Exhibit 10.1

Confidential Treatment Requested. Confidential information has been omitted and filed separately with the Securities and Exchange Commission. Confidential treatment has been requested with respect to this omitted information. Omissions are designated as “[Redacted].”

Execution Version

LEASE

between

ENERGY XXI GIGS SERVICES, LLC,

as Tenant,

and

GRAND ISLE CORRIDOR, LP

as Landlord

TABLE OF CONTENTS

|

|

Page

|

|

|

|

|

Article I DEFINITIONS AND Interpretive PROVISIONS

|

1

|

|

|

|

|

1.1

|

Definitions

|

1

|

|

1.2

|

Certain Interpretive Provisions

|

24

|

|

|

|

|

|

Article II Lease Characterization

|

25

|

|

|

|

|

2.1

|

Lease Characterization

|

25

|

|

|

|

|

|

Article III Leased Property

|

27

|

|

|

|

|

3.1

|

Lease of Leased Property

|

27

|

|

3.2

|

Additional Encumbrances

|

28

|

|

3.3

|

Tenant Other Activities

|

29

|

|

|

|

|

|

Article IV Representations and Warranties

|

29

|

|

|

|

|

4.1

|

Representations and Warranties of Landlord

|

29

|

|

4.2

|

Representations and Warranties of Tenant

|

30

|

|

|

|

|

|

Article V Rent

|

31

|

|

|

|

|

5.1

|

Base Rent

|

31

|

|

5.2

|

Account for Payment of Base Rent

|

31

|

|

5.3

|

Payment to Party Claiming Rent

|

32

|

|

5.4

|

Past Due Rent

|

32

|

|

|

|

|

Article VI TAXES and IMPOSITIONS

|

33

|

|

|

|

|

6.1

|

Taxes and Impositions

|

33

|

|

6.2

|

Payment

|

33

|

|

6.3

|

Exclusions from Taxes and Impositions

|

33

|

|

6.4

|

Payment of Taxes and Impositions

|

35

|

|

6.5

|

Abatements

|

35

|

|

6.6

|

Right to Contest Taxes

|

35

|

|

6.7

|

Right to Contest Impositions

|

36

|

|

|

|

|

Article VII Condition of Leased Property; Maintenance

|

36

|

|

|

|

|

7.1

|

Tenant Maintenance of Leased Property

|

36

|

|

7.2

|

No Trespass

|

36

|

|

|

|

|

Article VIII Utilities; Interconnection AGREEMENTS

|

37

|

|

|

|

|

8.1

|

Payment of Utility Charges

|

37

|

|

|

|

|

Article IX Use

|

38

|

|

|

|

|

9.1

|

Tenant Use

|

38

|

TABLE OF CONTENTS

(continued)

|

9.2

|

Operating Requirement

|

38

|

|

|

|

|

Article X PERMITTED CAPITAL IMPROVEMENT AND ADDITIONAL LINES, PARTS AND tenant OTHER ACTIVITIES

|

38

|

|

|

|

|

10.1

|

Permitted Capital Improvements and Additional Lines

|

38

|

|

10.2

|

Replacement of Parts

|

42

|

|

10.3

|

Tenant Other Activities

|

42

|

|

|

|

|

Article XI Regulatory Issues

|

43

|

|

|

|

|

11.1

|

Tenant’s Rights

|

43

|

|

11.2

|

Landlord’s Rights

|

45

|

|

|

|

|

Article XII Mechanic’s Liens

|

45

|

|

|

|

|

12.1

|

Tenant’s Obligations

|

45

|

|

12.2

|

Landlord’s Obligations

|

46

|

|

|

|

|

Article XIII TENANT PROPERTY

|

46

|

|

|

|

|

13.1

|

No Lien

|

46

|

|

13.2

|

Sole Risk of Tenant

|

46

|

|

13.3

|

Tenant’s Ability to Grant Liens on Tenant Property

|

46

|

|

|

|

|

Article XIV Insurance

|

47

|

|

|

|

|

14.1

|

Insurance Coverage

|

47

|

|

14.3

|

Waiver of Subrogation

|

47

|

|

14.4

|

No Release from Liability

|

47

|

|

|

|

|

Article XV Fire and Other Casualty

|

47

|

|

|

|

|

15.1

|

Fire and Other Casualty

|

47

|

|

15.2

|

Restoration Conditions

|

49

|

|

|

|

|

Article XVI Condemnation

|

50

|

|

|

|

|

16.1

|

Condemnation Damages and Awards

|

50

|

|

16.2

|

Apportionment of Award, Termination and Purchase Offer

|

50

|

|

16.3

|

Restoration Conditions

|

52

|

|

|

|

|

Article XVII LIMITS ON TRANSFERS, ASSIGNMENTS, LEASES AND LIENS

|

53

|

|

|

|

|

17.1

|

Assignment and Subletting by Tenant

|

53

|

|

17.2

|

No Restrictions on Indebtedness or Liens of Tenant or Tenant Guarantors

|

55

|

|

17.3

|

Cure Rights Upon Assignee Default

|

55

|

|

17.4

|

Release of Tenant and Tenant Guarantor

|

56

|

|

17.5

|

Transfers and Liens by Landlord and Equity Investors

|

56

|

TABLE OF CONTENTS

(continued)

|

Article XVIII Tenant’s Surrender of Leased Property

|

59

|

|

|

|

|

18.1

|

Surrender

|

59

|

|

|

|

|

Article XIX Assignment of Lease

|

60

|

|

|

|

|

19.1

|

Assignment of Lease

|

60

|

|

|

|

|

Article XX Mortgage Subordination and Non-Disturbance

|

60

|

|

|

|

|

20.1

|

Mortgage Subordination

|

60

|

|

|

|

|

Article XXI Indemnification

|

61

|

|

|

|

|

21.1

|

Indemnification by Tenant

|

61

|

|

21.2

|

Release and Indemnification by Landlord

|

62

|

|

21.3

|

Concurrent Negligence

|

63

|

|

21.4

|

Survival

|

63

|

|

21.5

|

Claims Procedure

|

63

|

|

|

|

|

Article XXII Environmental Laws

|

64

|

|

|

|

|

22.1

|

Environmental Undertakings

|

64

|

|

22.2

|

Environmental Covenants

|

64

|

|

22.3

|

Tenant Environmental Indemnity

|

65

|

|

22.4

|

Landlord Environmental Indemnity

|

66

|

|

22.5

|

Claims Procedure

|

66

|

|

22.6

|

Survival

|

67

|

|

|

|

|

Article XXIII DefaultS AND REMEDIES

|

67

|

|

|

|

|

23.1

|

Tenant Events of Default

|

67

|

|

23.2

|

Landlord’s Remedies for a Tenant Event of Default

|

68

|

|

23.3

|

Landlord Events of Default

|

72

|

|

23.4

|

Tenant’s Remedies for a Landlord Event of Default

|

74

|

|

23.5

|

Mitigation of Damages

|

75

|

|

|

|

|

Article XXIV Notice

|

75

|

|

|

|

|

24.1

|

Notices

|

76

|

|

24.2

|

Deemed Receipt

|

77

|

|

24.3

|

Delivery; Time of Notice

|

77

|

|

|

|

|

Article XXV RENEWAL AND End of Term Options, Right of First Refusal, and other Preferential Purchase Rights

|

77

|

|

|

|

|

25.1

|

Renewal Option

|

77

|

|

25.2

|

Tenant as Operator After Term

|

80

|

|

25.3

|

Right of First Refusal With Respect to the Transfer of All of the Leased Property

|

80

|

|

25.4

|

Right of First Refusal With Respect to a Landlord Lease Transaction

|

84

|

|

25.5

|

Application of Certain Right of First Refusal Rights to a Foreclosure Sale

|

86

|

TABLE OF CONTENTS

(continued)

|

Article XXVI Miscellaneous Provisions

|

86

|

|

|

|

|

26.1

|

Memorandum/Notice of Lease

|

86

|

|

26.2

|

Force Majeure

|

86

|

|

26.3

|

Consequential Damages

|

86

|

|

26.4

|

Holding Over

|

86

|

|

26.5

|

Quiet Enjoyment

|

87

|

|

26.6

|

Cost and Expense

|

87

|

|

26.7

|

Access; Reporting

|

87

|

|

26.8

|

Accord and Satisfaction

|

90

|

|

26.9

|

Prevailing Party

|

90

|

|

26.10

|

Confidentiality

|

90

|

|

26.11

|

Consent of Landlord and Tenant

|

91

|

|

26.12

|

Permitted Tenant Contests

|

92

|

|

26.13

|

Waiver

|

92

|

|

26.14

|

Interpretation

|

92

|

|

26.15

|

No Derivative Liability

|

93

|

|

26.16

|

Successors and Assigns

|

93

|

|

26.17

|

No Offer; Entire Agreement

|

93

|

|

26.18

|

Headings

|

93

|

|

26.19

|

Counterparts

|

93

|

|

26.20

|

Governing Law; Venue; Service of Process; Waiver of Jury Trial

|

94

|

|

26.21

|

Time of the Essence

|

94

|

|

26.22

|

Estoppel Certificates

|

94

|

|

|

|

|

Article XXVII Other Agreements of Landlord

|

95

|

|

|

|

|

27.1

|

Landlord Covenants

|

95

|

|

|

|

|

Article XXVIII Other Agreements of tenant

|

96

|

EXHIBITS

|

Exhibit A

|

Base Oil Revenue and Minimum Rent

|

|

Exhibit B

|

Right of Use Agreements

|

|

Exhibit C

|

Improvements

|

|

Exhibit D

|

Interconnection Agreements

|

|

Exhibit E

|

Landlord Guaranty

|

|

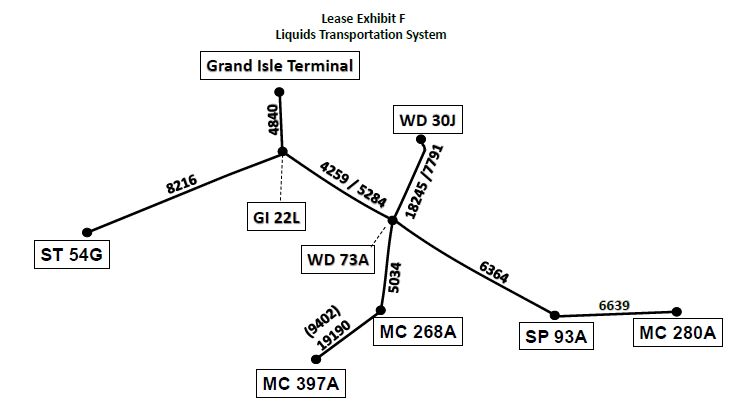

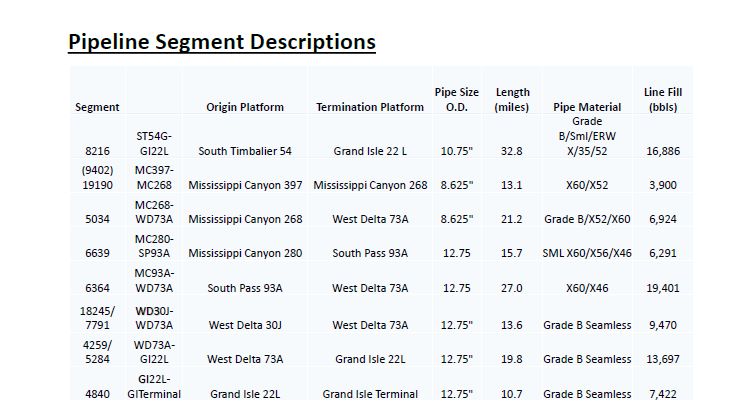

Exhibit F

|

Liquids Transportation System

|

|

Exhibit G

|

LTS Land

|

|

Exhibit H

|

Multi-Platform Access Agreement

|

|

Exhibit I

|

Notice of Lease

|

|

Exhibit J

|

Form of O&M Agreement

|

|

Exhibit K

|

SNDA

|

|

Exhibit L

|

Tenant Guaranty

|

|

Exhibit M

|

Protective Mortgage

|

|

Exhibit N

|

Insurance

|

|

Exhibit O

|

Form of Tenant Estoppel Certificate

|

|

Exhibit P

|

Form of Landlord Estoppel Certificate

|

|

Exhibit Q

|

Tenant’s Governing Documents

|

LEASE

This Lease (as amended, restated, replaced, supplemented, or otherwise modified from time-to-time, this “Lease”) is dated as of June 30, 2015 (the “Effective Date”) and is made by and between:

Landlord: GRAND ISLE CORRIDOR, LP, a Delaware limited partnership

and

Tenant: ENERGY XXI GIGS SERVICES, LLC, a Delaware limited liability company

RECITALS

A. Effective as of 11:59 p.m. on the Effective Date, EXXI USA sold the Leased Property to Landlord.

B. Landlord desires to lease the Leased Property to Tenant, and Tenant desires to lease the Leased Property from Landlord, in accordance with the terms and conditions of this Lease.

