Kansas City, MO 64112

Direct: 816.983.8000

Fax: 816.983.8080

www.huschblackwell.com

February 21, 2012

Division of Corporate Finance

United States Securities and Exchange Commission

100 F Street, N.E.

Washington, D.C. 20549

Attention: Michael McTeirnan

Re: Tortoise Capital Resources Corporation (the “Company”)

File No. 333-176944

Dear Mr. McTeirnan:

On September 21, 2011, the Company filed with the Securities and Exchange Commission (the “Commission”) a universal shelf registration statement on Form S-3 (the “Shelf Registration Statement”). The Company received comments on the filing via letter from the Commission’s staff (the “Staff”) dated October 17, 2011. The Company filed Pre-Effective Amendment No. 1 to the Shelf Registration Statement on November 18, 2011. The Company received comments on Pre-Effective Amendment No. 1 via letter from the Staff dated December 12, 2011. On December 23, 2011, the Company filed a written response to only Comment 6 contained in the December 12, 2011 letter. This response was discussed with Jessica Barberich of the Staff, who indicated there were no further questions or information required regarding the matter. On January 25, 2012, the Company filed Pre-Effective Amendment No. 2 to the Shelf Registration Statement and responded to the remaining December 12, 2011 comments. On February 9, 2012, the Company received comments on Pre-Effective Amendment No. 2. The following sets forth all of the February 9, 2012 comments and the Company’s responses to those comments. The Company has simultaneously filed Pre-Effective Amendment No. 3 to the Shelf Registration Statement. The text of each comment has been included in this letter for your reference, and the Company’s response is presented below each comment.

Supplemental Pro Forma Selected Financial Data, page 20

|

1.

|

Comment: We note your responses to comments 3 and 4 in our letter dated December 12, 2011. It is unclear how you determined that none of your interests in your portfolio companies meet either of the significance tests in Rule 1-02(w) of Regulation S-X. Please provide us with your calculations.

|

Husch Blackwell LLP

February 21, 2012

Page 2

Response: The Company’s calculations related to its analysis of Rules 3-09 and 4-08(g) of Regulation S-X, as of November 30, 2011, the end of its most recently completed fiscal year (and after withdrawal of its election to be regulated as a BDC), are set forth on Exhibit A hereto.

Until September 21, 2011, the date of the Company’s withdrawal of its election to be regulated as a BDC, the Company reported under the Investment Company Audit Guide (the “Guide”). The Company thus did not account for any of its investments using the equity method and only considered the application of Rule 3-09 in the context of significant subsidiaries.

Upon withdrawal of its election to be regulated as a BDC, the Company ceased reporting under the Guide and became subject to the equity method accounting requirement for limited partnerships in which it had an ownership interest greater than 3-5%. The Company has elected to report these investments at fair value, under the fair value option under ASC 825-10-25-4. The Company recognizes that Rules 3-09 and 4-08(g) of Regulation S-X apply to investments accounted for at fair value if such investments would have been accounted for using the equity method accounting had fair value not been applied.

Accordingly, the Company has included aggregate summarized financial information for its limited partnership interests in its Annual Report on Form 10-K filed February 13, 2012 as required by Rule 4-08(g). In addition, the Company has submitted a request to the Office of the Chief Accountant for the Division of Corporate Finance seeking a waiver from Rule 3-09 for its High Sierra investment. As explained in that letter, the Company believes that providing the financial statements for High Sierra will not be meaningful to users of the financial statements of the Company. The Company’s other limited partnership interests did not meet any of the tests under Rule 3-09.

|

2.

|

Comment: We note your response to comment 5 in our letter dated December 12, 2011. Please provide us with a complete analysis of your consideration of the requirements of Rule 3-14 and Rule 3-05 of Regulation S-X as well as guidance regarding properties subject to net lease. Please clearly distinguish if there is a rental history of the referenced property. Also, you note that historical accounting records of the trust are not available; to the extent you intend to request relief for required financial statements or consult on financial information provided for a significant lessee, please prepare a written submission to the Division of Corporation Finance’s Chief Accountant’s Office.

