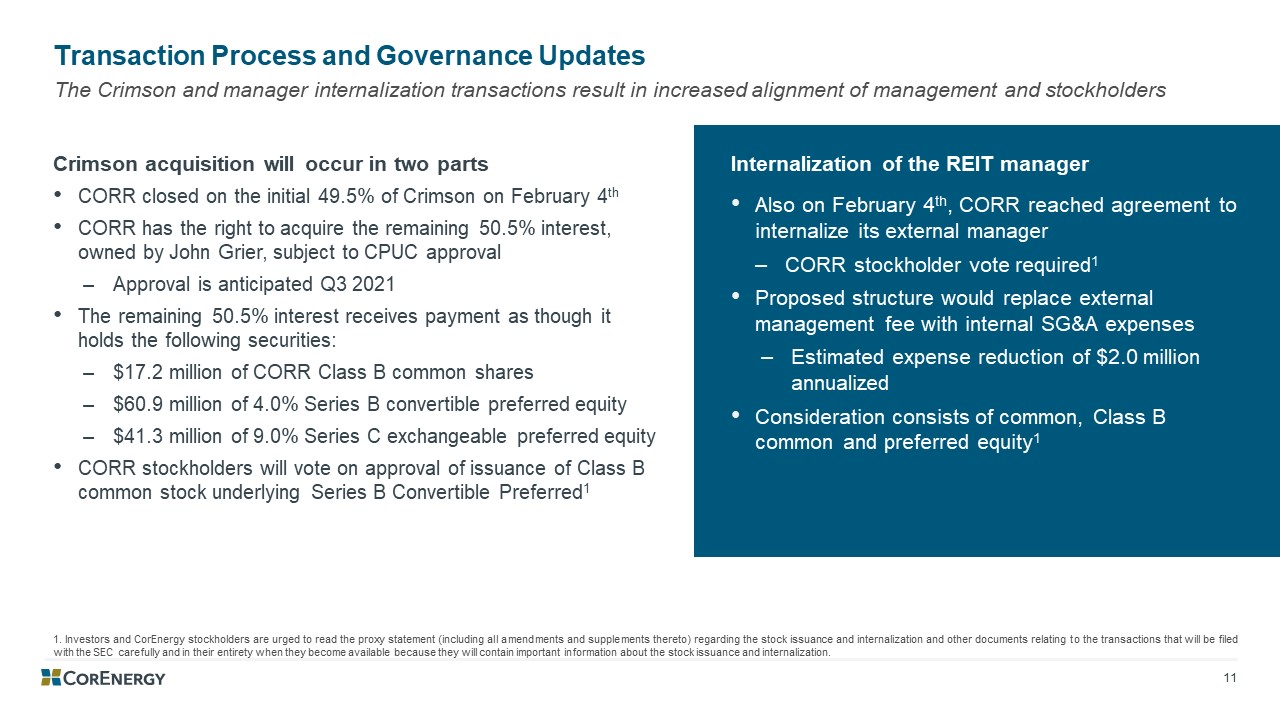

Transaction Process and Governance Updates 1. Investors and CorEnergy stockholders are urged to read

the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they

become available because they will contain important information about the stock issuance and internalization. Internalization of the REIT managerAlso on February 4th, CORR reached agreement to internalize its external managerCORR

stockholder vote required1 Proposed structure would replace external management fee with internal SG&A expensesEstimated expense reduction of $2.0 million annualizedConsideration consists of common, Class B common and preferred

equity1 Crimson acquisition will occur in two partsCORR closed on the initial 49.5% of Crimson on February 4thCORR has the right to acquire the remaining 50.5% interest, owned by John Grier, subject to CPUC approvalApproval is anticipated Q3

2021The remaining 50.5% interest receives payment as though it holds the following securities:$17.2 million of CORR Class B common shares$60.9 million of 4.0% Series B convertible preferred equity $41.3 million of 9.0% Series C exchangeable

preferred equityCORR stockholders will vote on approval of issuance of Class B common stock underlying Series B Convertible Preferred1 The Crimson and manager internalization transactions result in increased alignment of management and

