Exhibit 99.1

REPORT OF INDEPENDENT AUDITORS

To the Board of Directors and Stockholders of

Tortoise Capital Resources Corporation

We have audited the accompanying statement of revenues over certain operating expenses of the trust created under the trust agreement between General Foods Credit Corporation, as owner participant ("GFCC") and U.S. Bank national Association, successor to the First National Bank of Boston, as owner trustee ("Owner Trustee"), (referred to in this statement as the “Eastern Interconnection Project”) for the year ended December 31, 2010. This statement is the responsibility of Tortoise Capital Resources Corporation’s management. Our responsibility is to express an opinion on the statement based on our audit.

We conducted our audit in accordance with auditing standards generally accepted in the United States. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the statement of revenues over certain operating expenses is free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the statement of revenues over certain operating expenses. An audit also includes assessing the basis of accounting used and significant estimates made by management, as well as evaluating the overall presentation of the statement of revenues over certain operating expenses. We believe that our audit provides a reasonable basis for our opinion.

The accompanying statement of revenues over certain operating expenses was prepared for the purpose of complying with the rules and regulations of the Securities and Exchange Commission, as described in Note 2, and is not intended to be a complete presentation of the Eastern Interconnection Project’s revenues and expenses.

In our opinion, the statement of revenues over certain operating expenses referred to above presents fairly, in all material respects, the revenues and certain operating expenses described in Note 2 of Eastern Interconnection Project for the year ended December 31, 2010, in conformity with U.S. generally accepted accounting principles.

/s/ Ernst & Young LLP

Kansas City, Missouri

March 13, 2012

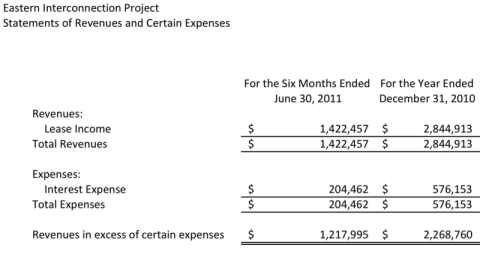

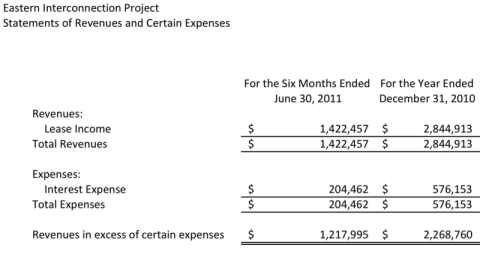

See the accompanying notes to Statements of Revenue and Certain Expenses.

Eastern Interconnect Project Trust

Notes to Statements of Revenue over Certain Expenses

For the Year Ended December 31, 2010

and the Six-Month Period Ended June 30, 2011 (unaudited)

|

|

1.

|

Description of the Real Estate Property

|

On June 30, 2011, Tortoise Capital Resources Corporation (the “Company”) purchased 100 percent ownership of the trust created under the Trust Agreement dated as of January 2, 1985 between U.S. Bank national Association (successor to the First National Bank of Boston), in its individual capacity and as owner trustee (the "Owner Trustee") and General Foods Credit Corporation (“GFCC”), as owner participant (the “Eastern Interconnect Project Trust”), which in turn owns a 40 percent-undivided interest in the Eastern Interconnect Project. The Eastern Interconnect Project is a 40 percent undivided interest in a 216 mile, 345-KV bulk power transmission line and related equipment and substations including towers, easement rights, converters and other grid support components (collectively the “Transmission Asset”). These Transmission Asset moves electric power across New Mexico between Albuquerque and Clovis.

The accompanying statements of revenues over certain expenses represent those of Eastern Interconnect Project Trust and have been prepared to comply with the rules and regulations of the Securities and Exchange Commission (“SEC”).

The accompanying statements of Eastern Interconnect Project Trust’s revenues over certain expenses are not representative of the actual operations for the periods presented, as certain revenues and expenses have been excluded that may not be comparable to the revenues and expenses the Company expects to incur in the future operations of Eastern Interconnect Project Trust. Excluded items include depreciation and amortization not directly comparable to the future operations of the Eastern Interconnect Project Trust.

The accompanying unaudited statement of revenues over certain operating expenses has been prepared in accordance with U.S. generally accepted accounting principles (“GAAP”) for interim financial information as contained within the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) and the rules and regulations of the SEC, including the instructions to Form 8-K and Article 3-14 of Regulation S-X. Accordingly, the unaudited statement of revenues over certain expenses does not include all of the information and footnotes required by GAAP for audited financial statements. In the opinion of management, the statement of revenues over operating expenses for the unaudited interim period presented includes all adjustments, which are of a normal and recurring nature, necessary for a fair and consistent presentation of the results for such period. Operating results for the six months ended June 30, 2011 are not necessarily indicative of the results that may be expected for the year ending December 31, 2011.

An audited statement of revenues over certain expenses is being presented for the most recent fiscal year available instead of the three most recent years based on the following

factors: (i) the Eastern Interconnect Project Trust was acquired from an unaffiliated party and (ii) based on due diligence of the Eastern Interconnect Project Trust by the Company, management is not aware of any material factors relating to the Eastern Interconnect Project Trust that would cause this financial information not to be indicative of future operating results.

|

|

3.

|

Summary of Significant Accounting Policies

|

Basis of Accounting

The accompanying statements of revenues and certain expenses have been prepared using the accrual method of accounting in accordance with US GAAP.

Revenue Recognition

Income related to the Eastern Interconnect Project Trust’s leased property is recognized on a straight-line basis over the term of the lease when collectability is reasonably assumed. Rental payments on the leased property are typically received on a semi-annual basis and are included as lease income within the accompanying statements of revenues and certain expenses.

Interest Expense

Interest expense on the Eastern Interconnect Project Trust debt is accrued as incurred and is paid on a semi-annual basis.

|

|

4.

|

Note Payable and Lease Agreement

|

Note

The Eastern Interconnect Project Trust entered into a note with an outstanding principal balance of $3.4 million (unaudited) at June 30, 2011 and $4.5 million at December 31, 2010. The debt is collateralized by the Eastern Interconnect Project Trust Transmission Asset. The note matures on October 1, 2012 and accrues interest at an annual rate of 10.25 percent, with principal and interest payments due on a semi-annual basis.

Lease

The Eastern Interconnect Project Trust’s interest in the Transmission Asset is leased on a triple net basis through April 1, 2015 to Public Service Company of New Mexico, an independent electric utility company serving approximately 500,000 customers in New Mexico. Public Service Company of New Mexico is a subsidiary of PNM Resources (NYSE: PNM). At the time of expiration of the lease, the Company may choose to renew the lease with the lessee, the lessee may offer to repurchase the Eastern Interconnect Project Trust, or the lease can be allowed to expire and the Eastern Interconnect Project Trust will find another lessee. Under the terms of the lease, the Eastern Interconnect Project Trust will receive semi-annual lease payments.

Future minimum lease payments to be received are as follows:

| |

Year Ending December 31, |

|

Amount |

| |

|

|

|

| |

2012 |

|

$2,844,914 |

| |

2013 |

|

2,844,914 |

| |

2014

|

|

2,844,914 |

| |

2015 |

|

1,422,457 |

| |

Thereafter |

|

------ |

| |

Total |

|

$9,957,199 |

Management of the Company has evaluated subsequent events through March 13, 2012 the date on which the statements of revenues and certain expense were issued, and determined there are no other subsequent events required to be disclosed.