|

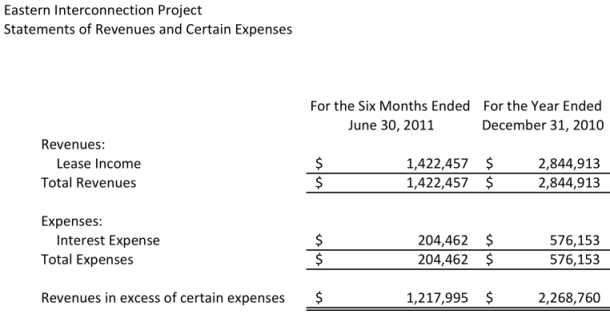

Response: The Company believes the acquired Eastern Interconnect Project (“EIP”) trust interest is a business and the acquisition of that business should be accounted for as a business combination under GAAP. The Company also believes the acquisition of 100% of the interests in the trust is in substance the acquisition of real estate, as the sole purpose of the trust was to own an interest in real estate rights and integral equipment and to enter into a related lease of those assets. The Company believes this “in substance” real estate meets the criteria of a real estate operation subject to Rule 3-14 because of its continuous and predictable cash flows over the remaining term of the lease, which expires in April of 2015. The trust’s cash inflows from this real estate operation consist solely of the lease payments that it receives from its single tenant, and the trust’s cash

Husch Blackwell LLP

February 21, 2012

Page 3

outflows consist of debt service and fees, all of which are fixed and determinable amounts. Similarly, the quarterly distribution to the Company is a fixed and determinable amount. Thus, the reduced financial statement requirements available to real estate operations under Rule 3-14 are being applied to this investment instead of the requirements under Rule 3-05. The acquired property held by the trust represents approximately 16% (see calculation at the end of this response) of the total assets of the Company as of November 30, 2010. The Company has concluded this acquisition is individually significant at the 10% level for the purpose of applying Rule 3-14. The Company intends to file the required financial statements for the EIP investment on a Form 8-K and will incorporate that filing into the Shelf Registration Statement. A draft of the 8-K is attached hereto as Exhibit B.

The Company notes that under the provisions of Rule 3-14:

“That such audited statements need be presented for only the most recent fiscal year if (i) the property is not acquired from a related party; (ii) material factors considered by the registrant in assessing the property are described with specificity in the filing with regard to the property, including sources of revenue (including, but not limited to, competition in the rental market, comparative rents, occupancy rates) and expense (including, but not limited to, utility rates, ad valorem tax rates, maintenance expenses, capital improvements anticipated); and (iii) the registrant indicates in the appropriate filing that, after reasonable inquiry, the registrant is not aware of any material factors relating to that specific property other than those discussed in response to paragraph (a)(1)(ii) of this section that would cause the reported financial information not to be necessarily indicative of future operating results.”

In considering the above, the Company notes that: (i) the EIP investment was not acquired from a related party, and (ii) that the material factors in assessing the property held by the trust represent (A) the net lease that results in its revenue and (B) its expenses, which result from the related debt, fees, and depreciation of the underlying asset, all of which will be described in the Form 8-K filing. The Company is not, and will confirm in the financial statement footnotes of its Form 8-K that it is not, aware of any material factors relating to EIP, other than those discussed and noted above, that would cause the reported financial information not to be necessarily indicative of future operating results. The Company further notes that the rental history of the real property held by the trust extends back to 1985.

Finally, the Company has considered the fact that the trust leases the real property held by the trust to a single tenant under a net lease that transfers substantially all of the property's nonfinancial operating and holding costs to the tenant. The Company has also considered whether financial data and other information about the tenant may be more relevant to investors than financial statements of the property. Because the remaining term of the lease at the time of acquisition was less than 5 years, the Company does not believe the lessee’s financial information is so material to the investor so as to require inclusion in the Shelf Registration Statement. However, the Company has included

Husch Blackwell LLP

February 21, 2012

Page 4

disclosure of the existence of a single tenant and directions to the tenant’s website where investors may find additional financial information regarding this public company tenant. The Company does not expect the Staff to declare the Shelf Registration Statement effective until such time as the Company has filed the requisite financial statements in form and substance satisfactory to the Staff.