AGREEMENT

In consideration of the rents and the other terms, covenants and conditions set forth in this Lease, Landlord leases to Tenant and Tenant leases from Landlord all of Landlord’s rights, title, and interests in and to the Leased Property (defined below) upon the following terms and conditions:

ARTICLE I

DEFINITIONS AND INTERPRETIVE PROVISIONS

1.1 Definitions. For all purposes of this Lease, except as may be expressly set forth herein or unless the context clearly indicates a contrary intent, the following terms have the following definitions:

“Actual Knowledge” means (a) with respect to any EXXI Entity Person, as of any date, the then-current actual knowledge of the Chief Accounting Officer, Chief Operating Officer, Chief Financial Officer, and Senior Vice President (Legal) of EXXI Parent, or, if the title of any such officer changes, an officer of EXXI Parent with an equivalent title, as of such date, and not any implied, imputed or constructive knowledge of such individuals, and without any independent investigation or inquiry having been made or any implied duty to investigate, make any inquiries or review any information, (b) with respect to Grand Isle Corridor, as of any date, the then-current actual knowledge of the Chairman of the Board, Chief Executive Officer and Chief Accounting Officer of CorEnergy, or, if the title of any such officers changes, an officer of CorEnergy with an equivalent title, as of such date, and not any implied, imputed or constructive knowledge of such individuals, and without any independent investigation or inquiry having been made or any implied duty to investigate, make any inquiries or review any information, and

(c) with respect to any other Person, as of any date, the then-current actual knowledge of the Responsible Officers of such Person as of such date, and not any implied, imputed or constructive knowledge of such individuals, and without any independent investigation or inquiry having been made or any implied duty to investigate, make any inquiries or review any information. The foregoing qualification of Actual Knowledge shall in no event give rise to any personal liability on the part of any such Person or any other officer or employee of such Party or its Affiliates on account of any breach hereunder.

“Actual Oil Price” means the average of the following price for each day (excluding weekends and holidays) of any calendar month or portion thereof during the Term: the OIL-ICE-BRENT price per barrel of Brent crude oil published by the Intercontinental Exchange (“ICE”) of the “First Nearby Month Futures Contract” for delivery on such day, stated in U.S. dollars and rounded to three (3) decimal places, as published by ICE such day (or, if such price is not available for any particular trading day, an alternative reference price for Brent crude oil, as agreed upon by the Parties, acting reasonably).

“Actual Oil Revenue” means, for any calendar month or portion thereof during the Term, Actual Oil Volume multiplied by Actual Oil Price.

“Actual Oil Volume” means, for any calendar month or portion thereof during the Term, the total volume (bbls) of oil produced by or on behalf of Tenant or any of its Affiliates physically transported through the Liquids Transportation System, measured by the Lease Automatic Custody Transfer unit meter located at ExxonMobil Pipeline Company’s Grand Isle Station (or, if such meter is not available for such purpose, at such point as the Parties agree, acting reasonably). For the avoidance of doubt, Actual Oil Volume shall include the oil physically transported through the Liquids Transportation System that is produced by or on behalf of Tenant or its Affiliates (but shall not include any volumes produced by or on behalf of owned by third parties), including any oil produced by or on behalf of by Tenant or its Affiliates received into the Liquids Transportation System from Additional Lines, if any, even if such Additional Lines do not become part of the Leased Property as provided in Section 10.1.

“Additional Lines” means such additional easements and rights of way and such additional pipelines (including gathering lines, distribution, or sales lines) and appurtenances that connect to the Leased Property but that are, in all cases, either upstream or downstream of the Liquids Transportation System, as Tenant may from time-to-time desire or be required to use, acquire or make.

“Additional Rent” means all amounts, costs, expenses, Losses, liabilities, indemnities and other monetary obligations (including Tenant’s obligation to pay any interest at the Default Interest Rate hereunder) which Tenant is required to pay pursuant to the terms of this Lease, other than Base Rent.

“Adverse Party” means, as of any date, (a) any Person who (i) is a substantial investor in Tenant or any Affiliate of Tenant, and (ii) has a pending proposal to merge with, acquire or takeover Tenant or any Affiliate of Tenant, which merger, acquisition or other takeover shall not have been approved by the board of directors of Tenant or such Affiliate, or otherwise be perceived by Tenant or such Affiliate to be hostile to the management of Tenant or such

Affiliate, (b) any Affiliate of each Person in subsection (a), and (c) any Person that has a net short position with respect to at least one-half of one percent (0.5%) of, or has, within the last twelve (12) months, made public adverse comments about, the stock of Tenant Guarantor or any Affiliate of Tenant. Within ten (10) Business Days after written request therefor from Landlord, Tenant shall advise Landlord if a Person(s) named by Landlord in such notice is an Adverse Party within the scope of this definition.

“Affiliate” has the meaning ascribed to such term in Rule 12b-2 of the General Rules and Regulations under the Exchange Act and, with respect to a Person, includes any Subsidiary of that Person.

“Aggregate Minimum Rent” has the meaning given in Section 23.2(a)(i)(E).

“Agreed FMV Rent” has the meaning given in Section 25.1(b).

“Applicable Legal Requirements” mean all statutes, ordinances, regulations, procedures and codes of any Governmental Authority having jurisdiction, including, without limitation, zoning, health, fire, safety and building codes, applicable to the Leased Property (or portion thereof at issue), applicable to Tenant (with respect only to Tenant’s (rather than Landlord’s) obligations hereunder regarding compliance with Applicable Legal Requirements), or applicable to Landlord (with respect only to Landlord’s (rather than Tenant’s) obligations hereunder regarding compliance with Applicable Legal Requirements).

“Auditor’s Report” means, with respect to financial statements or information of Tenant Guarantor or Tenant required to be delivered pursuant to Section 26.7(b)(ii), (a) the written report of the auditor for Tenant Guarantor or Tenant, as applicable, with respect to such financial statements or information (excluding any auditor’s report on internal controls), manually executed by such auditor, and (b) a manually executed consent of such auditor to the inclusion of such auditor’s report (and any auditor consent with respect thereto) in filings to be made by Landlord or Landlord Guarantor with the Securities and Exchange Commission.

“Base Oil Revenue” means for each calendar month during the Initial Term, the amount specified for such month on Exhibit A, prorated for any partial calendar month during the Initial Term.

“Base Rent” means (a) during the Initial Term, for any calendar month (or portion thereof) during the Initial Term, Minimum Rent plus Variable Rent for such calendar month (or portion thereof), and (b) during the Renewal Term, the amount determined pursuant to Section 25.1 hereof.

“Beneficial Owner” a Person (“such Person”) shall be deemed the “Beneficial Owner” of, and shall be deemed to “beneficially own” and have “beneficial ownership of,” any equity interests or other securities which:

(a) such Person or any of such Person’s Affiliates, directly or indirectly, has the right to acquire (whether such right is exercisable immediately or only after the passage of time) pursuant to any agreement, arrangement or understanding (whether or not in writing) or upon the exercise of conversion rights, exchange rights, rights, warrants or options, or otherwise;

(b) such Person or any of such Person’s Affiliates, directly or indirectly, has the right to vote or dispose of or has “beneficial ownership” of (as determined pursuant to Rule 13d-3 of the General Rules and Regulations under the Exchange Act), including pursuant to any agreement, arrangement or understanding, whether or not in writing; provided, however, that such Person shall not be deemed the “Beneficial Owner” of, or to “beneficially own,” any equity interest or other security under this subsection (b) as a result of an agreement, arrangement or understanding to vote such equity interest or other security if such agreement, arrangement or understanding: (i) arises solely from a revocable proxy given in response to a public proxy or consent solicitation made pursuant to, and in accordance with, the applicable provisions of the General Rules and Regulations under the Exchange Act, and (ii) is not also then reportable by such Person on a Schedule 13D under the Exchange Act (or any comparable or successor report); or

(c) are “beneficially owned,” directly or indirectly, by any other Person (or any Affiliate thereof) with which such Person (or any of such Person’s Affiliates) has any agreement, arrangement or understanding (whether or not in writing), for the purpose of acquiring, holding, voting (except pursuant to a revocable proxy as described in the proviso to subsection (b) above) or disposing of any voting equity interests or other securities;

provided, however, that (A) if such Person is engaged in business as an underwriter of securities such Person shall not be deemed the “Beneficial Owner” of or to “beneficially own” any securities acquired through such Person’s participation in good faith in a firm commitment underwriting, (B) the existence of rights of first bid, rights of first refusal, pre-emptive rights, drag-along rights, tag-along rights or other similar rights, if any, set forth in the Landlord’s Governing Documents shall not themselves cause such Person to be deemed the Beneficial Owner of Landlord Equity Interests held by one or more other Equity Investors, (C) such Person shall not be deemed the “Beneficial Owner” of or to “beneficially own” any securities solely by virtue of holding a lien on such securities to secure Indebtedness, and (D) such Person shall be deemed to be a “Beneficial Owner” of or to “beneficially own” any securities, whether or not publicly traded, only if such Person owns more than ten percent (10%) of all such securities outstanding.

“BOEM” means the Bureau of Ocean Energy Management, an agency within the U.S. Department of the Interior.

“BSEE” means the Bureau of Safety and Environmental Enforcement, an agency within the U.S. Department of the Interior.

“Business Day” means any day that is not a Saturday, Sunday or other day on which commercial banks in New York, New York or Houston, Texas, are authorized or required by law to remain closed. If the last day of any time period under this Lease, or the last day for performance of any obligation, or for giving any notice, or for taking any other action under this Lease falls on a day that is not a Business Day, then the last day of such time period shall be extended to the first day thereafter that is a Business Day.

“Capital Improvements” means such alterations, additions and replacements to any of the Improvements or Personal Property as Tenant may from time-to-time desire or be required to make.

“Casualty Date” means the date fire or other casualty damages any portion of the Leased Property.

“Casualty Proceeds” means the insurance proceeds actually received by, or that the insurer has agreed in writing are payable to, Tenant with respect to a fire or other casualty of the Leased Property, but excluding from such insurance proceeds (a) Tenant’s reasonable third party costs and expenses (including reasonable attorneys’ fees and expenses) incurred in collecting same, (b) as of any date, proceeds previously paid to Tenant and used to repair, restore, replace, or remediate (as to environmental matters) the Leased Property as a result of such fire or other casualty, and (c) the proceeds of any business interruption or similar insurance with respect to such fire or other casualty.

“Casualty Response Notice” has the meaning assigned to such term in Section 15.1(c).