stockholders

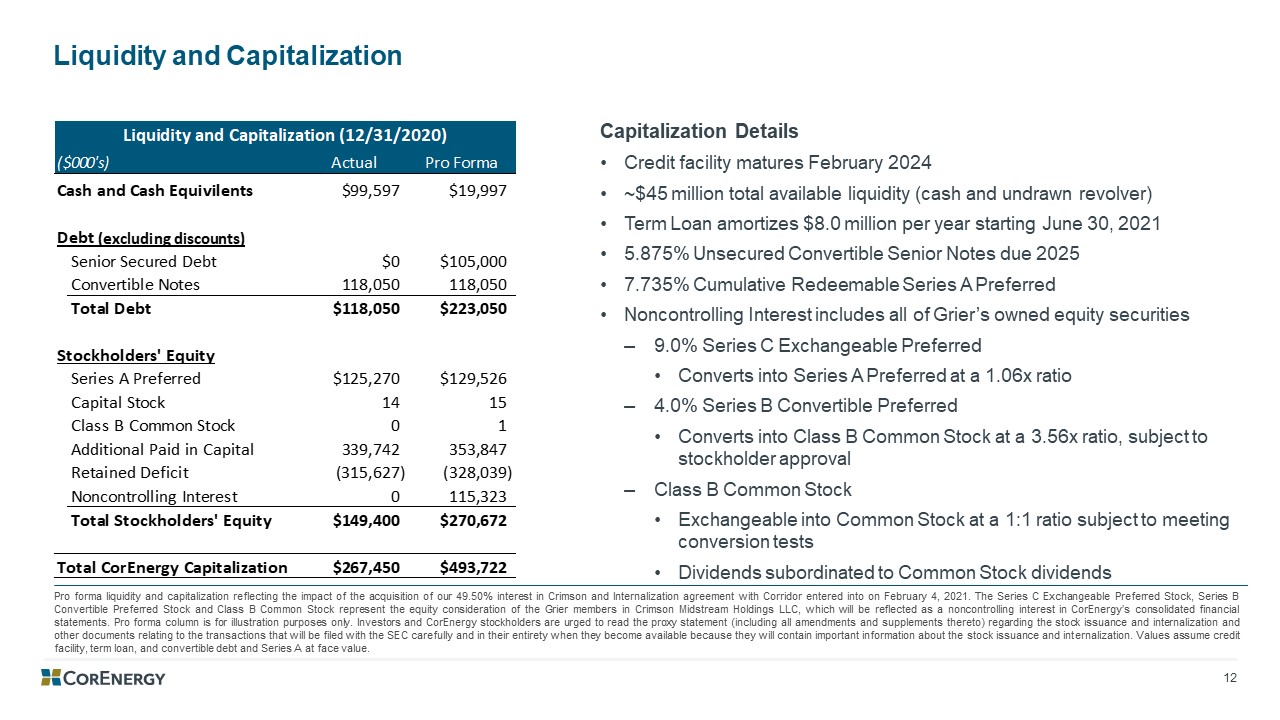

Liquidity and Capitalization Capitalization DetailsCredit facility matures February 2024~$45 million

total available liquidity (cash and undrawn revolver)Term Loan amortizes $8.0 million per year starting June 30, 20215.875% Unsecured Convertible Senior Notes due 20257.735% Cumulative Redeemable Series A Preferred Noncontrolling Interest

includes all of Grier’s owned equity securities9.0% Series C Exchangeable PreferredConverts into Series A Preferred at a 1.06x ratio4.0% Series B Convertible PreferredConverts into Class B Common Stock at a 3.56x ratio, subject to stockholder

approvalClass B Common StockExchangeable into Common Stock at a 1:1 ratio subject to meeting conversion testsDividends subordinated to Common Stock dividends Pro forma liquidity and capitalization reflecting the impact of the acquisition of

our 49.50% interest in Crimson and Internalization agreement with Corridor entered into on February 4, 2021. The Series C Exchangeable Preferred Stock, Series B Convertible Preferred Stock and Class B Common Stock represent the equity

consideration of the Grier members in Crimson Midstream Holdings LLC, which will be reflected as a noncontrolling interest in CorEnergy’s consolidated financial statements. Pro forma column is for illustration purposes only. Investors and

CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed with the SEC

carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. Values assume credit facility, term loan, and convertible debt and Series A at face

value.

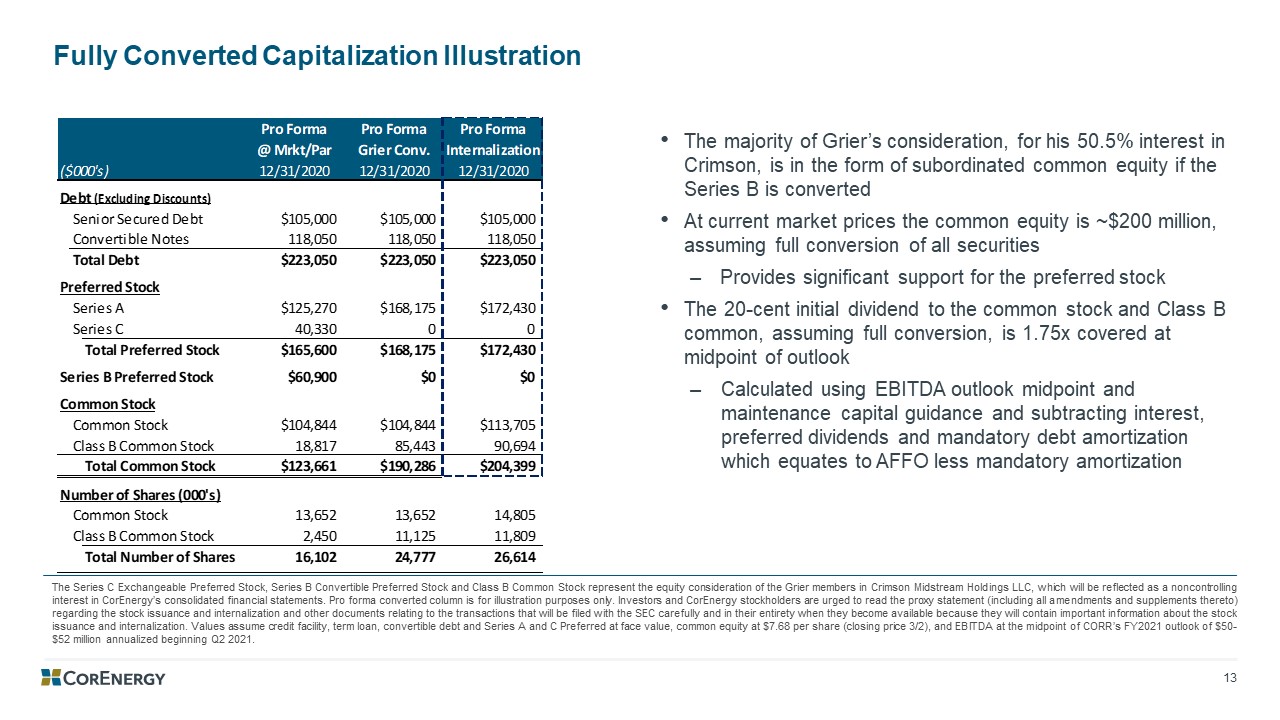

Fully Converted Capitalization Illustration The majority of Grier’s consideration, for his 50.5%