EIP Significance

The Total Assets of the Company as of November 30, 2010 were $96,041,393. The Company’s acquisition of EIP included a $12,250,000 cash payment and the assumption of $3,409,000 of debt, for a total acquisition price of $15,659,000. As a result, EIP was 16.30% of the Company’s total assets using the prescribed calculation method.

|

3.

|

Comment: Further to our previous comment, and in consideration of your response to comment 24 in our letter dated December 12, 2011, we note your representation that you met certain conditions required for accounting for your investment in EIP as an undivided interest in the assets, liabilities, revenue, and expenses of the venture. Please advise us how you met condition (iv) which states that each investor is responsible to pay only its pro rata share of expenses. It does not appear that you are responsible to pay certain expenses in light of the fact that the transmission assets are triple net leased to Public Service Company of New Mexico. We note that under a triple net lease, the lessee is typically required to pay the costs of ownership of the leased assets. Please advise.

|

Response: The Company’s response to your comment 24 in your letter dated December 12, 2011 may have created unnecessary confusion. The following sets forth (a) the Company’s basis for accounting for this acquisition and (b) whether the consolidation of such trust could utilize the method of consolidation referred to in the Staff’s previous comment 24.

(a) The 40% undivided interest is most appropriately characterized as an asset subject to a lease

The Company owns 100% of the interests in a trust (the “Trust”) that it consolidates for financial reporting purposes. The Trust in turn owns a 40% undivided interest in a 216 mile, 345-kV bulk power transmission line, tower, easement rights, converters and other grid support components (the “Transmission Assets”). The Trust was formed in January 1985 and a 100% interest in the Trust was acquired by the Company in June 2011. The Company is the only beneficiary to the trust agreement governing the Trust. The undivided interest owned by the Trust effectively provides the Trust with the commercial rights to 40% of the transmission capacity of the Transmission Assets. In the energy industry, it is not uncommon for businesses to sell access to transmission capacity.

The Company leases the Transmission Assets to the lessee who acts as the operator of the Transmission Assets. The lessor receives a rental payment from the lessee and the lessee conducts the business of operating the transmission assets and is responsible for the operating expenses. Since the lessee operates the Transmission Assets, the lessee incurs the operating expenses and receives the revenues associated with supplying power to

Husch Blackwell LLP

February 21, 2012

Page 5

customers. The Company’s earnings from the Transmission Assets is solely based on the terms of the lease contract, not in sharing in the operating earnings of the Transmission Assets. The Company would be responsible for the maintenance costs of the Transmission Assets absent the triple net lease arrangement with the lessee.

In evaluating the accounting treatment of the Company’s ownership of its interest in the Trust, it has evaluated whether the Transmission Assets meet the definition of real estate. The Company notes that the equipment portion of the Transmission Assets qualify as integral equipment, which is defined in ASC 360-10-20 as “any physical structure or equipment attached to the real estate that cannot be removed and used separately without incurring significant cost.” Guidance on significant cost is further defined in ASC 360-20-15-7, which states that “when the combined total of both the cost to remove plus the decrease in value (for leasing transactions, the information used to estimate those costs and the decrease in value shall be as of lease inception) exceeds 10 percent of the fair value of the equipment (installed) (for leasing transactions, at lease inception), the equipment is integral equipment.” The Company has concluded that because of the dedicated use of the Transmission Assets and the significance of easement and construction costs, that the cost of removal and the diminution of value would significantly exceed 10%. Thus, the Company has concluded that the Transmission Assets meet the definition of integral equipment subject to a lease and are properly treated as real estate for the purposes of applying accounting guidance.

(b) The method of consolidation is appropriate

The Company considered the factors set forth by Accounting Standard Codification 970-323 (ASC 970-323) in determining whether the Trust should account for its undivided interest in the Transmission Assets under the equity method of accounting or, alternatively, whether joint control is not present and therefore another basis of accounting is more appropriate. The Company notes that nothing in the bill of sale, operating or lease agreements limits its or another owner’s ability to finance, develop, sell or operate each parties’ respective undivided interest. Given that this asset is not subject to joint control, ASC 970-810-45 provides that an investment in real property may be presented by recording the undivided interest in the assets, liabilities, revenue and expenses of the venture if all of the following conditions are met:

|

|

(i)

|

The real property is owned by undivided interests;

|

|

|

(ii)

|

The approval of two or more of the owners is not required for decisions regarding the financing, development, sale, or operations of real estate owned;

|

|

|

(iii)

|

Each investor is entitled to only its pro rate share of income.

|

|

|

(iv)

|

Each investor is responsible to pay only its pro rata share of expenses; and

|

|

|

(v)

|

Each investor is severally liable only for indebtedness it incurs in connection with its interest in the property.

|

In considering whether the Company meets criteria (iv), the Company notes that it owns a 100% interest in a Trust that owns a 40% undivided interest in the Transmission Assets. That undivided interest in the Transmission Assets is leased to Public Service Company New Mexico (“PNM”). Pursuant to the triple net lease terms, PNM pays the

Husch Blackwell LLP

February 21, 2012

Page 6

costs the Company would otherwise be responsible for as a result of its ownership of the Transmission Assets. These costs are 40% of the operating costs of the Transmission Assets and in no situation would the Company be responsible for costs greater than its 40% proportionate share of expenses.