“Casualty Termination Date” has the meaning assigned to such term in Section 15.1(d).

“Code” means Title 11 of the United States Code, 11 U.S.C. Sec. 101 et seq., as amended.

“Competitor” means, as of any date, (a) any Person engaged in the business of exploration and/or production of oil or gas, and (b) any Affiliate of such Person.

“Confidential Information” means (a) all Proprietary Information, and (b) all other information furnished to Landlord by or on behalf of Tenant, Tenant Guarantor or any of their respective Affiliates prior to, on or after the Effective Date and designated as confidential. Notwithstanding the foregoing, Confidential Information shall not include information that is publicly available other than as a result of actions in violation of Section 26.10 hereof.

“Control” or any derivation thereof has the meaning set forth in Rule 12b-2 under the Exchange Act. “Controlling” and “Controlled” have meanings correlative thereto.

“CorEnergy” means CorEnergy Infrastructure Trust, Inc., a Maryland corporation.

“Corrective Action” means any investigation, study, assessment, evaluation, sampling, testing, monitoring, containment, response or response action, removal or removal action, disposal, closure, corrective action, remediation or remedial action (regardless of whether active or passive), natural attenuation, restoration, bioremediation, response, repair, corrective measure, cleanup, or abatement that is required under any Environmental Law.

“Current Lease Term End” means the end of the then-current Term assuming that this Lease will not be renewed at the end thereof.

“Debtor Relief Law” means the Code and all other liquidation, conservatorship, bankruptcy, assignment for the benefit of creditors, moratorium, rearrangement, receivership,

insolvency, reorganization, or similar debtor relief laws of the United States of America or other applicable jurisdictions from time-to-time in effect and affecting the rights of creditors generally.

“Default Interest Rate” means, for any period, (a) with respect to any obligation of any Tenant, Tenant Guarantor, or their respective Affiliates hereunder, if, as of the date of such Tenant’s acquisition of the leasehold estate under this Lease, either such Tenant or Tenant Guarantor is an Investment Grade Person, the lesser of (A) the annual rate of two percent (2%) over the average base, non-default rate of interest for such period (and without imputation of any gross-up components or default interest), under such Person’s Indebtedness which is Material Debt and which is held by a third party not an Affiliate of such Person, or, if such Person does not have any such Material Debt, then the Prime Rate for such period, and (B) the highest rate permitted by Applicable Legal Requirements, and (b) with respect to any obligation of (i) Grand Isle Corridor, CorEnergy or any of their respective Affiliates, and (ii) any other Landlord or Landlord Guarantor hereunder or their respective Affiliates if, as of the date of such Landlord’s acquisition of the leasehold estate under this Lease, either such Landlord or Landlord Guarantor is an Investment Grade Person, the lesser of (A) the annual rate of two percent (2%) over the average base, non-default rate of interest for such period (and without imputation of any gross-up components or default interest), under the Landlord Indebtedness of such Person which is held by a third party not an Affiliate of such Person or, if such Person does not have any such Landlord Indebtedness, then the Prime Rate for such period, and (B) the highest rate permitted by Applicable Legal Requirements, and (c) with respect to any other Tenant, Tenant Guarantor, Landlord or Landlord Guarantor, and their respective Affiliates, with respect to their respective obligations under or related to this Lease, the lesser of (i) the annual rate of six percent (6%) over the Prime Rate for such period, and (ii) the highest rate permitted by Applicable Legal Requirements.

“Designation Notice” has the meaning given in Section 25.1(c).

“Discount Rate” means seven percent (7%).

“Disqualified Person” means, as of any date, each Competitor and each Adverse Party; provided, however, that (a) for so long as Landlord is owned, in whole or in part, by CorEnergy or by direct or indirect Subsidiaries of CorEnergy, then no direct or indirect wholly-owned Subsidiary of CorEnergy shall be a Disqualified Person for purposes of this Lease, and (b) a Disqualified Person shall not include any banking and lending company that (i) is a Landlord Lender (in its capacity as such, or as the holder of an Equity Investor Interest or Landlord Interest as a result of enforcing any Permitted Landlord Lien) and (ii) would, but for this clause (b), be a Disqualified Person because it is an Affiliate of another Disqualified Person.

“Due Date for Other Additional Rent” has the meaning given in Section 5.4.

“Easement Land” means the land underlying, subject to and covered by the Right of Use Agreements.

“Effective Date” has the meaning specified in the preamble.

“Effective Date Recorded Documents” means all restrictions and charges created or imposed pursuant to documents and instruments recorded in the Official Public Records against

the Leased Property as of the time of conveyance of the Leased Property by EXXI USA to Landlord pursuant to the Purchase Agreement.

“Enhanced Response” has the meaning given in Section 22.2(a).

“Environmental Laws” means all applicable U.S. federal, state, and local laws, statutes, rules, regulations, orders, judgments, ordinances, codes, injunctions, decrees, and other legally enforceable requirements relating to (a) pollution or protection of the environment or natural resources or human health and safety (to the extent such health and safety relate to human exposure to Hazardous Substances), (b) any Release into the environment of, or any exposure to, any Hazardous Substances, or (c) the generation, manufacture, processing, distribution, use, treatment, storage, transport, disposal or handling of any Hazardous Substances; including the federal Comprehensive Environmental Response, Compensation and Liability Act, the Superfund Amendments and Reauthorization Act, the Emergency Planning and Community Right-to-Know Act, the Resource Conservation and Recovery Act, the Clean Air Act, the Clean Water Act, the Safe Drinking Water Act, the Toxic Substances Control Act, the Oil Pollution Act of 1990, the Outer Continental Shelf Lands Act, the Federal Hazardous Substances Transportation Law, the Marine Mammal Protection Act, the Endangered Species Act, the National Environmental Policy Act, and the Occupation, Safety and Health Act, as each is amended during the Term.

“Equity Investor” means any Person that beneficially owns any Equity Investor Interest.

“Equity Investor Interest” means each beneficial ownership interest greater than ten 10% in the equity of the Landlord.

“ERISA” means the Employee Retirement Income Security Act of 1974, as amended.

“Estimates” has the meaning given in Section 25.1(c).

“Evaluation Period” has the meaning given in Section 10.1(d)(ii)(A).

“Excess Oil Revenue” means, for any calendar month (or portion thereof) during the Term, the greater of (a) zero or (b) Actual Oil Revenue for such month (or portion thereof) minus Base Oil Revenue for such month (or portion thereof).

“Exchange Act” means the Securities Exchange Act of 1934.

“Excluded Matters” has the meaning given in Section 6.3.

“Exclusions from Tenant’s Indemnification Obligations” has the meaning given in Section 21.1(a).

“EXXI Entity Person” means EXXI GIGS and any Affiliate of or successor to EXXI GIGS so long as EXXI GIGS or such Affiliate or successor is Controlled, directly or indirectly, by EXXI Parent or a Permitted EXXI Parent Successor.

“EXXI GIGS” means Energy XXI GIGS Services, LLC, a Delaware limited liability company, the initial Tenant under this Lease; however, the term EXXI GIGS shall not include any successor or assignee of the interest of EXXI GIGS hereunder.

“EXXI Parent” means Energy XXI Ltd, a Bermuda company, an initial Tenant Guarantor; however, the term “EXXI Parent” shall not include any successor Tenant Guarantor under this Lease.

“EXXI USA” means Energy XXI USA, Inc., a Delaware corporation.

“Fair Market Rent” means, with respect to the Leased Property during the proposed Renewal Term (or, for purposes of Landlord’s Lease termination remedy during the continuance of a Level 1 Tenant Default, during the portion of the Term which would have occurred after termination of this Lease as a result of such Level 1 Tenant Default), a rental rate that is a fair market value rental rate that would apply assuming that the Leased Property is offered on the open market as a rental property for the proposed Renewal Term (or, with respect to termination of this Lease by Landlord as a result of a Level 1 Tenant Default, during the portion of the Term which would have occurred after such termination of this Lease), taking into account all relevant factors. The Fair Market Rent will be assumed to be a monthly rent payable in advance on the first day of each calendar month. The Fair Market Rent may, but is not required to, follow the model of the current rent structure (i.e., using a Base Rent formulation).

“Fair Market Rent Determination Notice” has the meaning given in Section 25.1(c).

“Fair Market Value” or “fair market value” means the price that would be agreed on between a willing buyer and a willing seller, with neither being required to act, and both having reasonable knowledge of the relevant facts.

“Federal ROWs” means the federal Outer Continental Shelf pipeline rights-of-way included in the Right of Use Agreements, as specified in Exhibit B.

“Financing Notice” has the meaning given in Section 10.1(d)(ii)(A).

“Flow and Volume Information” means the flow and volume information of the type to be furnished by Tenant pursuant to Section 26.7(b)(i).

“FMV Estimates” has the meaning given in Section 25.3(g).

“Force Majeure” has the meaning given in Section 26.2.

“GAAP” means generally accepted accounting principles in effect from time-to-time in the United States of America.

“Grand Isle Corridor” means Grand Isle Corridor, LP, a Delaware limited partnership, the initial Landlord under this Lease; however, the term Grand Isle Corridor shall not include any successor or assignee of the interest of Grand Isle Corridor hereunder.

“Good Condition and Repair” means good condition and repair consistent with (a) Tenant’s past practices and industry standards, and (b) the condition and repair that a reasonably prudent operator would maintain for a system of a similar size, nature, use, age and location as the Liquids Transportation System.

“Governing Documents” means (a) with respect to a Person that is a limited partnership, its limited partnership agreement and certificate of limited partnership, (b) with respect to a Person that is a general partnership, its partnership agreement, (c) with respect to a Person that is a limited liability company, its limited liability company agreement, together with its certificate of formation and any operating agreement, regulations and similar agreements or documents of such Person, (d) with respect to a Person that is a corporation, its articles of organization and bylaws, together with any shareholders agreement and similar agreements and documents of such Person, (e) in the case of any other form of entity, its organizational agreements, certificates and documents, and (f) in each case, with respect to subsections (a)-(e), as such agreements, certificates and documents may be amended or restated from time-to-time, subject however to the limitations on amendments set forth herein.

“Governmental Authority” means any governmental authority, agency, department, commission, bureau, board, instrumentality, court or quasi-governmental authority having jurisdiction or supervisory or regulatory authority over any of the Leased Property, applicable to Tenant (with respect only to Tenant’s (rather than Landlord’s) obligations hereunder regarding compliance or interaction with Governmental Authority), or applicable to Landlord (with respect only to Landlord’s (rather than Tenant’s) obligations hereunder regarding compliance or interaction with Governmental Authority).

“Hazardous Substances” means (i) any substance that is regulated as a hazardous waste, solid waste, hazardous material, pollutant, contaminant or toxic or hazardous substance under any Environmental Law (ii) any petroleum, petroleum hydrocarbons, petroleum products and petrochemical products, any crude oil or any components, fractions or derivatives thereof, any oil or natural gas exploration or production waste, and any natural gas, synthetic gas, and any mixtures thereof, as each is regulated under Environmental Law, and (iii) radioactive materials or polychlorinated biphenyls, as each is regulated under Environmental Law.

“Impositions” mean, collectively, all charges, fees and expenses imposed on the Leased Property under any Easement or any other Record Agreement during and accruing with respect to the Term, but excluding in any event all Excluded Matters.