interest in Crimson, is in the form of subordinated common equity if the Series B is convertedAt current market prices the common equity is ~$200 million, assuming full conversion of all securitiesProvides significant support for the

preferred stockThe 20-cent initial dividend to the common stock and Class B common, assuming full conversion, is 1.75x covered at midpoint of outlookCalculated using EBITDA outlook midpoint and maintenance capital guidance and subtracting

interest, preferred dividends and mandatory debt amortization which equates to AFFO less mandatory amortization The Series C Exchangeable Preferred Stock, Series B Convertible Preferred Stock and Class B Common Stock represent the equity

consideration of the Grier members in Crimson Midstream Holdings LLC, which will be reflected as a noncontrolling interest in CorEnergy’s consolidated financial statements. Pro forma converted column is for illustration purposes only.

Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the transactions that will be filed

with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. Values assume credit facility, term loan, convertible debt and Series A and

C Preferred at face value, common equity at $7.68 per share (closing price 3/2), and EBITDA at the midpoint of CORR’s FY2021 outlook of $50-$52 million annualized beginning Q2 2021.

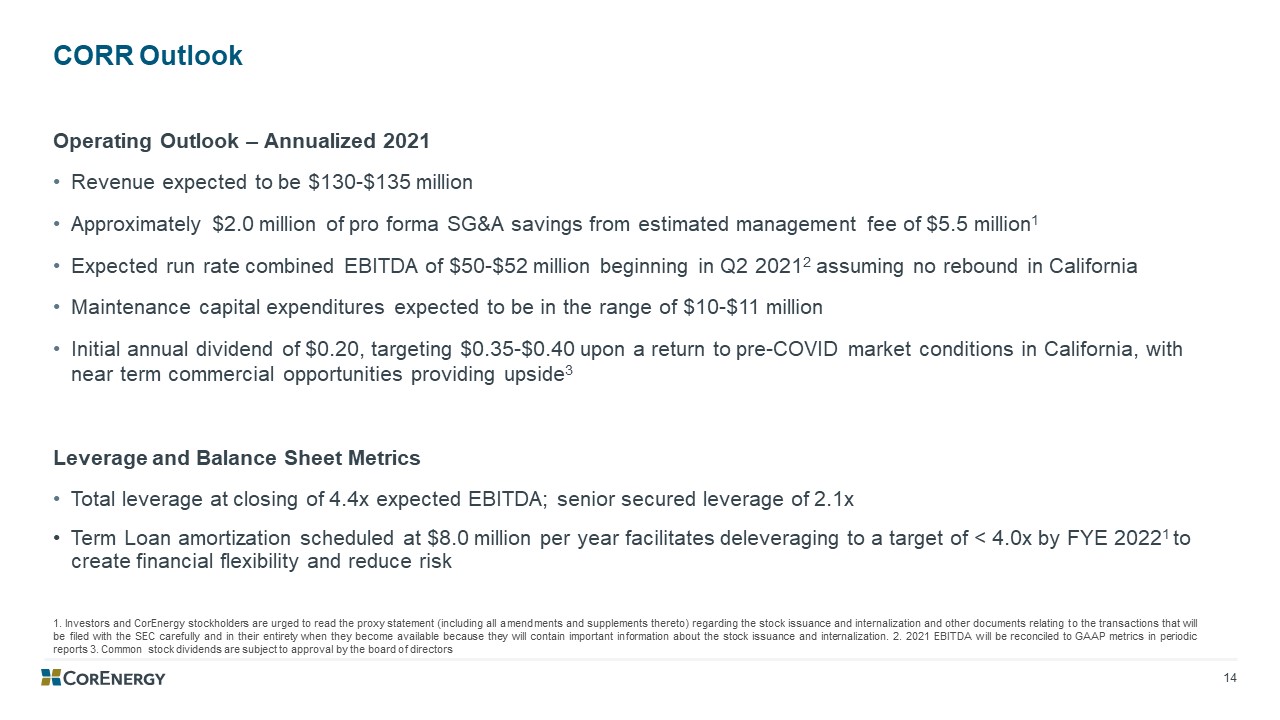

Operating Outlook – Annualized 2021Revenue expected to be $130-$135 millionApproximately $2.0 million

of pro forma SG&A savings from estimated management fee of $5.5 million1 Expected run rate combined EBITDA of $50-$52 million beginning in Q2 20212 assuming no rebound in California Maintenance capital expenditures expected to be in the

range of $10-$11 millionInitial annual dividend of $0.20, targeting $0.35-$0.40 upon a return to pre-COVID market conditions in California, with near term commercial opportunities providing upside3Leverage and Balance Sheet MetricsTotal

leverage at closing of 4.4x expected EBITDA; senior secured leverage of 2.1xTerm Loan amortization scheduled at $8.0 million per year facilitates deleveraging to a target of < 4.0x by FYE 20221 to create financial flexibility and reduce

risk CORR Outlook 1. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization and other documents relating to the

transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. 2. 2021 EBITDA will be reconciled to GAAP

metrics in periodic reports 3. Common stock dividends are subject to approval by the board of directors

