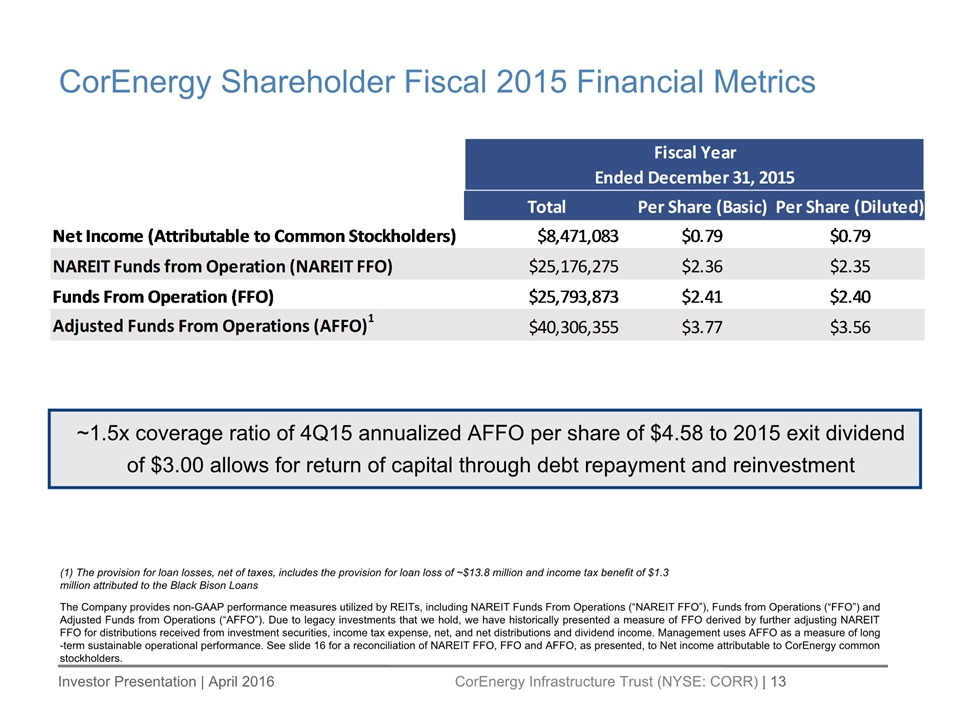

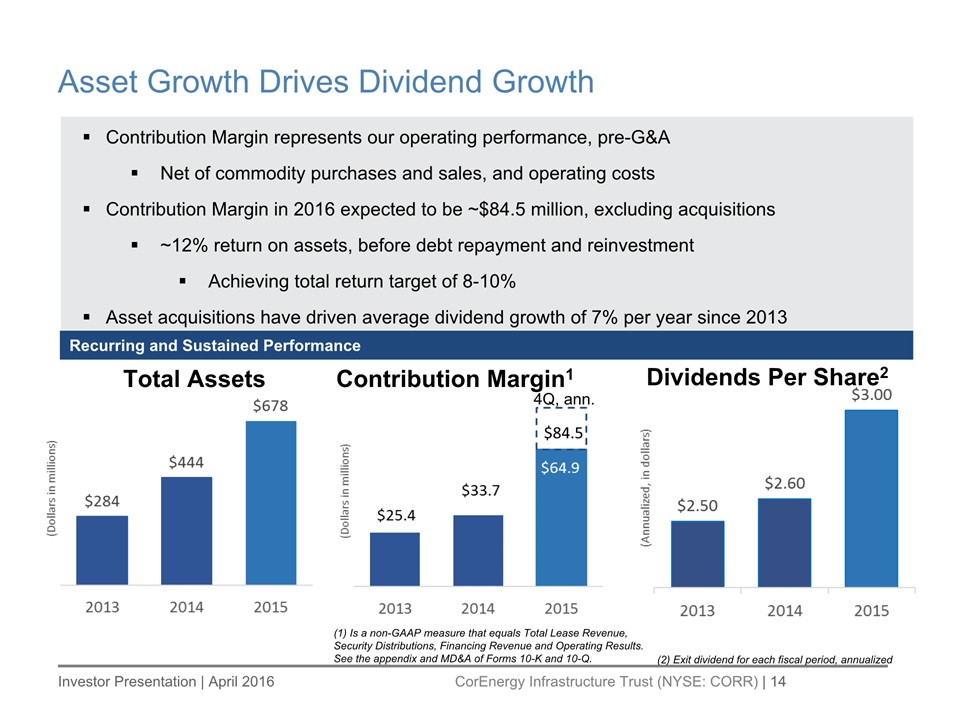

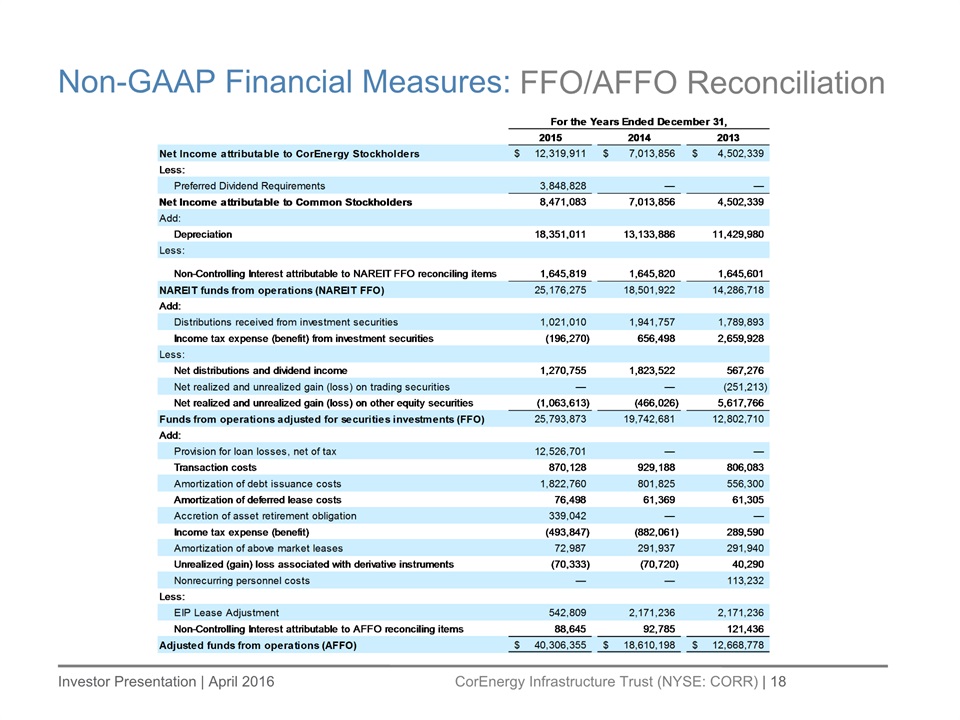

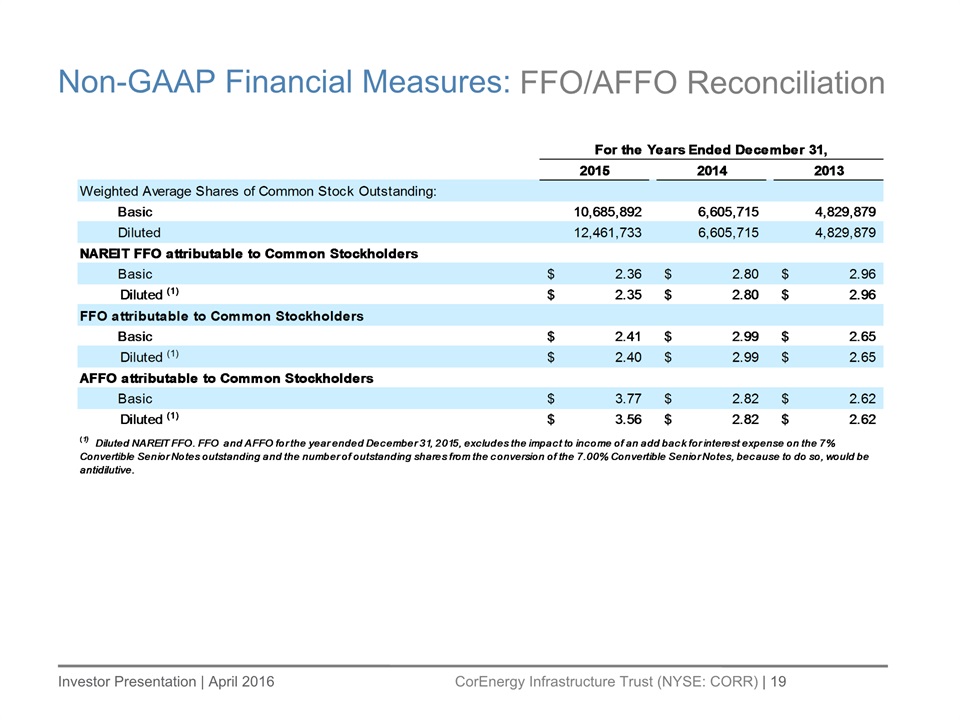

The Company provides non-GAAP performance measures utilized by REITs, including NAREIT Funds From Operations (“NAREIT FFO”), Funds from Operations (“FFO”) and Adjusted Funds from Operations (“AFFO”). Due to legacy investments that we hold, we have historically presented a measure of FFO derived by further adjusting NAREIT FFO for distributions received from investment securities, income tax expense, net, and net distributions and dividend income. Management uses AFFO as a measure of long-term sustainable operational performance. See slide 16 for a reconciliation of NAREIT FFO, FFO and AFFO, as presented, to Net income attributable to CorEnergy common stockholders. CorEnergy Shareholder Fiscal 2015 Financial Metrics (1) The provision for loan losses, net of taxes, includes the provision for loan loss of ~$13.8 million and income tax benefit of $1.3 million attributed to the Black Bison Loans ~1.5x coverage ratio of 4Q15 annualized AFFO per share of $4.58 to 2015 exit dividend of $3.00 allows for return of capital through debt repayment and reinvestment