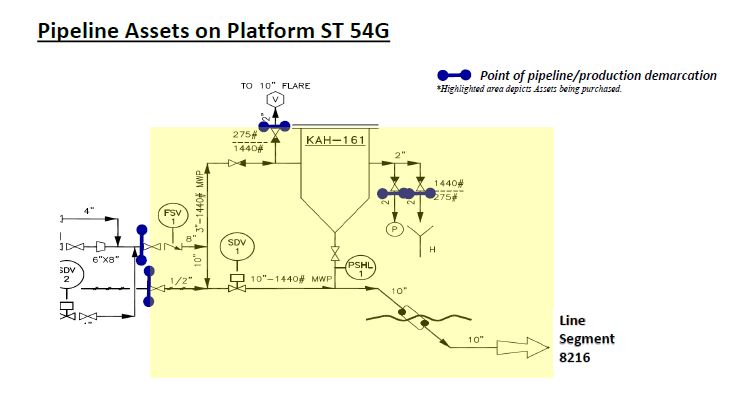

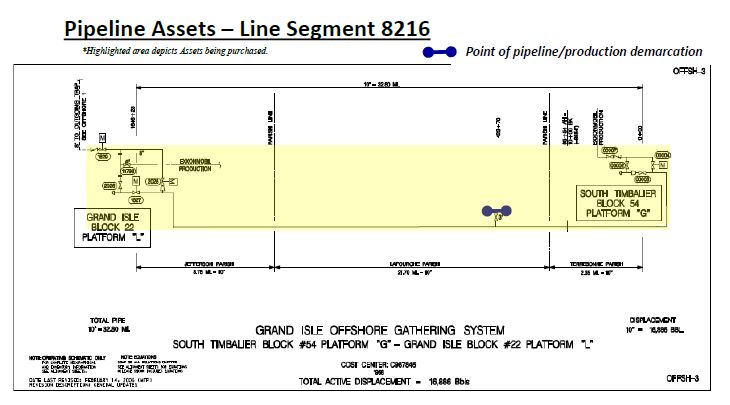

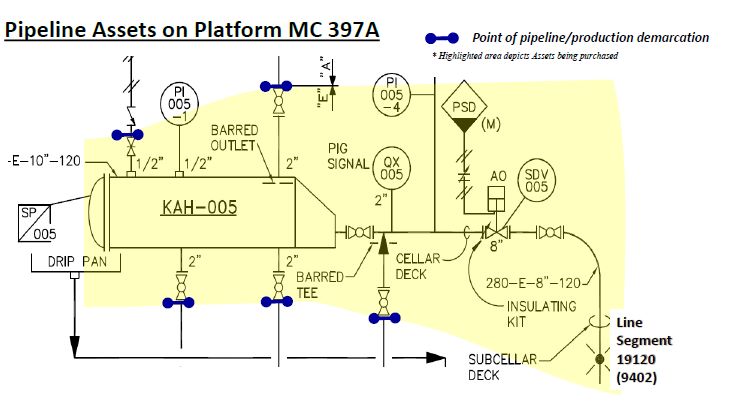

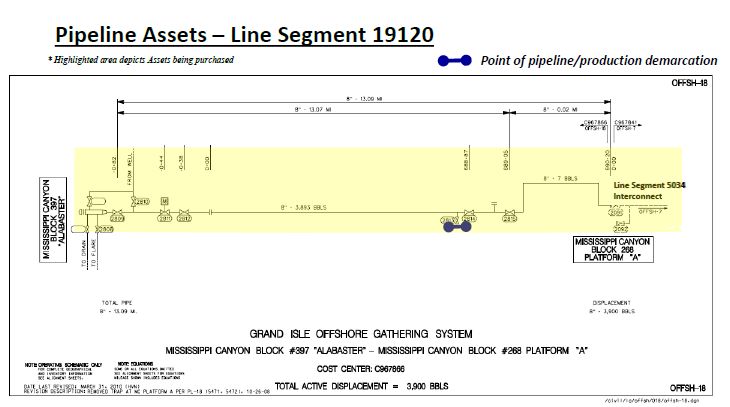

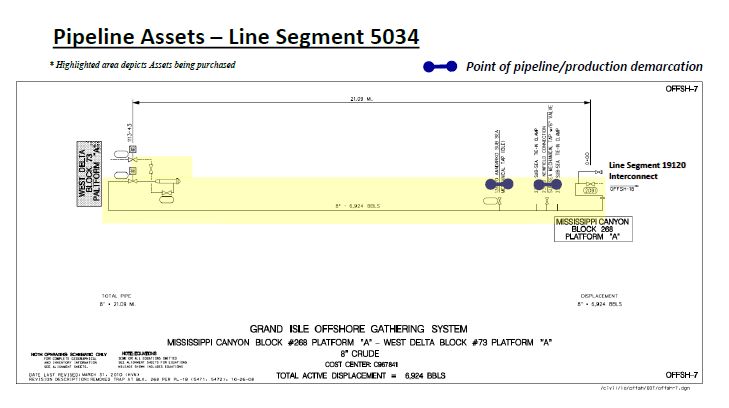

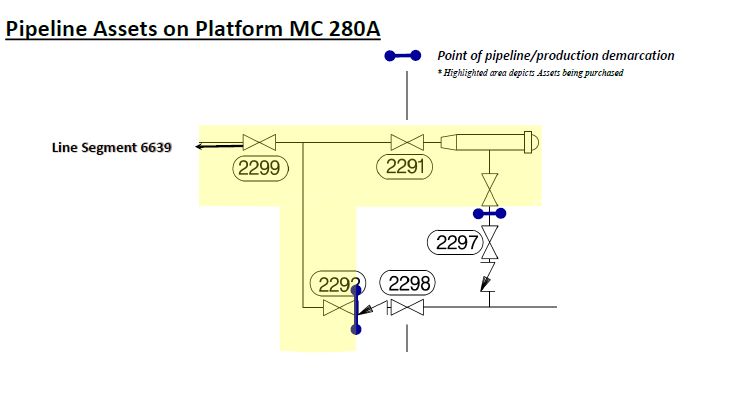

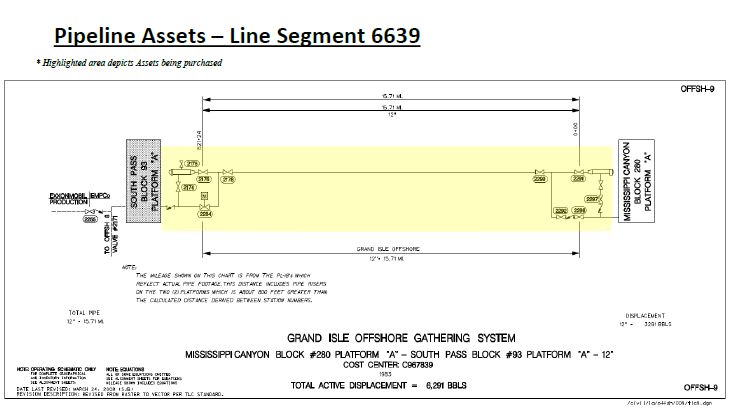

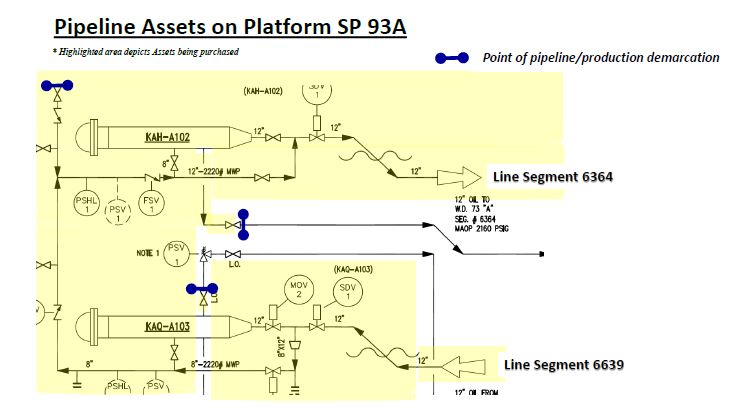

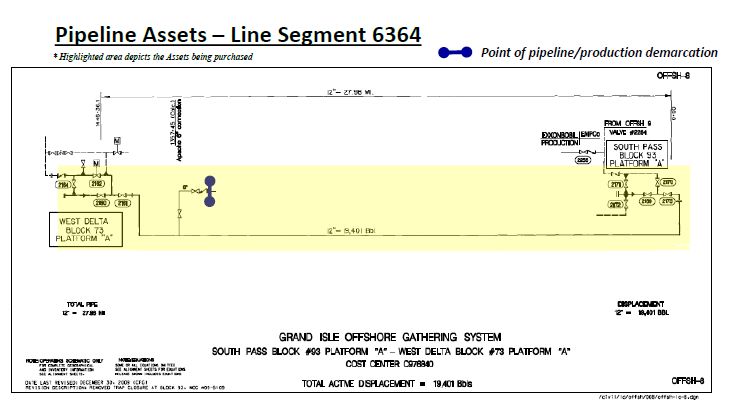

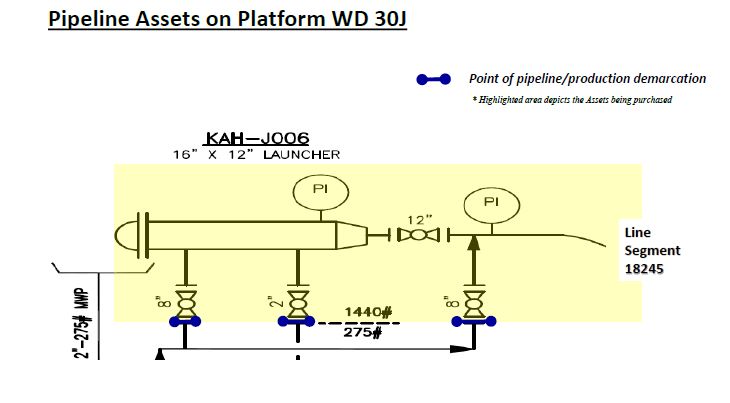

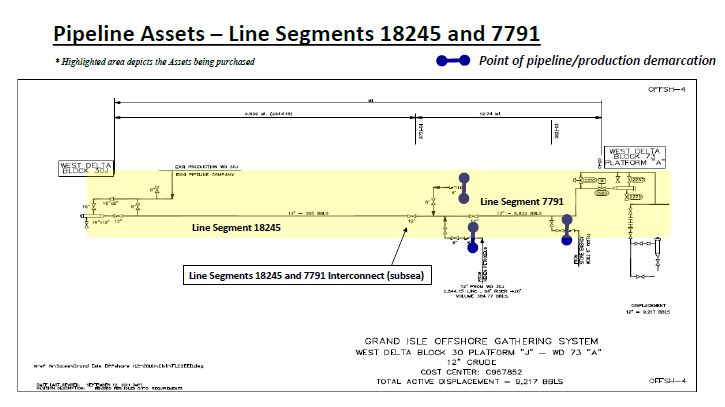

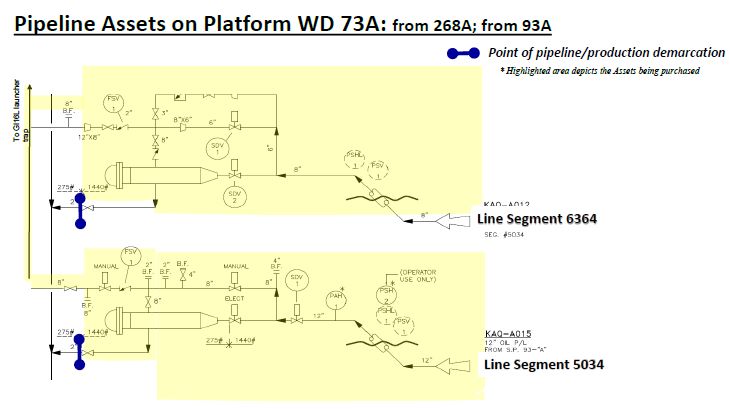

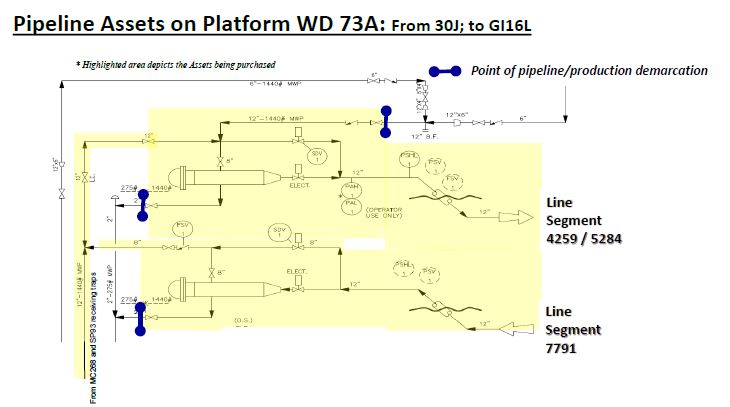

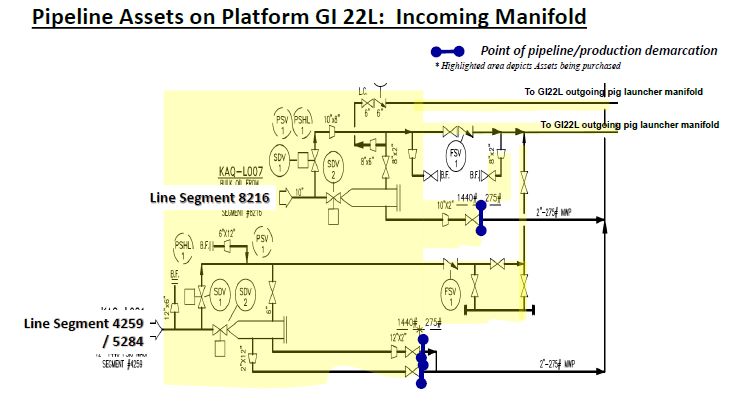

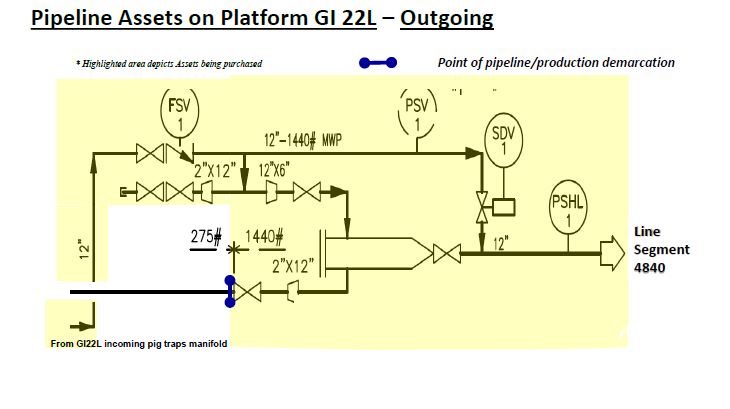

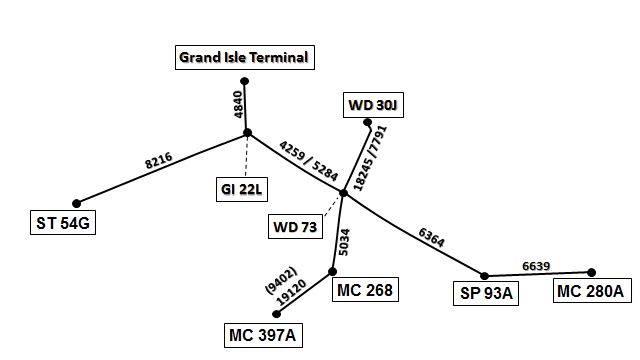

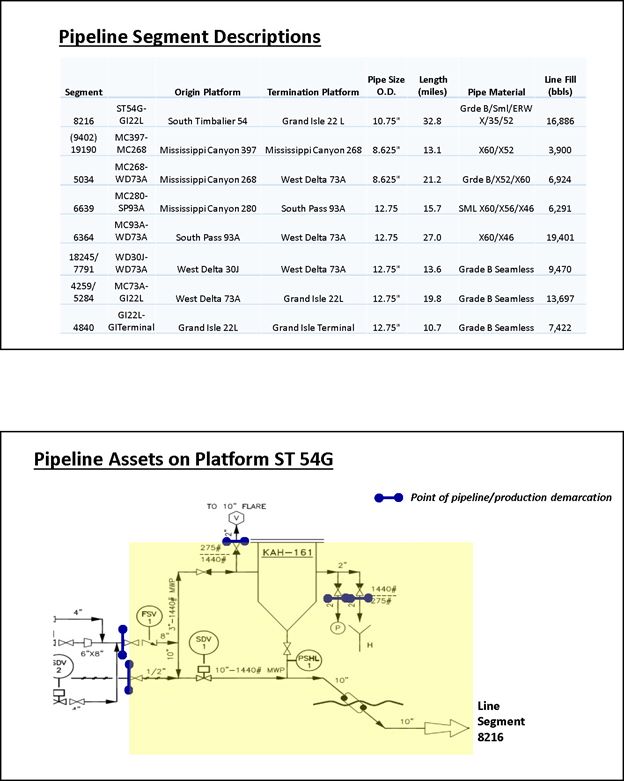

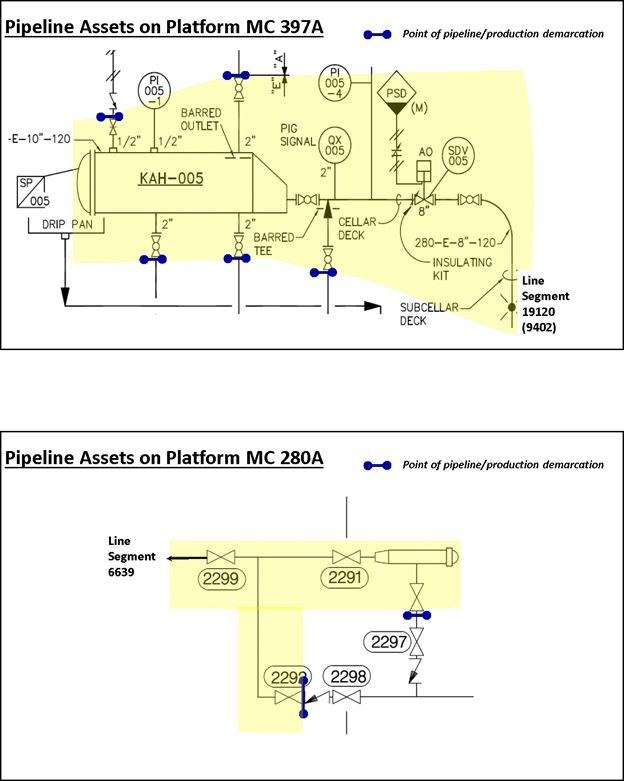

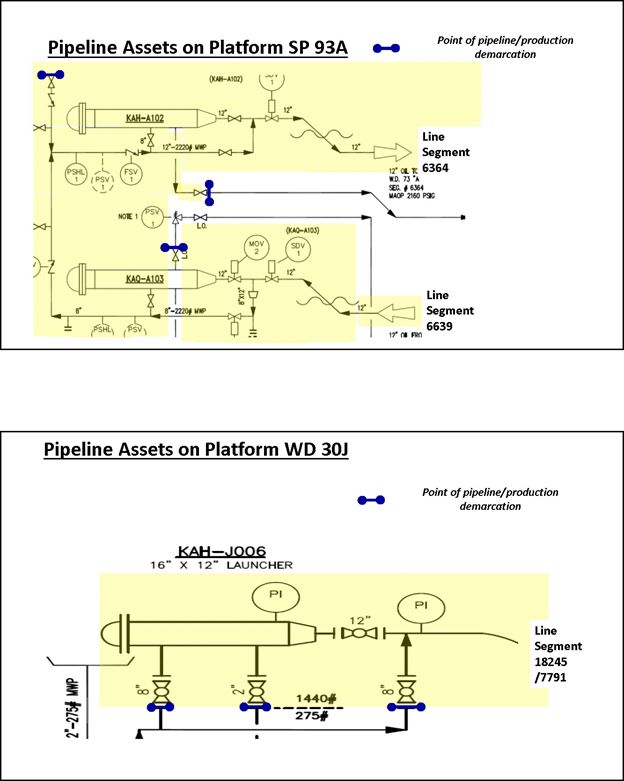

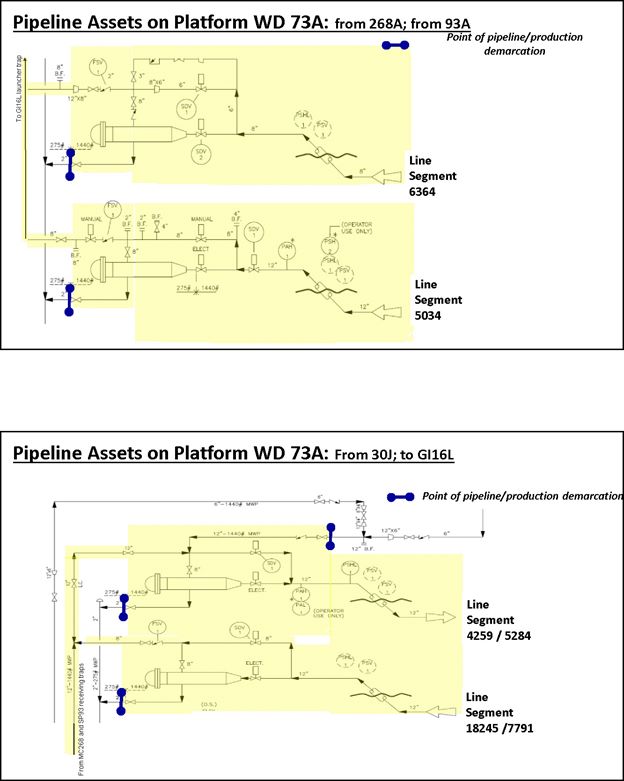

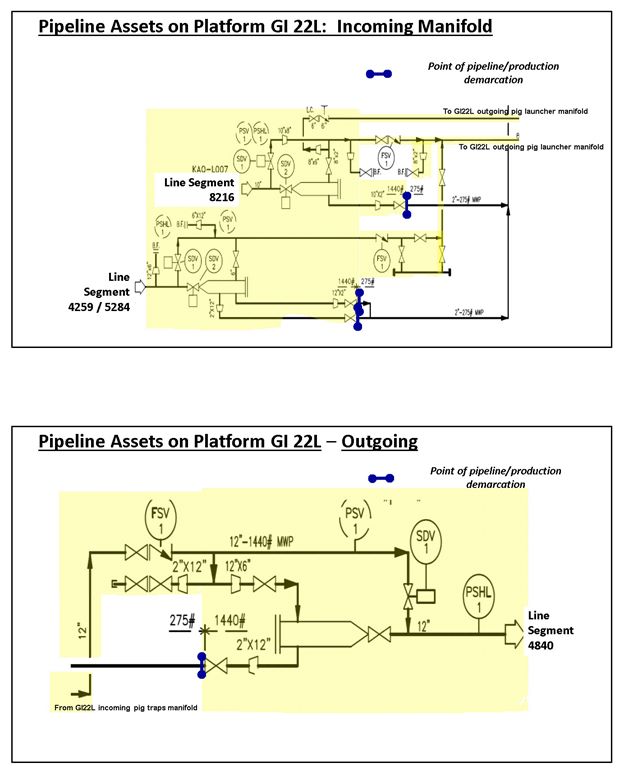

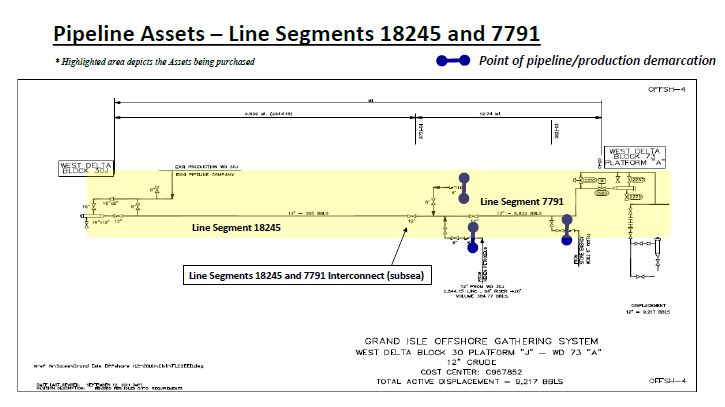

“Improvements” means all of the improvements and fixtures used as part of the Liquids Transportation System, including: any and all surface or subsurface pipelines; surface or subsurface machinery and equipment, line pipe, pipe connections, fittings, flanges, welds, other interconnections, and valves (including subsea tie-in valves); control and monitoring equipment; cathodic or electrical protection units; by-passes; regulators; drips; brine pumps, salt water disposal pumps, and oil pumps; salt water filter systems; treating, dehydration, separation, processing equipment; crude oil and produced water storage tanks; gas compressors; vapor recovery units and associated gas lines; towers and storage sheds; gas and electric fixtures; electrical generators, fuel tanks, switchgear, transformers, and switches; and motor control center, in each case, that are downstream of the inlet flange to each pipeline pig launcher trap on