ESG Considerations Environmental Safety Stewardship through safety of oil & gas storage and

supplyAnnual investment to maintain integrity of assetsOperate and monitor assets using the latest technologyDetailed and regularly practicedemergency response plansAudit performance and adjust foroptimal safeguardingRegular communications

with allgovernmental respondersWork only with top-tier, proven contractorsTrack asset inspection performance using benchmarking Corporate Governance Proposed shift to internal managerAll committees follow NYSE governance requirements for

independenceBoard committees engage outsideadvisors at company’s expensePolicies in place to identify and avoid conflicts of interestDirector share ownership requiredRisks and mitigant matrixingprior to each investmentCompensation &

successionplanning Social Responsibility Mission #1: No one gets hurt Job creation at competitive pay in multiple statesBuild and maintain local, state, &federal regulatory relationshipsCommunity volunteerism encouraged and

prioritizedCulture of integrity, respect and inclusivity internally & externallyOutreach and community aware-ness programsSponsor of multiple local charitable organizationsSponsor multiple school activities,including sports team and

outings

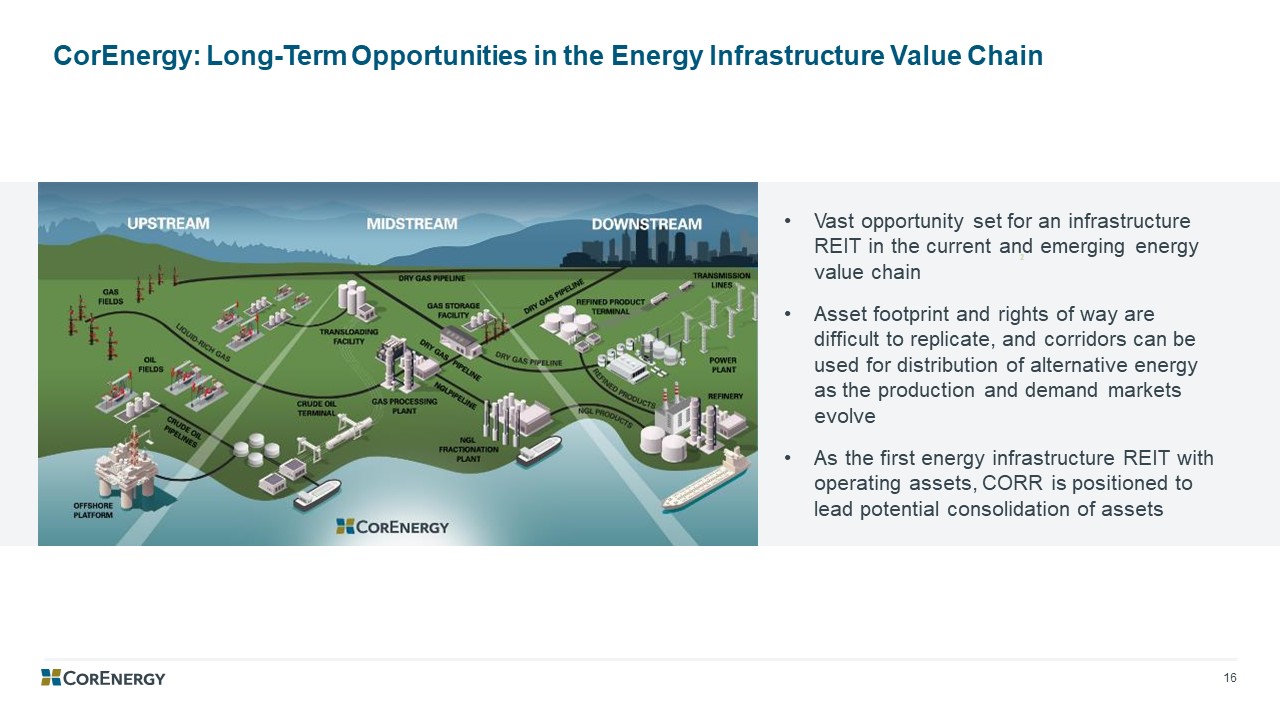

CorEnergy: Long-Term Opportunities in the Energy Infrastructure Value Chain 1 2 Vast opportunity

set for an infrastructure REIT in the current and emerging energy value chainAsset footprint and rights of way are difficult to replicate, and corridors can be used for distribution of alternative energy as the production and demand markets

evolveAs the first energy infrastructure REIT with operating assets, CORR is positioned to lead potential consolidation of assets 3

For additional information: CorEnergy Infrastructure Trust, Inc. Investor RelationsDebbie Hagen or Matt