As such, the Company has concluded that the EIP investment is not an investment in an unincorporated business that should be accounted for under the equity method, but rather that it is an investment that should be accounted for by recording as an asset the 40% undivided interest in the Transmission Assets. The Company will record the revenues generated from the lease of the Transmission Assets, as well as the related depreciation expense over the related estimated useful life.

|

4.

|

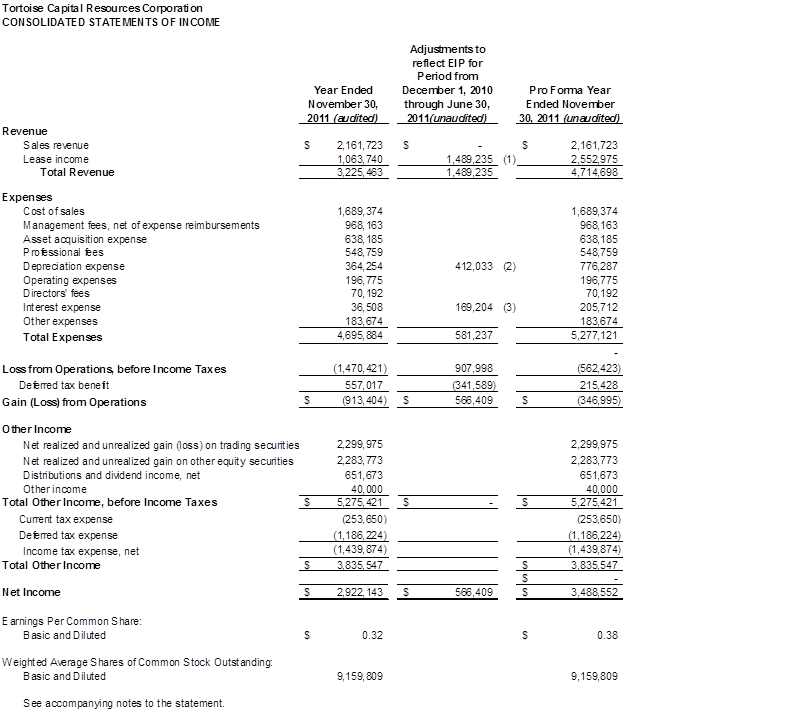

Comment: We note the revisions to your pro forma data. Please present a separate column for the adjustments related to the consolidation of Mowood.

|

Response: The Company has presented a separate column for the adjustments related to the consolidation of Mowood.

|

5.

|

Comment: We note your revised presentation of revenues on a gross basis. Please further tell us the general sales terms for the distribution of the natural gas and the terms of the purchase agreements to obtain the natural gas to be delivered. Explain if you act as an agent or principal in these delivery transactions and provide us your detailed analysis regarding the presentation of your revenues on a gross versus net basis. Also, clarify if you maintain any inventory of natural gas.

|

Response: Omega Pipeline Company, LLC (“Omega”), acting as a principal, provides transportation services and natural gas supply for its customers on a firm basis. In addition, Omega is paid fees for the operation and maintenance of its pipeline on Fort Leonard Wood (the “Fort”), including expansion of the pipeline. Omega is responsible for the coordination, supervision and quality of any expansion, while actual construction is generally performed by third party contractors.

The Fort accounts for more than 80% of Omega’s revenue and EBITDA each year. Omega’s contract is structured so that the majority of items in the monthly bill are pass-through expenses, with Omega earning a monthly fee for its services. Each month the Fort nominates the amount of natural gas it expects to use. Within 10% above or below the nominated amount, Omega gets paid for gas based on an index price and a set amount to cover transportation. If the Fort uses an amount outside of the 10% range, Omega is reimbursed for all additional costs for gas delivered, or, if gas is sold due to lower usage and a profit it made, Omega and the Fort split the profit. Omega contracts for gas delivery with MoGas Pipeline, LLC, a FERC regulated transportation pipeline of which Omega and the Fort are the terminal point. The Fort determines the size of the reservation held on its behalf and the cost is passed through with no additional fees. For providing reliable natural gas, Omega is paid a monthly fee of approximately $90,100 (in addition to $0.224 per linear foot of pipe added since the contract began), or approximately $7,500 per month. These fees increase 2% each February. Other than

Husch Blackwell LLP

February 21, 2012

Page 7

imbalances that occur from the difference in expected usage and actual usage, Omega does not maintain any inventory of natural gas. In addition, Omega does not have any agreements related to storage of natural gas on its own or any customers’ behalf.