oil platforms GI 22L, ST 54G, WD 73A, WD 30J, MC 268A, MC 397A, SP 93A, and MC 280A in the Gulf of Mexico to, and including, the Grand Isle terminal facility on the Land, including any of the foregoing described on the attached Exhibit C. The term “Improvements” includes all of the improvements and fixtures which are a part of the Liquids Transportation System as described herein, regardless of whether they are included or properly described in Exhibit C.

“Inception Date Present Value” has the meaning given in Section 23.2(a)(i)(E).

“Indebtedness” means with respect to a Person, such Person’s (a) liabilities for borrowed money, (b) liabilities for the deferred purchase price of property acquired by it (excluding accounts payable arising in the ordinary course of businesses), (c) obligations that are required to be accounted for as capital leases on a balance sheet under GAAP (and the amount of such obligations shall be the capitalized amount thereof determined in accordance with GAAP), (d) agreements to mitigate interest rate risk in connection with other Indebtedness, and (e) guaranty obligations with respect to liabilities of another Person of the type described in the preceding subsections (a)-(d).

“Indemnified Party” means a Landlord Indemnified Party or a Tenant Indemnified Party, as applicable.

“Indemnifying Party” has the meaning given in Section 21.3.

“Independent Appraiser” means an independent valuation firm with at least five (5) years’ experience in undertaking valuations of oil or other commodity pipeline properties.

“Initial Term” means that period beginning on the day after the Effective Date and ending on the last day of the one hundred thirty-second (132nd) full calendar month thereafter.

“Interconnection Agreements” means agreements pursuant to which the Liquids Transportation System, or any component thereof, is interconnected to other pipeline systems, facilities, or assets, including the agreements listed on Exhibit D.

“Investment Grade Person” means (a) a Person that has a long term issuer corporate credit rating or long-term unsecured debt rating of “BBB-” or higher from Standard & Poor’s or Fitch, or “Baa3” or higher from Moody’s Investor Service Inc., or (b) an Affiliate of such Person whose obligations under this Lease are guaranteed by such Person.

“Involuntary” means, with respect to a Transfer or Lien, any transaction, proceeding or action by or in which Landlord or an Equity Investor is involuntarily deprived or involuntarily divested of any right, title or interest in and to its applicable property, rights or interests (including any seizure under levy of attachment or execution, transfer in connection with bankruptcy or other court proceeding to a trustee or receiver or other officer or agency or any transfer to a state or to a public officer or agency pursuant to any statute pertaining to escheat or abandoned property).

“Landlord” has the meaning given in the preamble.

“Landlord Environmental Liabilities” means Losses arising or resulting from any of the following: (a) the presence, use, storage, generation, transportation or Release of any Hazardous Substances on, under, from or at the Leased Property, or any portion thereof, or at any real property offsite the Leased Property where such Hazardous Substances from such Leased Property have been transported or disposed or arranged for transport or disposal, in each case during the Term and to the extent caused by or resulting from the negligence, gross negligence or willful misconduct of Landlord, any other Landlord Party or any Landlord Lender and for which Tenant or any other Tenant Party or Landlord, any other Landlord Party or any Landlord Lender has or may have any legal obligation, (b) allegations made in writing by a third party that is neither Tenant nor another Tenant Party (but only so long as neither Tenant nor any Tenant Party has voluntarily initiated contact with such third party and affirmatively caused such third party to raise such allegation unless such contact is required to be made by Tenant or any other Tenant Party under Environmental Law or such allegation is required to be made by such third party under Environmental Law) regarding the presence, use, storage, generation, transportation or Release of any Hazardous Substances on, under, from or at the Leased Property, or any portion thereof, or at any real property offsite the Leased Property where such Hazardous Substances from such Leased Property have been transported or disposed or arranged for transport or disposal, in each case, during the Term and for which Tenant or any other Tenant Party or Landlord, any other Landlord Party or any Landlord Lender has or may have any legal obligation, to the extent caused by or resulting from the negligence, gross negligence or willful misconduct of Landlord, any other Landlord Party or any Landlord Lender, or (c) any violation of Environmental Laws occurring during the Term at or affecting any portion of the Leased Property and for which Tenant or any other Tenant Party or Landlord, any other Landlord Party or any Landlord Lender has or may have any legal obligation, to the extent caused by or resulting from the negligence, gross negligence or willful misconduct of Landlord, any other Landlord Party or any Landlord Lender; provided, however, that the term “negligence” as used in this definition shall not include negligence imputed as a matter of law to Landlord solely by reason of Landlord’s failure to act in respect of matters to the extent such matters are or were the sole obligation of Tenant under this Lease or solely as a result of Landlord’s ownership of the Leased Property.

“Landlord Equity Interests” means the equity interests issued by Landlord including, as applicable, any general or limited partnership interests, limited liability company membership interests, common or preferred stock, or other interest which would be classified as equity on Landlord’s balance sheet under GAAP and any right to acquire such equity interests in Landlord, including upon conversion or exercise of securities (but, for clarity, not including the right to acquire such equity interests by enforcing any pledge of Landlord Equity Interests to secure Landlord Indebtedness). References herein to a percentage of Landlord Equity Interests means Landlord Equity Interests which confer on the holder thereof the right to vote the applicable percentage of votes for the election of directors or a similar governing body, or to receive the applicable percentage of dividends, distributions, including liquidating distributions or other payments with respect to the Landlord Equity Interests.

“Landlord Equity Interest Owner” means each owner of a Landlord Equity Interest.

“Landlord Event of Default” has the meaning given in Section 23.3.

“Landlord Guarantor” means CorEnergy and any successor Landlord Guarantor (i) with a tangible net worth of $50,000,000 and (ii) that executes a Landlord Guaranty, until CorEnergy or any such successor Landlord is released from further liability upon a Permitted Sale as provided in Section 17.5(b).

“Landlord Guaranty” means that certain Landlord Guaranty executed by CorEnergy and dated as of the Effective Date and any subsequent Landlord Guaranty executed after the Effective Date and in substantially the form of Landlord Guaranty attached as Exhibit E unless and until the Landlord Guarantor under such Landlord Guaranty is released to the extent provided in Section 17.5(b) upon a Permitted Sale.

“Landlord Indebtedness” means Indebtedness (a) of Landlord (which, for clarity, may also be Indebtedness of one or more Affiliates of Landlord) or (b) secured by all or any portion of the Landlord Interests or the Landlord Equity Interests.

“Landlord Indemnified Parties” means Landlord, Landlord Guarantor and their respective Related Parties (solely in their capacity as such), and permitted successors and assigns of any of the foregoing, including any permitted successors by merger, consolidation or acquisition of all or substantially all of the Landlord’s rights under this Lease.

“Landlord Interests” means (a) all or any portion of Landlord’s right, title and interest in and to the Leased Property, and (b) all or any portion of Landlord’s right, title and interest under this Lease.

“Landlord Lease Transaction” means a transaction pursuant to which Landlord enters into a lease or other agreement or arrangement with respect to the use or occupancy by a third party of all or any portion of the Leased Property.

“Landlord Lender” means (a) any holder of Landlord Indebtedness (including any Lien on any of the Landlord Interests or Landlord Equity Interests) or (b) any agent or trustee for any such holder.

“Landlord Loan Documents” means the agreements and instruments evidencing or governing Landlord Indebtedness.

“Landlord Majority Owner” means any Person (a) that is not (i) an individual or (ii) a Disqualified Person; (b) whose tangible net worth, or the tangible net worth of an Affiliate providing an appropriate guarantee, both immediately before and after giving effect to the applicable transfer, is at least $50,000,000 determined in accordance with GAAP, provided, that, such Person or such Affiliate having such tangible net worth guarantees (i) all of Landlord’s obligations under this Lease, and (ii) the obligations, if any, of such Person under the SNDA to which such Person is subject; and (c) that owns or controls, at all times, over fifty percent (50%) of the Lease Rights.

“Landlord Observer” has the meaning given in Section 23.2(b)(vii).

“Landlord Parent” means (a) for so long as Grand Isle Corridor is the Landlord, CorEnergy, and (b) for so long as any other Person is the Landlord, such Person’s ultimate parent company.

“Landlord Party” means Landlord, any Equity Investor, and their respective officers, employees, agents, servants, or assignees.

“Lease” has the meaning given in the preamble.

“Lease Assignment” means a Transfer by Tenant of its interest under this Lease or its interest in the Leased Property hereunder.

“Lease Rights” means the rights to vote on, consent to, or approve of decisions made by Landlord with respect to actions, decisions, approvals, waivers, consents, declarations of default, exercise of remedies or other matters under this Lease, whether through ownership of securities, the ability to exercise voting power, by contract, arrangement, understanding, course of conduct or otherwise, but not including veto rights held by passive minority investors.

“Leased Property” means the Liquids Transportation System, the Personal Property, and the Interconnection Agreements.

“Level 1 Landlord Default” means (a) any Landlord Event of Default under Sections 23.3(c), 23.3(f), 23.3(g), 23.3(i) or 23.3(j) and (b) any Landlord Event of Default arising out of a breach of Article XI or Section 26.10.

“Level 1 Tenant Default” means any Tenant Event of Default described in Sections 23.1(a), 23.1(b), 23.1(d), 23.1(g), 23.1(h), 23.1(j), 23.1(k), or 23.1(l).

“Lien” means any mortgage lien, deed of trust lien, Tax lien, deed to secure debt, vendor’s lien, security interest, pledge, collateral assignment, mechanic’s or materialman’s lien, or other similar instruments and all restatements, modifications, amendments, consolidations, extensions, renewals or substitutions thereto or thereof.