Kreps877-699-CORR (2677)info@corenergy.reit

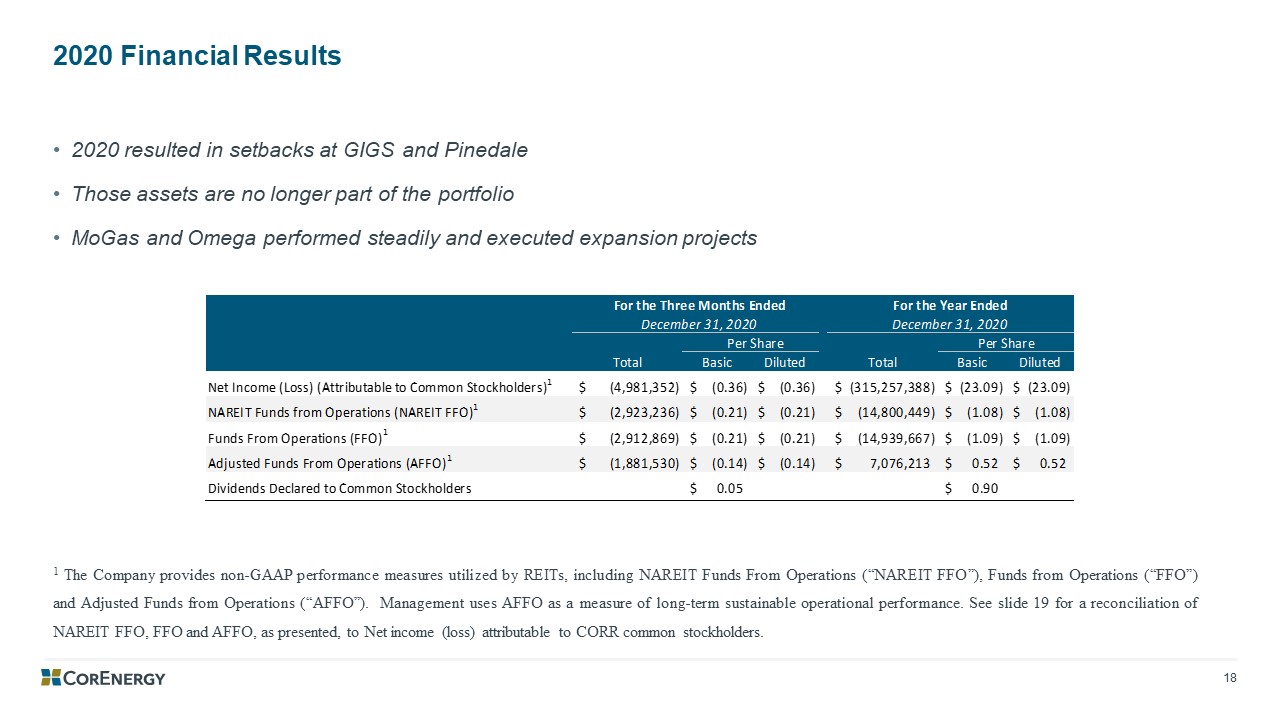

2020 Financial Results 1 The Company provides non-GAAP performance measures utilized by REITs,

including NAREIT Funds From Operations (“NAREIT FFO”), Funds from Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”). Management uses AFFO as a measure of long-term sustainable operational performance. See slide 19 for a

reconciliation of NAREIT FFO, FFO and AFFO, as presented, to Net income (loss) attributable to CORR common stockholders. 2020 resulted in setbacks at GIGS and PinedaleThose assets are no longer part of the portfolioMoGas and Omega performed

steadily and executed expansion projects

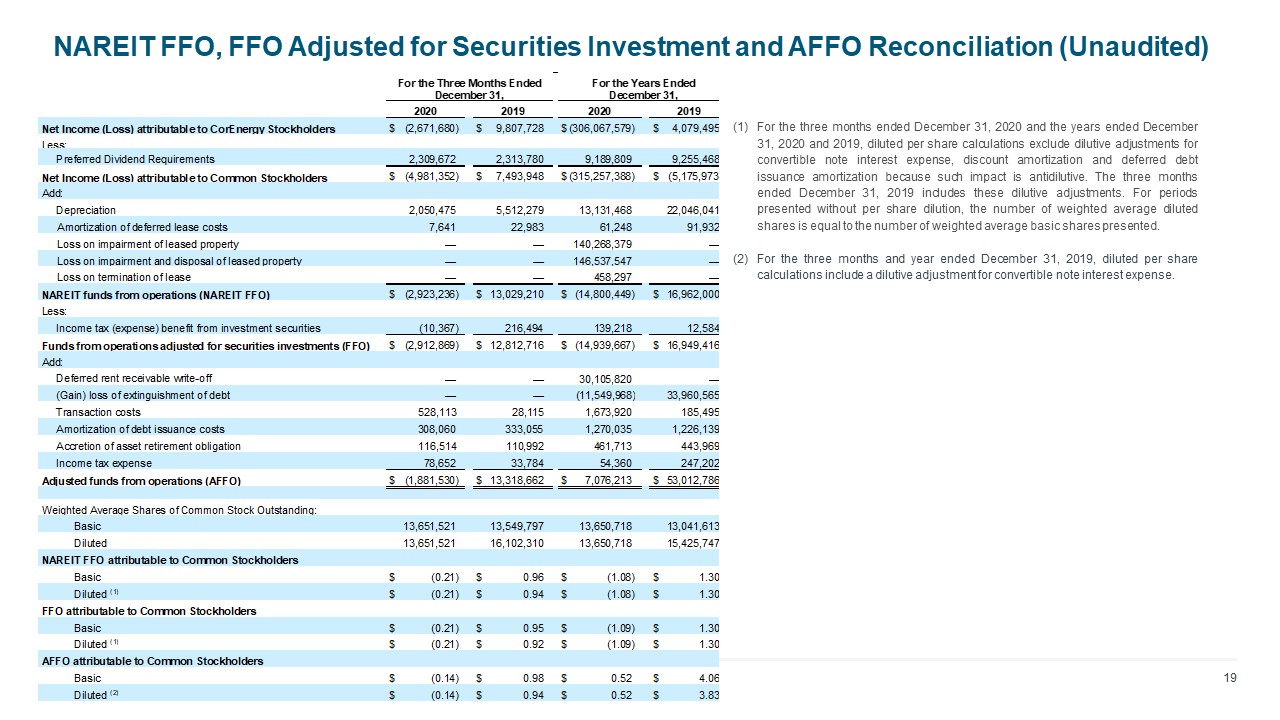

NAREIT FFO, FFO Adjusted for Securities Investment and AFFO Reconciliation (Unaudited) For the three