We have considered our presentation of revenues on a gross versus net basis under the guidance provided in ASC 605-45. In addition to the considerations above, we believe the following are indicators that gross reporting is appropriate:

a. Omega is the primary obligor in the arrangement – Pursuant to the agreement with

the Fort, the Fort is contracting directly with Omega. If Omega fails to deliver

upon its contractual obligations to the Fort, the Fort has recourse against Omega;

b. Omega has the latitude to establish pricing – The contract with the Fort is based on

an index price and a spread which was negotiated by Omega;

c. Omega has discretion in supplier selection – In fulfilling its contracts, Omega has

discretion to select from several suppliers at its discretion;

d. Omega has physical loss inventory risk – Omega has risk of physical loss for gas

that is distributed through its pipeline; and

e. Omega has credit risk – Omega has credit risk for the full amount billed to the

Fort. Further, Omega is responsible for collecting from the Fort but must pay

amounts owed to its suppliers after the supplier performs, regardless of whether

the sales price is fully collected.

|

6.

|

Comment: Please explain what “expansion management and supervision services” are and quantify the amount of revenues from this source.

|

Response: Expansion management and supervision services refer to the construction services Omega provides at the Fort’s direction to expand the natural gas system. Omega typically outsources the vast majority of any system expansion work requested, by the Fort, but remains responsible for the quality, coordination, oversight and supervision of the work. Omega is responsible for making sure that the work is completed per Fort specifications as well as in compliance with applicable laws and regulations. In 2011, construction related projects generated approximately $935,000 of revenue and $215,000 of EBITDA, exclusive of general operating costs. In 2010, construction related projects generated $1,150,000 of revenue and $225,000 of EBITDA, exclusive of general operating costs.

|

7.

|

Comment: We note adjustments (4) and (5), and it is still unclear how you calculated the amounts related to the change in accounting for your debt and equity securities. Tell us how you determined the amounts. Please address the balance sheet and income statement separately; quantify the net change in the amounts reclassified and explain the differences.

|

Response: The Company has revised its income statement presentation to comply with Article 5 of Regulation S-X, to appropriately reflect its recent change in operations, and to reflect its intention to liquidate its remaining securities portfolio in an orderly manner.

Husch Blackwell LLP

February 21, 2012

Page 8

8. Comment: It is still unclear how your presentation complies with the guidance in Article 5 of Regulation S-X. Specifically, tell us your basis for including income related to your investments (i.e., realized and unrealized gains) within revenues rather than as part of non-operating income. Address your consideration of the recent change in operations and your intention to liquidate the related investments in an orderly manner in determining the appropriate income statement presentation.

Response: The disclosure has been revised as requested.

Draft Legality and Tax Opinions

|

9.

|

Comment: We note your response to comment 16 in our letter dated December 12, 2011. We will review the debt opinion when filed.

|

Response: The opinion has been filed with Pre-Effective Amendment No. 3.

|

10.

|

Comment: We note your response to comment 17 in our letter dated December 12, 2011. We continue to believe that the tax opinion should, with appropriate assumptions and limitations, opine as to whether the company has been organized in conformity with the requirements for qualification and taxation as a REIT under the Internal Revenue Code, and whether the company’s proposed method of operation as disclosed in the prospectus will enable it to meet the requirements for qualification and taxation as a REIT. Please revise or advise.

|

Response: The opinion has been revised as requested and filed with Pre-Effective Amendment No. 3.

** ** ** ** ** ** ** ** ** ** **

We look forward to hearing from you soon to discuss any comments you may have on this letter or on Pre-Effective Amendment No. 3. Please contact the undersigned at (816) 983-8362 or Steve Carman at (816) 983-8153.

| Sincerely, | |||

| /s/ Eric J. Gervais | |||

| Eric J. Gervais | |||

Husch Blackwell LLP