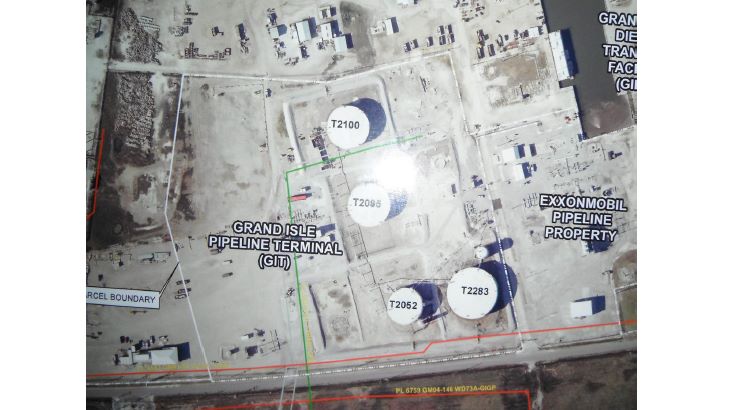

“Liquids Transportation System” (a) means, generally, the system of pipelines, storage tanks, collection and separation facilities, salt water disposal wells and facilities, and related properties, facilities, equipment and rights, as highlighted or otherwise identified on Exhibit F, as such system exists as of the Effective Date and as it may be subsequently modified as permitted by this Lease, that is capable of (i) transporting, collecting, separating, storing, and delivering for sale or transport oil produced from oil wells located in the Gulf of Mexico, and (ii) transporting, collecting, separating, and disposing of salt water associated with the production of such oil, and (b) includes, specifically, the Land, the Right of Use Agreements, and the Improvements. The Liquids Transportation System begins at the inlet flange to each pipeline pig launcher trap on oil platforms GI 22L, ST 54G, WD 73A, WD 30J, MC 268A, MC 397A, SP 93A, and MC 280A in the Gulf of Mexico, extends through an interconnected system of pipelines and subsea tie-in valves to the collection, separation equipment, storage tanks, disposal wells, and pipelines located at the Grand Isle terminal facility on the Land, and includes the pipeline from such terminal facility to the interconnection point under the Interconnection Agreement, dated

December 17, 2010, with ExxonMobil Pipeline Company (as such agreement may be amended or replaced from time to time).

“Loss” or “Losses” means mean any actual losses, costs, expenses (including court costs, reasonable fees and expenses of attorneys, technical experts and expert witnesses and the cost of Corrective Action), liabilities, damages, demands, suits, claims, and sanctions of every kind and character (including civil fines) arising from, related directly or indirectly or reasonably incident to, matters indemnified against, excluding however all of the following:

(d) Consequential and Similar Damages. Any consequential, punitive or exemplary damages or loss of profits incurred by an Indemnified Party hereto; and

(e) Diminution in Value. Any diminution in value incurred or suffered (i) by a Landlord Indemnified Party except to the extent, and proportionately to the extent, such diminution in value results directly from the actions of, or the failure to act by, Tenant, any Affiliate of Tenant, any Tenant Party, or any Tenant Indemnified Party, and (ii) by a Tenant Indemnified Party except to the extent, and proportionately to the extent, such diminution in value results directly from the actions of, or the failure to act by, Landlord, any Affiliate of Landlord, any Landlord Party, or any Landlord Indemnified Party; and

(f) Third Party Indemnities. Any such Losses incurred by an Indemnified Party and arising as a result of such Indemnified Party indemnifying a third party (i) with respect to a Landlord Indemnified Party, if (A) such third party is either (I) an Affiliate of such Landlord Indemnified Party, (II) another Landlord Indemnified Party or (III) a Landlord Party, or (B) any Person described in subsections (I)-(III) above causes such third party to raise such claim (except to the extent such Person is required by Applicable Legal Requirements to cause such third party to raise such claim), (ii) with respect to a Tenant Indemnified Party, if (A) such third party is either (I) an Affiliate of such Tenant Indemnified Party, (II) another Tenant Indemnified Party or (III) a Tenant Party, or (B) any Person described in subsections (I)-(III) above causes such third party to raise such claim (except to the extent such Person is required by Applicable Legal Requirements to cause such third party to raise such claim), or (iii) to the extent such third party indemnified claim duplicates or exceeds the loss, cost or expense to the Indemnified Party; and

(g) Excluded Matters. Any such Losses which constitute an Excluded Matter; and

(h) Section 2.1 Waivers. Any such Losses with respect to claims and other matters waived in Section 2.1(b).

“Louisiana ROW” means the State of Louisiana right-of-way included in the Right of Use Agreements, as specified in Exhibit B.

“Lowest Cost Response” shall mean the Corrective Action response required or allowed under Environmental Laws that addresses Hazardous Substances present at the lowest cost (considered as a whole taking into consideration any negative impact such response may have on the business conducted on the property and any potential additional costs or liabilities that may arise as a result of such response) as compared to any other response that is consistent with Environmental Laws. Taking no action shall constitute the Lowest Response Cost if, after investigation, taking no action is determined to be consistent with Environmental Laws. If

taking no action is not consistent with Environmental Laws, the least costly non-permanent remedy (such as mechanisms to contain or stabilize Hazardous Substances including caps, dikes, encapsulation, leachate collection systems, etc.) shall be the Lowest Cost Response, provided that such non-permanent remedy is consistent with Environmental Laws and less costly than the least costly permanent remedy (such as excavation and removal of soil).

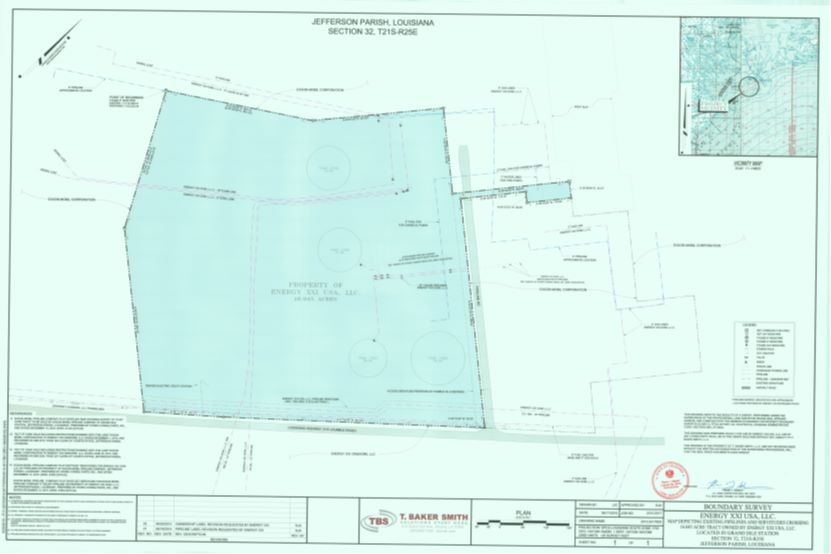

“LTS Land” is described in the attached Exhibit G.

“Material Adverse Event” means any event or circumstance resulting in a material adverse effect on (a) the ability of Tenant to perform the monetary and other material obligations under this Lease, or (b) the ownership, financial condition or operation of the Leased Property taken as a whole.

“Material Amendment” means (a) with respect to Section 25.3 hereof, (i) any decrease in the purchase price; (ii) any change in the identity of the direct or indirect owners of the proposed purchaser; (iii) any change in the Landlord Interests included in the Transfer that is the subject of such ROFR rights of Tenant, or (iv) any other change in the terms of the Transfer that, taken together with any other changes after the relevant ROFR Asset Sale Notice, results in economic or business terms of the relevant Transfer that are materially more favorable to the proposed purchaser than the terms first disclosed to Tenant, and (b) with respect to Section 25.4 hereof, (i) any decrease in the annual rent for the Leased Property; (ii) any change in the identity of the direct or indirect owners of the proposed tenant, licensee or subtenant; or (iii) any other change in the terms of the Landlord Lease Transaction that, taken together with any other changes after the relevant ROFR Lease Notice, results in economic or business terms of the relevant Landlord Lease Transaction that are materially more favorable to the proposed tenant, licensee or subtenant than the terms first disclosed to Tenant.

“Material Debt” means, (a) with respect to any Tenant who is an Investment Grade Person or whose Affiliate is a Tenant Guarantor that is an Investment Grade Person, in each case at the time such Person became the Tenant, Indebtedness of Tenant or Tenant Guarantor, the principal balance of which is in excess of $100,000,000, and (b) with respect to any other Tenant, Indebtedness of Tenant or Tenant Guarantor, the principal balance of which is in excess of $20,000,000.

“Minimum Rent” means (a) for each calendar month during the Initial Term, the amount of rent specified for such month on Exhibit A, prorated for any partial calendar month during the Term, and (b) during the Renewal Term, the amount determined pursuant to Section 25.1 hereof.

“Multi-Platform Access Agreement” means the Multi-Platform Pipeline Connection and Access Agreement by and between Landlord and Energy XXI GOM, LLC, dated as of the date hereof and attached hereto as Exhibit H in respect of (i) oil platforms GI 22L, ST 54G, WD 73A, WD 30J, MC 268A, MC 397A, and SP 93A in the Gulf of Mexico and (ii) the Connection Points specified therein.

“Non-Consent Matters” means a change of direct or indirect ownership of Tenant as a result of a merger, consolidation, reorganization, sale, distribution, contribution or other transfer of assets or equity interests, joint venture, or public offering of common stock or other equity

interests, provided that following such change, Tenant and the Person that owns all or substantially all of the oil production assets and related rights in connection with which the Leased Property is used either are the same Person or are Affiliates.

“Non-Cash Consideration” has the meaning given in Section 25.3(g).

“Non-Cash Consideration Value” has the meaning given in Section 25.3(g).

“Non-Separable Addition” has the meaning given in Section 10.1(b).

“Notice” has the meaning given in Section 24.1.

“Notice of Lease” means the Notice of Lease in the form attached to this Agreement as Exhibit I.

“Notice of Non-Separable Addition” has the meaning set forth in Section 10.1(b).

“Notice of Separable Addition” has the meaning given in Section 10.1(c).

“O&M Agreement” means the Operation and Maintenance Services Agreement in the form attached hereto as Exhibit J.

“Offered Terms” has the meaning given in Section 10.1(d)(ii)(B).

“Official Public Records” means the mortgage or conveyance records of the Louisiana Parish (a) where the Leased Property is located or (b) with respect to Leased Property located on the Outer Continental Shelf, to which such Leased Property is adjacent.

“Other Recorded Document” means any easement agreement, restrictive covenant, declaration, right-of-way or any other similar agreement or document affecting, benefiting or burdening all or any portion of the Liquids Transportation System, but excluding Liens.

“Parts” has the meaning given in Section 10.2.

“Party” means either Tenant or Landlord individually, and “Parties” means Tenant and Landlord collectively.

“Permitted Capital Improvements and Additional Lines” means Capital Improvements and Additional Lines which (a) will not materially and adversely affect the structural integrity of the then existing Improvements, (b) will not materially and adversely affect the use or functionality of the Leased Property, and (c) will not adversely affect the value of the Leased Property in any material respect.

“Permitted Equity Transfer” has the meaning given in Section 17.5(c).

“Permitted EXXI Parent Successor” means any successor to EXXI Parent so long as no change in control has occurred with respect to EXXI Parent. As used in this defined term, “change in control” means an event or series of events by which any “person” or “group” (as such terms are used in Sections 13(d) and 14(d) of the Exchange Act, but excluding any

employee benefit plan, and any Person acting in its capacity as trustee, agent or other fiduciary or administrator of any such plan) becomes the Beneficial Owner, directly or indirectly, of 50% or more of the equity interests of EXXI Parent entitled to vote, on a fully diluted basis, for members of the board of directors or equivalent governing body of EXXI Parent.

“Permitted Landlord Contest” has the meaning given in Section 27.1(e).

“Permitted Landlord Liens” means (a) Liens on the Leased Property or Landlord’s right, title and interest under this Lease but only if (i) such Liens secure only Landlord Indebtedness, (ii) Landlord and each Landlord Lender with respect to such Liens have executed and delivered to Tenant an SNDA, and (iii) Landlord has complied with Section 20.1 with respect to such Liens, and (b) Liens on any Landlord Equity Interest but only if (i) such Liens secure only Landlord Indebtedness and (ii) Landlord and each Landlord Lender with respect to such Liens have executed and delivered to Tenant an SNDA.