months ended December 31, 2020 and the years ended December 31, 2020 and 2019, diluted per share calculations exclude dilutive adjustments for convertible note interest expense, discount amortization and deferred debt issuance amortization

because such impact is antidilutive. The three months ended December 31, 2019 includes these dilutive adjustments. For periods presented without per share dilution, the number of weighted average diluted shares is equal to the number of

weighted average basic shares presented. For the three months and year ended December 31, 2019, diluted per share calculations include a dilutive adjustment for convertible note interest expense.

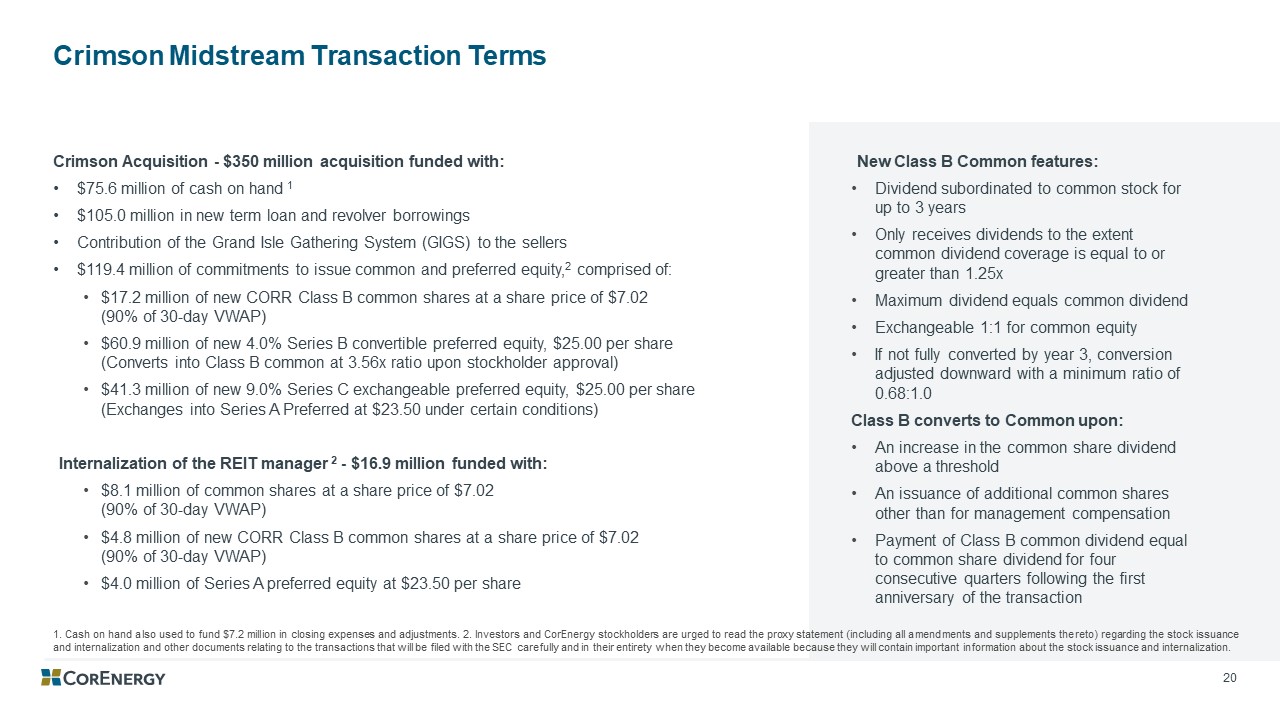

Crimson Midstream Transaction Terms Crimson Acquisition - $350 million acquisition funded with:

$75.6 million of cash on hand 1 $105.0 million in new term loan and revolver borrowings Contribution of the Grand Isle Gathering System (GIGS) to the sellers $119.4 million of commitments to issue common and preferred equity,2 comprised of:

$17.2 million of new CORR Class B common shares at a share price of $7.02 (90% of 30-day VWAP)$60.9 million of new 4.0% Series B convertible preferred equity, $25.00 per share (Converts into Class B common at 3.56x ratio upon stockholder

approval)$41.3 million of new 9.0% Series C exchangeable preferred equity, $25.00 per share (Exchanges into Series A Preferred at $23.50 under certain conditions)Internalization of the REIT manager 2 - $16.9 million funded with: $8.1 million

of common shares at a share price of $7.02 (90% of 30-day VWAP)$4.8 million of new CORR Class B common shares at a share price of $7.02 (90% of 30-day VWAP)$4.0 million of Series A preferred equity at $23.50 per share 1. Cash on hand also

used to fund $7.2 million in closing expenses and adjustments. 2. Investors and CorEnergy stockholders are urged to read the proxy statement (including all amendments and supplements thereto) regarding the stock issuance and internalization

and other documents relating to the transactions that will be filed with the SEC carefully and in their entirety when they become available because they will contain important information about the stock issuance and internalization. New

Class B Common features: Dividend subordinated to common stock for up to 3 yearsOnly receives dividends to the extent common dividend coverage is equal to or greater than 1.25xMaximum dividend equals common dividendExchangeable 1:1 for common

equityIf not fully converted by year 3, conversion adjusted downward with a minimum ratio of 0.68:1.0Class B converts to Common upon: An increase in the common share dividend above a thresholdAn issuance of additional common shares other than

for management compensationPayment of Class B common dividend equal to common share dividend for four consecutive quarters following the first anniversary of the transaction

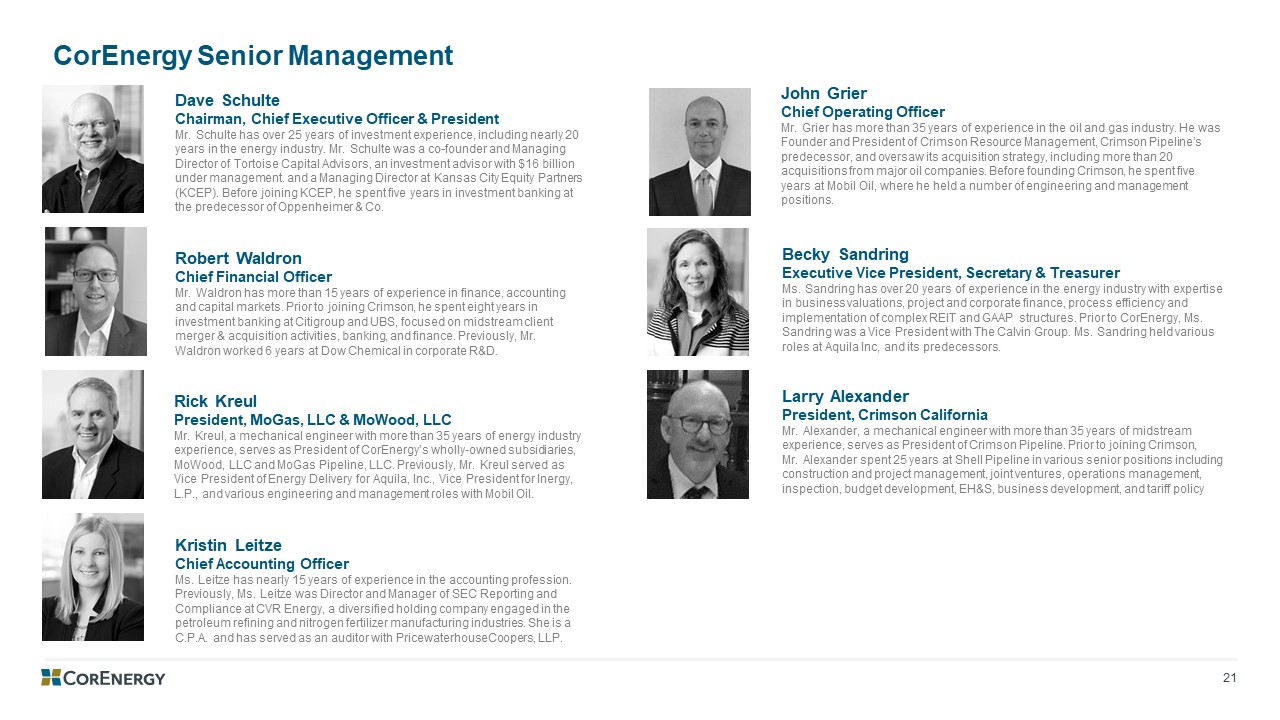

Becky SandringExecutive Vice President, Secretary & TreasurerMs. Sandring has over 20 years of

experience in the energy industry with expertise in business valuations, project and corporate finance, process efficiency and implementation of complex REIT and GAAP structures. Prior to CorEnergy, Ms. Sandring was a Vice President with The

Calvin Group. Ms. Sandring held various roles at Aquila Inc, and its predecessors. Dave SchulteChairman, Chief Executive Officer & PresidentMr. Schulte has over 25 years of investment experience, including nearly 20 years in the energy

industry. Mr. Schulte was a co-founder and Managing Director of Tortoise Capital Advisors, an investment advisor with $16 billion under management. and a Managing Director at Kansas City Equity Partners (KCEP). Before joining KCEP, he spent

five years in investment banking at the predecessor of Oppenheimer & Co. John GrierChief Operating OfficerMr. Grier has more than 35 years of experience in the oil and gas industry. He was Founder and President of Crimson Resource

Management, Crimson Pipeline’s predecessor, and oversaw its acquisition strategy, including more than 20 acquisitions from major oil companies. Before founding Crimson, he spent five years at Mobil Oil, where he held a number of engineering

and management positions. Robert WaldronChief Financial OfficerMr. Waldron has more than 15 years of experience in finance, accounting and capital markets. Prior to joining Crimson, he spent eight years in investment banking at Citigroup

and UBS, focused on midstream client merger & acquisition activities, banking, and finance. Previously, Mr. Waldron worked 6 years at Dow Chemical in corporate R&D. Rick KreulPresident, MoGas, LLC & MoWood, LLCMr. Kreul, a

mechanical engineer with more than 35 years of energy industry experience, serves as President of CorEnergy’s wholly-owned subsidiaries, MoWood, LLC and MoGas Pipeline, LLC. Previously, Mr. Kreul served as Vice President of Energy Delivery

for Aquila, Inc., Vice President for Inergy, L.P., and various engineering and management roles with Mobil Oil. Kristin LeitzeChief Accounting OfficerMs. Leitze has nearly 15 years of experience in the accounting profession. Previously, Ms.