“Permitted Lease Assignment” has the meaning given in Section 17.1(a).

“Permitted Liens” means (a) Liens placed on the Tenant’s interest in the Leased Property by, through, or under Tenant, (b) Liens placed on the Leased Property prior to the Effective Date, (c) Liens securing obligations for which Tenant is responsible hereunder, (d) Liens recorded in the Official Public Records as of the Effective Date, (e) Liens imposed by law for taxes, assessments, or similar charges, incurred in the ordinary course of business that are not yet due and payable, or that are subject to a Permitted Landlord Contest, Tax Challenge or Permitted Tenant Contest, (f) Liens of mechanics, materialmen, warehousemen, carriers, landlords or other like Liens, securing obligations incurred in the ordinary course of business that are not yet due and payable, or that are subject to a Permitted Landlord Contest and that do not attach to Landlord’s interest in the Leased Property, (g) the exercise or enforcement by Governmental Authorities or other Persons of eminent domain or condemnation rights, or any other rights or restrictions under Applicable Legal Requirements on or with respect to the use of real property in effect on the Effective Date or that are imposed after the Effective Date, including zoning restrictions and requirements under permits, (h) Permitted Landlord Liens, (i) inchoate Liens in respect of royalty owners, and (j) any other Liens that would not reasonably be expected to result in, individually or in the aggregate, a Material Adverse Event.

“Permitted Sale” has the meaning given in Section 17.5(b).

“Permitted Sublease” has the meaning in Section 17.1(b).

“Permitted Tenant Contest” means any contest made in accordance with Section 26.12.

“Permitted Tenant Transferee” means, with respect to any Tenant, (a) any EXXI Entity Person, (b) any Affiliate of a Tenant, (c) any Person who purchases or otherwise accepts a transfer or assignment of all or substantially all of the interest of such Tenant or its Affiliates in the oil production assets and related rights in connection with which the Leased Property is used, (d) any Affiliate of the Person acquiring such oil production assets, if such Person guarantees the obligations of such Affiliate under this Lease, (e) any Investment Grade Person approved by Landlord, which approval shall not be unreasonably withheld and which approval shall be based solely on the following: (i) a review of such Investment Grade Person’s experience in the oil

exploration and production business or midstream energy transportation business, and (ii) the proposed use of the Leased Property by such Investment Grade Person would not (A) constitute a breach of Article IX, or (B) in Landlord’s reasonable judgment, impair the structural integrity, functionality or value of the Leased Property in any material respect, and (f) any other Person approved by Landlord, which approval shall not be unreasonably withheld and which approval shall be based solely on the following: (i) such other Person’s current and future projected financial strength and creditworthiness, management style, financial philosophy and reputation, (ii) such other Person’s experience in the oil exploration and production business, (iii) such other Person’s ability to recover costs or pass them on to its customers and other Persons, and (iv) the proposed use of the Leased Property by such other Person would not (A) constitute a breach of Article IX, or (B) in Landlord’s reasonable judgment, impair the structural integrity, functionality or value of the Leased Property in any material respect. For the avoidance of doubt, any Permitted Tenant Transferee must provide, or have a Guarantor that can provide, audited financials to satisfy the requirements of Sections 4.2(d) and 26.7(b).

“Person” means any individual, firm, corporation, partnership, limited liability company, incorporated or unincorporated association, joint venture, Governmental Authority or any other entity of any kind.

“Personal Property” means (a) the monitoring equipment located in or on the Liquids Transportation System, (b) the computer hardware and software used in respect of the Liquids Transportation System, (c) the wires and other connectors between such computer hardware and such monitoring equipment, (d) all office furnishings, computers and associated hardware located at the Grand Isle terminal facility, (e) spare parts and stores for the Liquids Transportation System, and (f) the Records, all as of the Effective Date and as such personal property may be modified or replaced as permitted or required by this Lease.

“Planned Additional Line” has the meaning given in Section 10.1(d)(ii).

“Prime Rate” means the prime rate of interest as reported in The Wall Street Journal or, if The Wall Street Journal is no longer published or no longer reports such prime rate, the prime rate of interest as reported in another authoritative publication or news retrieval service.

“Proprietary Information” means (a) the business concept, operating techniques, marketing methods, financial information, plans, site and system renderings, schedules, itemized costs, development plans and all related trade secrets or confidential or proprietary information treated as such by Tenant, whether by course of conduct, by letter or report or by use of any appropriate proprietary stamp of legend designating such information item to be confidential or proprietary, by communication to such effect made prior to or at the time any such Proprietary Information is disclosed to Landlord, or otherwise, (b) all financial statements and financial information that relates to the Liquids Transportation System delivered to Landlord by an EXXI Entity Person pursuant to Section 26.7(b) and similar financial statements and financial information that relates to the Liquids Transportation System delivered to Landlord by an EXXI Entity Person prior to the Effective Date, and (c) all Flow and Volume Information and similar information that relates to the Liquids Transportation System delivered to Landlord by an EXXI Entity Person prior to the Effective Date. Notwithstanding the foregoing, Proprietary

Information shall not include information that is publicly available other than as a result of actions in violation of Section 26.10 hereof.

“Protective Mortgage” has the meaning given in Section 2.1(e).

“Protective UCCs” has the meaning given in Section 2.1(e).

“Purchase Agreement” means the Purchase and Sale Agreement dated as of June 22, 2015, between EXXI USA, as Seller, and Grand Isle Corridor, as Buyer, with respect to the transfer of the Leased Property to Landlord.

“Record Agreements” shall mean the agreements constituting (a) the Effective Date Recorded Documents (and including, without limitation, those evidencing the Right of Use Agreements), (b) any Other Recorded Document executed by Tenant after the Effective Date other than in violation of this Lease, and (c) any Other Recorded Document executed by Landlord other than in violation of this Lease. In no event shall any Lien or document that creates, or may create, an interest that could ripen into a Lien, constitute a “Record Agreement”.

“Records” means the following, to the extent acquired by Landlord (a) from Tenant under the Purchase Agreement or (b) in connection with the making or constructing of Permitted Capital Improvements and Additional Lines paid for by Landlord and made or constructed by Tenant for Landlord hereunder: all engineering drawings or plans and specifications of or covering the Liquids Transportation System or any component thereof, site assessments and environmental reports regarding or covering the Liquids Transportation System or any component thereof, manuals relating to the operation of the Leased Property, and “as-built” surveys of the pipelines and drawings of the Liquids Transportation System.

“Related Parties” of a Person means such Person’s directors, officers, employees, agents, trustees, administrators, managers, advisors, accountants, attorneys and representatives.

“Release” (a) any leaking, spilling, pouring, pumping, emitting, injecting, escaping, leaching, dumping, discharging, depositing or disposing of any Hazardous Substances into the environment (including the air, soil, groundwater or surface water) in sufficient quantity or concentration such that notification to a Governmental Authority is required under Environmental Laws or permitting is required under Environmental Laws, or (b) any presence or discovery of Hazardous Substances in soils, surface waters or groundwater on or under the Assets that exceeds screening standards under the Louisiana Risk Evaluation and Corrective Action Program, as may be modified or amended from time to time.

“Renewal Notice Date” has the meaning given in Section 25.1(b).

“Renewal Option” has the meaning given in Section 25.1(a).

“Renewal Term” has the meaning given in Section 25.1(a).

“Repairs” means any repairs, restoration, replacement, or rebuilding, on or at the Leased Property due to any damage to the Leased Property under Articles XV or XVI of this Lease.

“Responsible Officer” means (a) with respect to any EXXI Entity Person, the Chief Accounting Officer, Chief Operating Officer, Chief Financial Officer, and Senior Vice President (Legal) of EXXI Parent or, if the title of any such officer changes, an officer of EXXI Parent with an equivalent title, (b) with respect to any other Tenant, any of the chief executive officer, chief operating officer, chief financial officer, principal accounting officer, chief legal officer, treasurer and controller of Tenant or its Tenant Guarantor, if applicable, and (c) with respect to Landlord, any of the chief executive officer, chief operating officer, chief financial officer, principal accounting officer, chief legal officer, treasurer and controller of Landlord or its Landlord Guarantor, if applicable.

“Right of Use Agreements” means the easements, servitudes, rights of way, and similar agreements and instruments listed in Exhibit B, including all rights of the grantee thereunder.

“ROFR Asset Acceptance Notice” has the meaning given in Section 25.3(e).

“ROFR Asset Election Period” has the meaning given in Section 25.3(e).

“ROFR Asset Offer” has the meaning given in Section 25.3(d).

“ROFR Asset Sale Notice” has the meaning given in Section 25.3(c).

“ROFR Asset Transfer Deadline” has the meaning given in Section 25.3(e).

“ROFR Lease Election Period” has the meaning given in Section 25.4(e).

“ROFR Lease Notice” has the meaning given in Section 25.4(c).

“ROFR Lease Offer” has the meaning given in Section 25.4(d).

“ROFR Lease Period” means the period beginning at the end of the Term and ending two (2) years later.

“ROFR Lease Transfer Deadline” has the meaning given in Section 25.4(e).

“ROFR Transfer Period” means (a) the period during the Term, and (b) the period beginning at the end of the Term and ending two (2) years thereafter.

“Separable Addition” has the meaning given in Section 10.1(c).

“SNDA” means each Subordination, Non-Disturbance and Attornment Agreement, in the form of Exhibit K hereto, (a) entered into as of the Effective Date among each of Landlord’s Lenders, Landlord and Tenant, and consented to by the Landlord Guarantor and the Tenant Guarantor and (b) entered into after the Effective Date between each Landlord Lender, Landlord and Tenant, and consented to by the Landlord Guarantor and the Tenant Guarantor, and in each case as the same may be subsequently amended, supplemented or restated.

“Solvent” means, with respect to any Person on a particular date, that on such date, (i) the present fair salable value of the property and assets of such Person exceeds the debts and

liabilities, including contingent liabilities, of such Person, (ii) the present fair salable value of the property and assets of the such Person is greater than the amount that will be required to pay the probable liability of such Person on its debts and other liabilities, including contingent liabilities, as such debts and other liabilities become absolute and matured in the ordinary course, (iii) such Person does not intend to incur, or believe that it will incur, debts and liabilities, including contingent liabilities, beyond its ability to pay such debts and liabilities as they become absolute and matured in the ordinary course, and (iv) such Person does not have unreasonably small capital with which to conduct the business in which it is engaged as such business is now conducted and is proposed to be conducted. For purposes of this definition, the amount of a Person’s contingent liabilities at any time shall be computed as the amount that, in the light of all the facts and circumstances existing at such time, represents the amount that can reasonably be expected to become an actual or matured liability

“Specified Discount Rate” has the meaning given in Section 23.2(a)(i)(E).

“Sublease” means a sublease by Tenant of a portion of or less than all of Tenant’s rights under this Lease or in the Leased Property hereunder.

“Subsidiaries” means, with respect to any parent company at any date, any corporation, limited liability company, partnership, association or other entity the accounts of which would be consolidated with those of the parent in the parent’s consolidated financial statements if such financial statements were prepared in accordance with GAAP as of such date, as well as any other corporation, limited liability company, partnership, association or other entity (a) of which securities or other ownership interests representing more than fifty percent (50%) of the equity or more than fifty percent (50%) of the ordinary voting power or, in the case of a partnership, more than fifty percent (50%) of the general partnership interests are, as of such date, owned, controlled or held by the parent or one or more subsidiaries of the parent or by the parent and one or more subsidiaries of the parent, or (b) that is, as of such date, otherwise Controlled, by the parent or one or more subsidiaries of the parent or by the parent and one or more subsidiaries of the parent.

“Taking” means acquisition of all or any portion of the Leased Property for any public or quasi-public use through taking by condemnation, eminent domain or any like proceeding, or purchase in lieu thereof.