Leitze was Director and Manager of SEC Reporting and Compliance at CVR Energy, a diversified holding company engaged in the petroleum refining and nitrogen fertilizer manufacturing industries. She is a C.P.A. and has served as an auditor with

PricewaterhouseCoopers, LLP. Larry AlexanderPresident, Crimson CaliforniaMr. Alexander, a mechanical engineer with more than 35 years of midstream experience, serves as President of Crimson Pipeline. Prior to joining Crimson, Mr. Alexander

spent 25 years at Shell Pipeline in various senior positions including construction and project management, joint ventures, operations management, inspection, budget development, EH&S, business development, and tariff policy CorEnergy

Senior Management

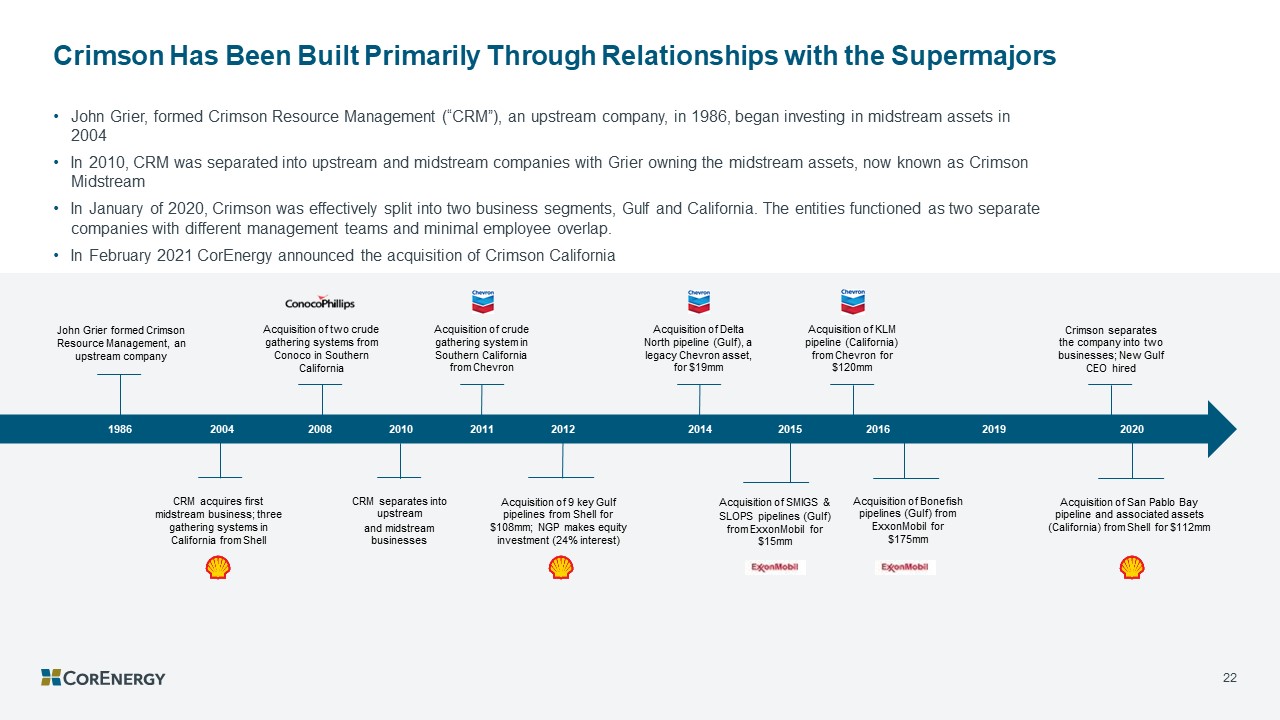

John Grier, formed Crimson Resource Management (“CRM”), an upstream company, in 1986, began investing

in midstream assets in 2004In 2010, CRM was separated into upstream and midstream companies with Grier owning the midstream assets, now known as Crimson MidstreamIn January of 2020, Crimson was effectively split into two business segments,

Gulf and California. The entities functioned as two separate companies with different management teams and minimal employee overlap.In February 2021 CorEnergy announced the acquisition of Crimson California 2016 Crimson Has Been Built

Primarily Through Relationships with the Supermajors 1986 John Grier formed Crimson Resource Management, an upstream company 2008 Acquisition of two crude gathering systems from Conoco in Southern California 2011 Acquisition of crude

gathering system in Southern California from Chevron 2014 Acquisition of Delta North pipeline (Gulf), a legacy Chevron asset, for $19mm Acquisition of KLM pipeline (California) from Chevron for $120mm 2019 Crimson separates the company

into two businesses; New Gulf CEO hired 2004 CRM acquires first midstream business; three gathering systems in California from Shell 2010 CRM separates into upstream and midstream businesses 2012 Acquisition of 9 key Gulf pipelines

from Shell for $108mm; NGP makes equity investment (24% interest) 2015 Acquisition of SMIGS & SLOPS pipelines (Gulf) from ExxonMobil for $15mm Acquisition of Bonefish pipelines (Gulf) from ExxonMobil for $175mm 2020 Acquisition of

San Pablo Bay pipeline and associated assets (California) from Shell for $112mm 22